- United States

- /

- Tech Hardware

- /

- NasdaqGS:WDC

Dividend Investors: Don't Be Too Quick To Buy Western Digital Corporation (NASDAQ:WDC) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Western Digital Corporation (NASDAQ:WDC) is about to trade ex-dividend in the next 2 days. Ex-dividend means that investors that purchase the stock on or after the 2nd of January will not receive this dividend, which will be paid on the 21st of January.

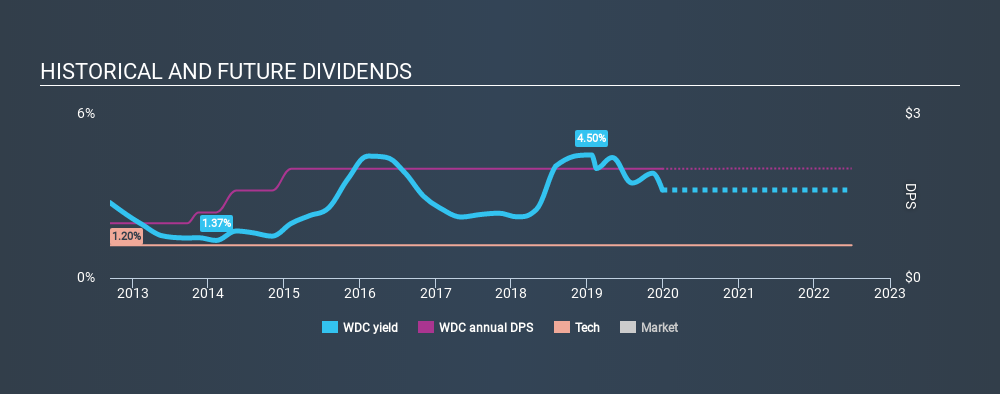

Western Digital's next dividend payment will be US$0.50 per share. Last year, in total, the company distributed US$2.00 to shareholders. Last year's total dividend payments show that Western Digital has a trailing yield of 3.2% on the current share price of $62.13. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for Western Digital

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Western Digital reported a loss last year, so it's not great to see that it has continued paying a dividend. With the recent loss, it's important to check if the business generated enough cash to pay its dividend. If cash earnings don't cover the dividend, the company would have to pay dividends out of cash in the bank, or by borrowing money, neither of which is long-term sustainable. Over the past year it paid out 166% of its free cash flow as dividends, which is uncomfortably high. It's hard to consistently pay out more cash than you generate without either borrowing or using company cash, so we'd wonder how the company justifies this payout level.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Western Digital reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, seven years ago, Western Digital has lifted its dividend by approximately 10% a year on average.

We update our analysis on Western Digital every 24 hours, so you can always get the latest insights on its financial health, here.

Final Takeaway

Should investors buy Western Digital for the upcoming dividend? It's hard to get used to Western Digital paying a dividend despite reporting a loss over the past year. Worse, the dividend was not well covered by cash flow. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

Ever wonder what the future holds for Western Digital? See what the 27 analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:WDC

Western Digital

Develops, manufactures, and sells data storage devices and solutions based on hard disk drive (HDD) technology in the Americas, Asia, Europe, the Middle East, and Africa.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives