- China

- /

- Commercial Services

- /

- SZSE:002266

Discovering 3 Penny Stocks In Global With Market Caps Under US$3B

Reviewed by Simply Wall St

Global markets have recently experienced a rally, with indices like the S&P 500 and Nasdaq Composite hitting all-time highs amid easing geopolitical tensions and positive trade developments. In such a buoyant market environment, investors often seek opportunities in lesser-known areas, such as penny stocks. Although the term "penny stocks" may seem outdated, it still captures the essence of investing in smaller or newer companies that can offer significant growth potential when backed by strong financials.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.23 | A$114.16M | ✅ 4 ⚠️ 2 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.25 | HK$782.38M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.82 | A$439.42M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.24 | SGD8.82B | ✅ 5 ⚠️ 0 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.525 | SEK2.42B | ✅ 4 ⚠️ 1 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ✅ 5 ⚠️ 0 View Analysis > |

| AWC Berhad (KLSE:AWC) | MYR0.60 | MYR201.18M | ✅ 5 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.845 | £11.63M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 3,840 stocks from our Global Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

CASIN Real Estate Development GroupLtd (SZSE:000838)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CASIN Real Estate Development Group Ltd (SZSE:000838) is engaged in real estate development and related operations, with a market cap of CN¥2.88 billion.

Operations: The company generates revenue of CN¥559.65 million from its operations in China.

Market Cap: CN¥2.88B

CASIN Real Estate Development Group Ltd faces significant challenges as it navigates its current financial landscape. The company is unprofitable, with a negative return on equity and a declining earnings trend. Despite having short-term assets that exceed liabilities, CASIN's revenue has sharply decreased from CN¥4 billion to CN¥828.49 million within a year, highlighting operational struggles. However, the company has reduced its debt-to-equity ratio significantly over five years and maintains an experienced management team. While recent earnings reports show persistent losses, they also indicate slight improvements in loss per share compared to previous periods.

- Navigate through the intricacies of CASIN Real Estate Development GroupLtd with our comprehensive balance sheet health report here.

- Evaluate CASIN Real Estate Development GroupLtd's historical performance by accessing our past performance report.

Zhefu Holding Group (SZSE:002266)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhefu Holding Group Co., Ltd. operates through its subsidiaries to focus on the research, development, manufacture, installation, and servicing of hydropower equipment both in China and internationally, with a market cap of CN¥16.16 billion.

Operations: Zhefu Holding Group Co., Ltd. has not reported specific revenue segments.

Market Cap: CN¥16.16B

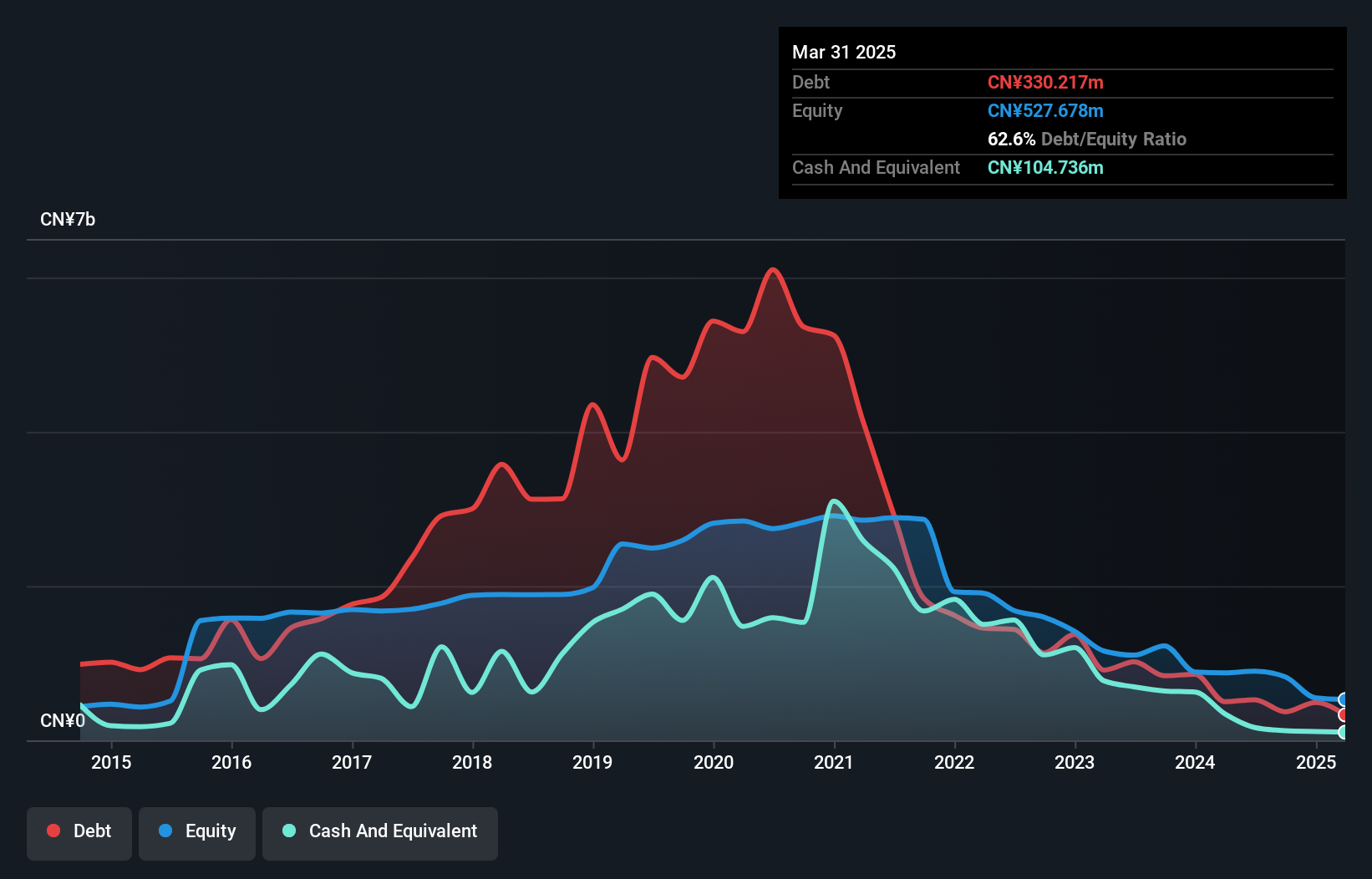

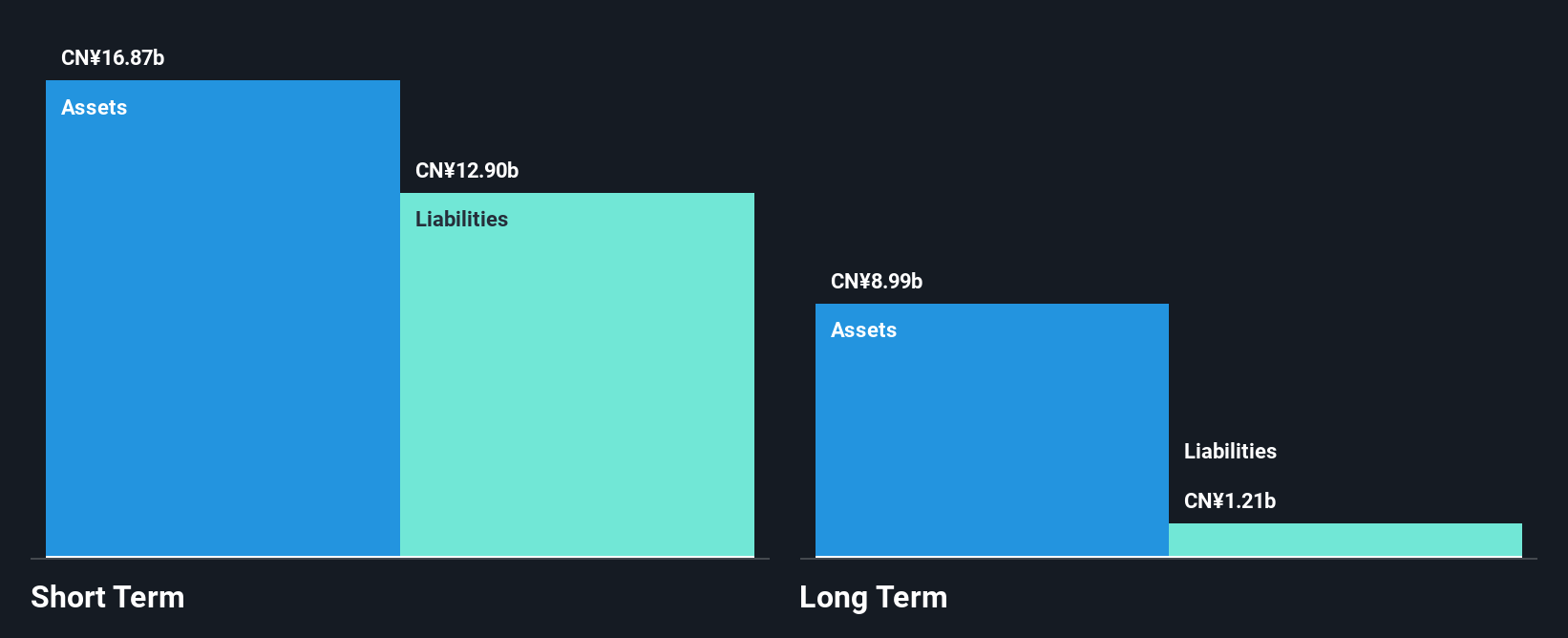

Zhefu Holding Group demonstrates a mixed financial profile with stable earnings growth of 10.6% over the past year, surpassing industry averages. The company's operating cash flow effectively covers its debt obligations, and it maintains a healthy balance sheet with short-term assets exceeding both short and long-term liabilities. Despite these strengths, Zhefu's return on equity remains low at 8.4%, and profit margins have slightly declined compared to the previous year. Trading at a favorable price-to-earnings ratio relative to peers, Zhefu offers value potential but faces challenges in sustaining consistent dividend payouts amidst fluctuating net income figures.

- Click here to discover the nuances of Zhefu Holding Group with our detailed analytical financial health report.

- Examine Zhefu Holding Group's earnings growth report to understand how analysts expect it to perform.

HARBIN GLORIA PHARMACEUTICALS (SZSE:002437)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Harbin Gloria Pharmaceuticals Co., Ltd focuses on the research, development, production, and sale of pharmaceutical products mainly in China, with a market cap of CN¥6.58 billion.

Operations: Harbin Gloria Pharmaceuticals Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥6.58B

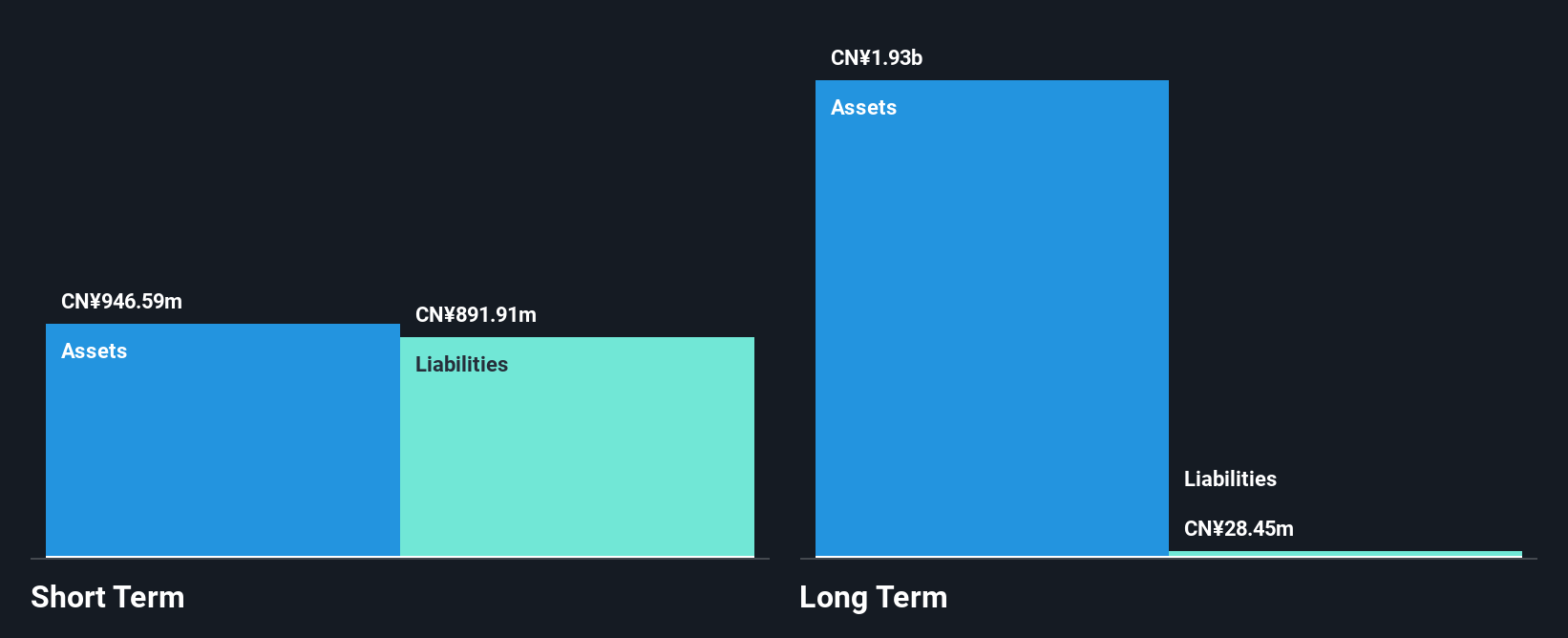

Harbin Gloria Pharmaceuticals presents a compelling yet cautious investment narrative within the penny stock realm. The company has demonstrated robust earnings growth of 57.8% over the past year, significantly outpacing industry averages, although this was partly influenced by a substantial one-off gain. Its financial health is underscored by a strong balance sheet with more cash than debt and short-term assets exceeding liabilities. While trading below estimated fair value offers potential upside, investors should note its low return on equity at 12.7% and an inexperienced board with an average tenure of just 0.7 years, which may pose governance challenges moving forward.

- Take a closer look at HARBIN GLORIA PHARMACEUTICALS' potential here in our financial health report.

- Evaluate HARBIN GLORIA PHARMACEUTICALS' prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Take a closer look at our Global Penny Stocks list of 3,840 companies by clicking here.

- Looking For Alternative Opportunities? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhefu Holding Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002266

Zhefu Holding Group

Through its subsidiaries, primarily engages in the research and development, manufacture, installation, and service of hydropower equipment in China and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives