Alrik Danielson has been the CEO of AB SKF (publ) (STO:SKF B) since 2015. First, this article will compare CEO compensation with compensation at similar sized companies. After that, we will consider the growth in the business. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This process should give us an idea about how appropriately the CEO is paid.

Check out our latest analysis for AB SKF

How Does Alrik Danielson's Compensation Compare With Similar Sized Companies?

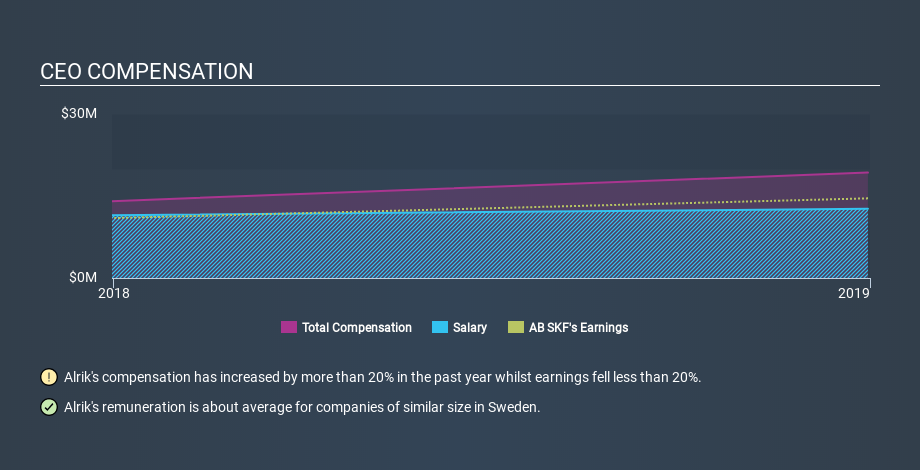

At the time of writing, our data says that AB SKF (publ) has a market cap of kr86b, and reported total annual CEO compensation of kr19m for the year to December 2018. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at kr13m. When we examined a selection of companies with market caps ranging from kr38b to kr114b, we found the median CEO total compensation was kr17m.

That means Alrik Danielson receives fairly typical remuneration for the CEO of a company that size. While this data point isn't particularly informative alone, it gains more meaning when considered with business performance.

The graphic below shows how CEO compensation at AB SKF has changed from year to year.

Is AB SKF (publ) Growing?

On average over the last three years, AB SKF (publ) has grown earnings per share (EPS) by 23% each year (using a line of best fit). In the last year, its revenue is up 2.4%.

This shows that the company has improved itself over the last few years. Good news for shareholders. It's nice to see a little revenue growth, as this is consistent with healthy business conditions. You might want to check this free visual report on analyst forecasts for future earnings.

Has AB SKF (publ) Been A Good Investment?

With a total shareholder return of 23% over three years, AB SKF (publ) shareholders would, in general, be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

Remuneration for Alrik Danielson is close enough to the median pay for a CEO of a similar sized company .

We would wish for better returns (whether dividends or capital gains) but we do admire the solid EPS growth on show here. So considering these factors, we think the CEO pay is probably quite reasonable. If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at AB SKF.

Important note: AB SKF may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OM:SKF B

AB SKF

Designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring, and services worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

The nimble tech network turning innovation into profits

AMZN Narrative

Constellation Software: The Fortress the AI Panic Forgot to Account For

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion