Every investor in Evolution Gaming Group AB (publ) (STO:EVO) should be aware of the most powerful shareholder groups. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. Warren Buffett said that he likes 'a business with enduring competitive advantages that is run by able and owner-oriented people'. So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

Evolution Gaming Group has a market capitalization of kr58b, so it's too big to fly under the radar. We'd expect to see both institutions and retail investors owning a portion of the company. Our analysis of the ownership of the company, below, shows that institutions are noticeable on the share registry. We can zoom in on the different ownership groups, to learn more about Evolution Gaming Group.

View our latest analysis for Evolution Gaming Group

What Does The Institutional Ownership Tell Us About Evolution Gaming Group?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

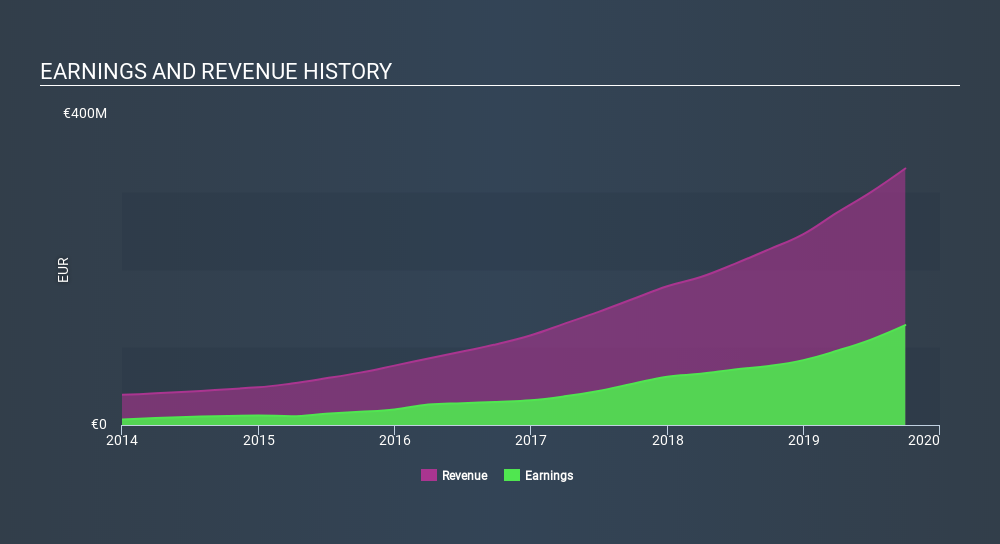

We can see that Evolution Gaming Group does have institutional investors; and they hold 40% of the stock. This suggests some credibility amongst professional investors. But we can't rely on that fact alone, since institutions make bad investments sometimes, just like everyone does. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Evolution Gaming Group's earnings history, below. Of course, the future is what really matters.

We note that hedge funds don't have a meaningful investment in Evolution Gaming Group. The company's largest shareholder is Ian Livingstone, with ownership of 16%, Grundbulten 22555 AB is the second largest shareholder with 15% of common stock, followed by Swedbank Robur Fonder AB, holding 8.6% of the stock.

We also observed that the top 6 shareholders account for 52% of the register, with a few smaller shareholders to balance the interests of the larger ones to a certain extent.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Evolution Gaming Group

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

It seems insiders own a significant proportion of Evolution Gaming Group AB (publ). It has a market capitalization of just kr58b, and insiders have kr12b worth of shares in their own names. That's quite significant. Most would be pleased to see the board is investing alongside them. You may wish to access this free chart showing recent trading by insiders.

General Public Ownership

With a 24% ownership, the general public have some degree of sway over EVO. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Company Ownership

We can see that Private Companies own 15%, of the shares on issue. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Evolution Gaming Group better, we need to consider many other factors. For example, we've discovered 1 warning sign for Evolution Gaming Group that you should be aware of before investing here.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OM:EVO

Evolution

Develops, produces, markets, and licenses online casino systems to gaming operators in Europe, Asia, North America, Latin America, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives