Measuring Atlas Copco AB's (OM:ATCO A) track record of past performance is an insightful exercise for investors. It enables us to reflect on whether the company has met or exceed expectations, which is a powerful signal for future performance. Below, I will assess ATCO A's recent performance announced on 31 December 2019 and compare these figures to its historical trend and industry movements.

Check out our latest analysis for Atlas Copco

Commentary On ATCO A's Past Performance

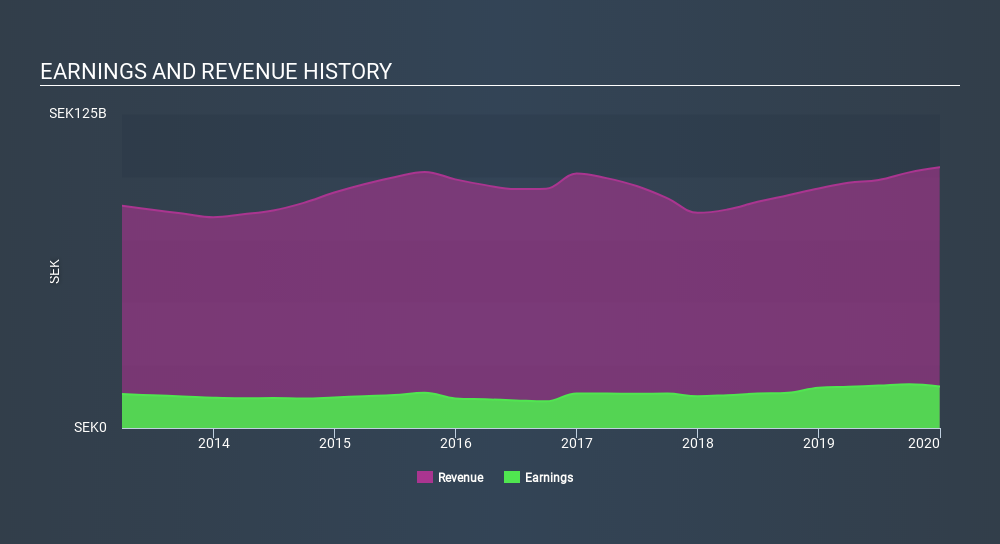

ATCO A's trailing twelve-month earnings (from 31 December 2019) of kr17b has increased by 2.8% compared to the previous year.

However, this one-year growth rate has been lower than its average earnings growth rate over the past 5 years of 7.1%, indicating the rate at which ATCO A is growing has slowed down. Why could this be happening? Well, let's examine what's occurring with margins and if the entire industry is facing the same headwind.

In terms of returns from investment, Atlas Copco has invested its equity funds well leading to a 31% return on equity (ROE), above the sensible minimum of 20%. Furthermore, its return on assets (ROA) of 15% exceeds the SE Machinery industry of 8.3%, indicating Atlas Copco has used its assets more efficiently. And finally, its return on capital (ROC), which also accounts for Atlas Copco’s debt level, has increased over the past 3 years from 24% to 28%. This correlates with a decrease in debt holding, with debt-to-equity ratio declining from 48% to 44% over the past 5 years.

What does this mean?

Though Atlas Copco's past data is helpful, it is only one aspect of my investment thesis. Positive growth and profitability are what investors like to see in a company’s track record, but how do we properly assess sustainability? You should continue to research Atlas Copco to get a better picture of the stock by looking at:

- Future Outlook: What are well-informed industry analysts predicting for ATCO A’s future growth? Take a look at our free research report of analyst consensus for ATCO A’s outlook.

- Financial Health: Are ATCO A’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

NB: Figures in this article are calculated using data from the trailing twelve months from 31 December 2019. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OM:ATCO A

Atlas Copco

Provides compressed air and gas, vacuum, energy, dewatering and industrial pumps, industrial power tools, and assembly and machine vision solutions in North America, South America, Europe, Africa, the Middle East, Asia, and Oceania.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

The Grid Modernizer: Leidos and the $2.4 Billion Bet on Sovereign AI and Energy

EU#6 - From Political Experiment to Global Aerospace Power

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.