As of August 2025, the European markets have shown resilience, with the pan-European STOXX Europe 600 Index rising by 1.40%, fueled by optimism over potential rate cuts in the U.S. and a rebound in eurozone business activity. Amid these developments, investors are exploring opportunities beyond traditional blue-chip stocks, turning their attention to penny stocks—smaller or newer companies that can offer unique investment prospects despite their somewhat outdated label. This article will explore three European penny stocks that stand out for their financial strength and potential to deliver value in today's market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 5 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.06 | €15.75M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.40 | €45.16M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €253.45M | ✅ 2 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.498 | RON16.84M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €3.15 | €66.44M | ✅ 4 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.81 | €424.69M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.105 | €290.95M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.942 | €31.77M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 344 stocks from our European Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Catenon (BME:COM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Catenon, S.A. is a technology-based company offering recruitment services both in Spain and internationally, with a market cap of €19.73 million.

Operations: The company's revenue is derived from the application of new IT and communication technologies, amounting to €12.03 million.

Market Cap: €19.73M

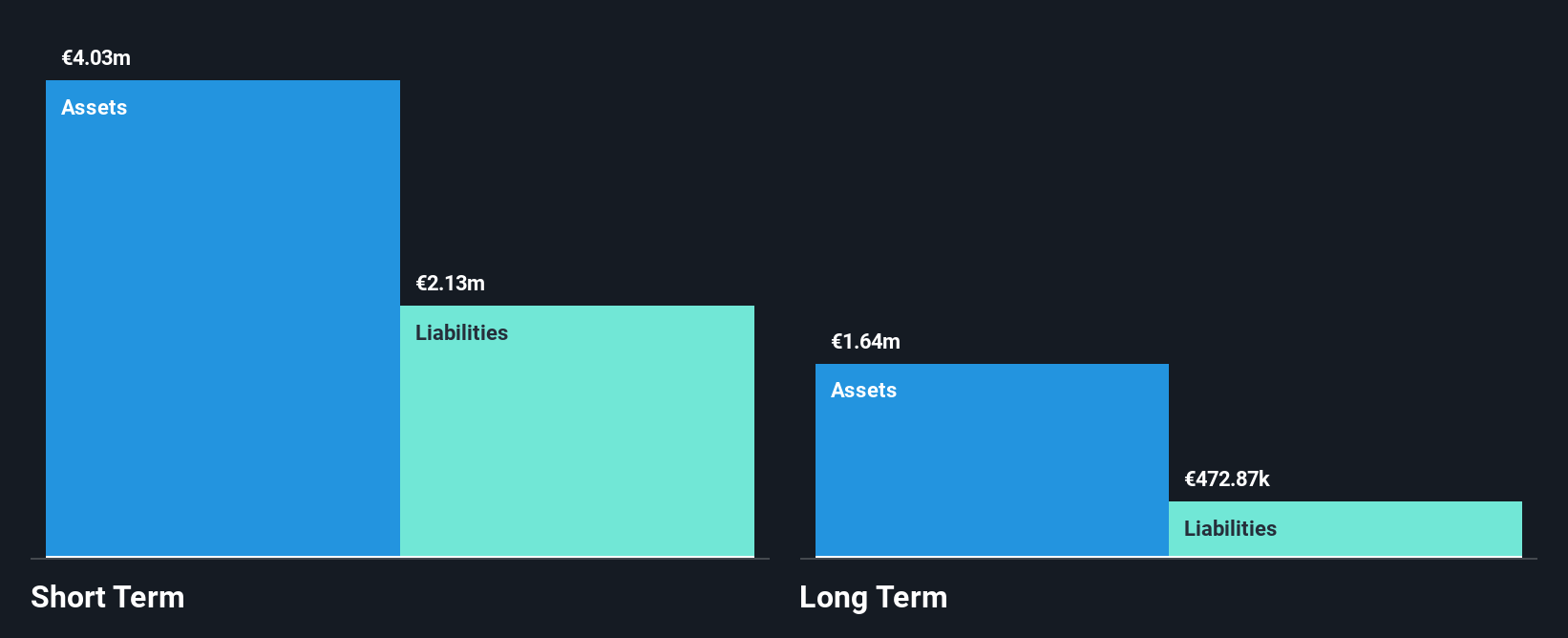

Catenon, S.A. has shown financial improvements with its short-term assets (€4.0M) covering both short-term (€2.1M) and long-term liabilities (€472.9K). The company has transitioned to profitability recently, achieving high-quality earnings and reducing its debt-to-equity ratio from 80.6% to 37.1% over five years, indicating better financial health. Interest payments are well covered by EBIT (30.9x), though the return on equity remains low at 4.8%. Despite stable weekly volatility over the past year, the share price remains highly volatile in recent months, which is typical for penny stocks like Catenon in Europe.

- Navigate through the intricacies of Catenon with our comprehensive balance sheet health report here.

- Examine Catenon's past performance report to understand how it has performed in prior years.

Deceuninck (ENXTBR:DECB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Deceuninck NV is a company involved in the design, manufacture, recycling, and distribution of multi-material window, door, and building solutions across Europe, North America, Turkey, and other international markets with a market cap of €290.95 million.

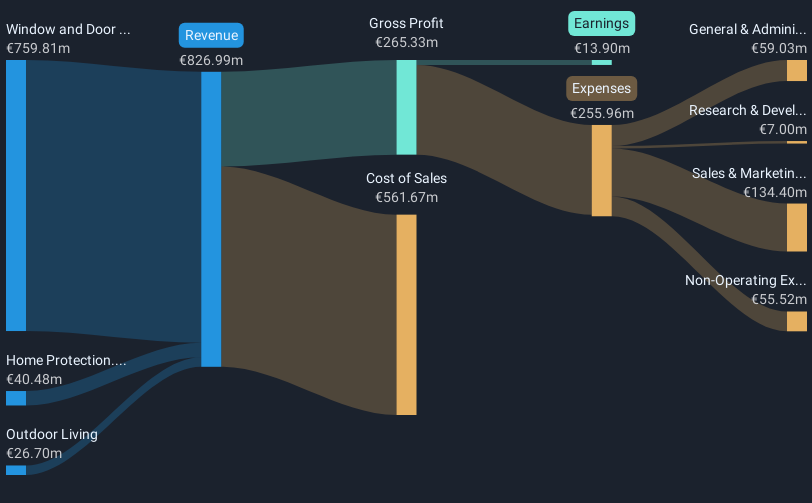

Operations: The company's revenue is primarily driven by its Window and Door Systems segment, which generated €724.41 million, followed by Home Protection at €38.30 million and Outdoor Living at €26.26 million.

Market Cap: €290.95M

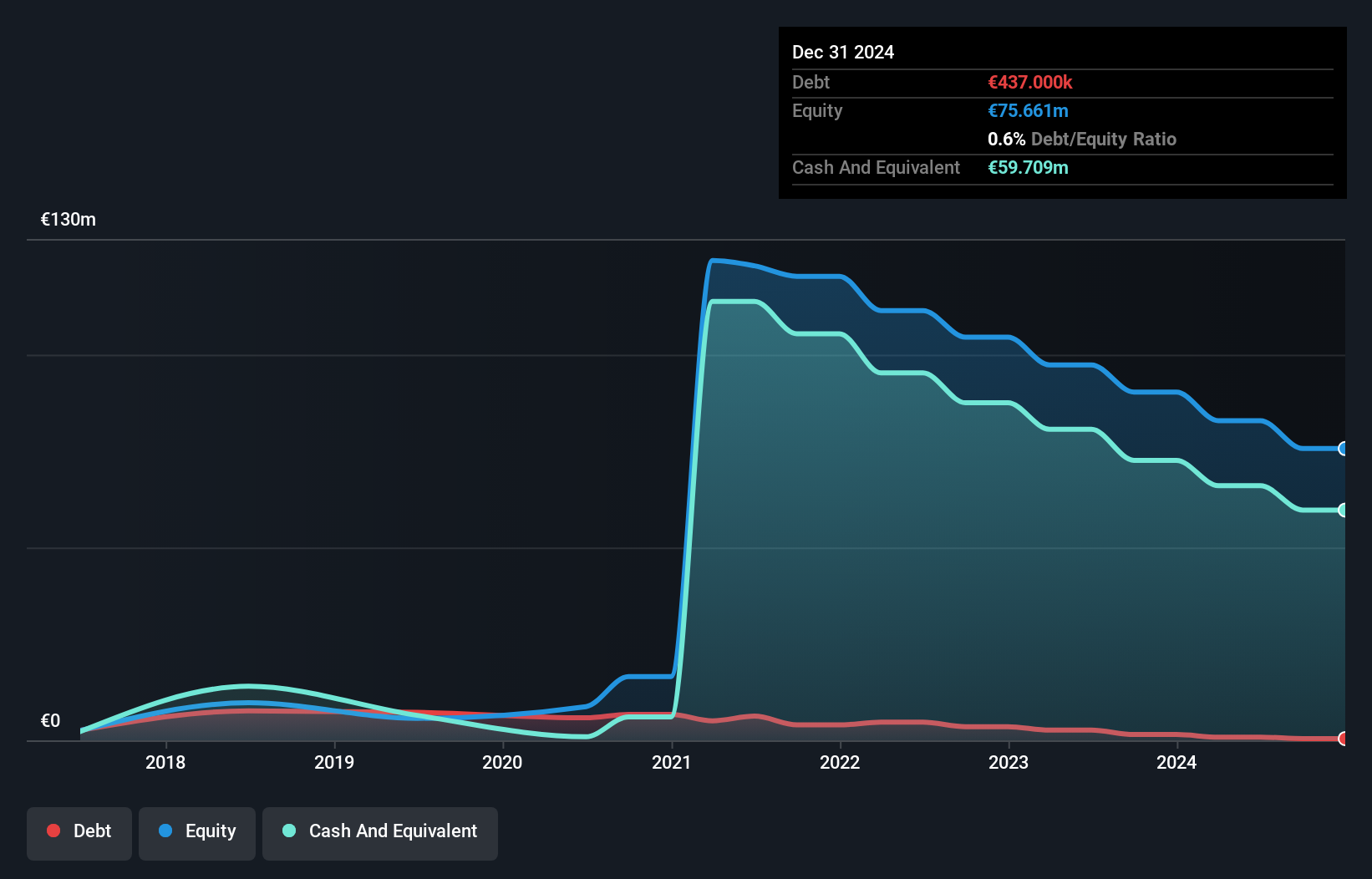

Deceuninck NV has demonstrated financial resilience, with its debt-to-equity ratio improving from 106.2% to 44.5% over five years, supported by operating cash flow covering 65.4% of its debt. The company reported a significant earnings growth of 811.3% last year, surpassing the building industry's performance, and has maintained stable weekly volatility at 3%. Although trading at a good value relative to peers and industry standards, Deceuninck's return on equity is low at 5.7%. Recent earnings show increased net income despite lower sales compared to last year, reflecting operational efficiency improvements.

- Take a closer look at Deceuninck's potential here in our financial health report.

- Learn about Deceuninck's future growth trajectory here.

Nightingale Health Oyj (HLSE:HEALTH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nightingale Health Oyj is a health technology company that provides a health data platform for detecting disease risks across Finland, the United Kingdom, Europe, the United States, and internationally with a market cap of €140.92 million.

Operations: The company's revenue is primarily derived from its Medical Labs & Research segment, totaling €4.95 million.

Market Cap: €140.92M

Nightingale Health Oyj, with a market cap of €140.92 million, is navigating the penny stock landscape by leveraging its health data platform to secure strategic partnerships and expand globally. Despite being unprofitable with increasing losses, the company maintains a strong cash position with short-term assets covering both short- and long-term liabilities. Recent developments include a contract for Italy's Moli-sani study worth approximately €728,000 and expansion into the U.S. market through its new laboratory in New York. These moves highlight Nightingale's commitment to growth in metabolomics and preventative healthcare sectors while managing financial constraints effectively.

- Dive into the specifics of Nightingale Health Oyj here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Nightingale Health Oyj's future.

Next Steps

- Take a closer look at our European Penny Stocks list of 344 companies by clicking here.

- Ready To Venture Into Other Investment Styles? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:DECB

Deceuninck

Engages in the design, manufacture, recycling, and distribution of multi-material window, door, and building solutions in Europe, North America, Turkey, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives