- Canada

- /

- Metals and Mining

- /

- TSXV:SUP

Discover TSX Penny Stocks With Market Caps Under CA$200M

Reviewed by Simply Wall St

Despite rising tariff rates, the Canadian market has shown resilience, with inflation and economic data holding steady. In this context, penny stocks—typically representing smaller or newer companies—remain an intriguing investment area. While the term might seem outdated, these stocks can offer growth potential when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.70 | CA$69.79M | ✅ 3 ⚠️ 3 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.09 | CA$108.9M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.025 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.64 | CA$427.48M | ✅ 4 ⚠️ 0 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$492.32M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.38 | CA$176.12M | ✅ 1 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.53 | CA$153.38M | ✅ 4 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.94 | CA$186.11M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.84 | CA$8.91M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 450 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Happy Creek Minerals (TSXV:HPY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Happy Creek Minerals Ltd. is involved in the acquisition, exploration, and development of mineral properties in Canada, with a market capitalization of CA$12.54 million.

Operations: Happy Creek Minerals Ltd. does not report any specific revenue segments.

Market Cap: CA$12.54M

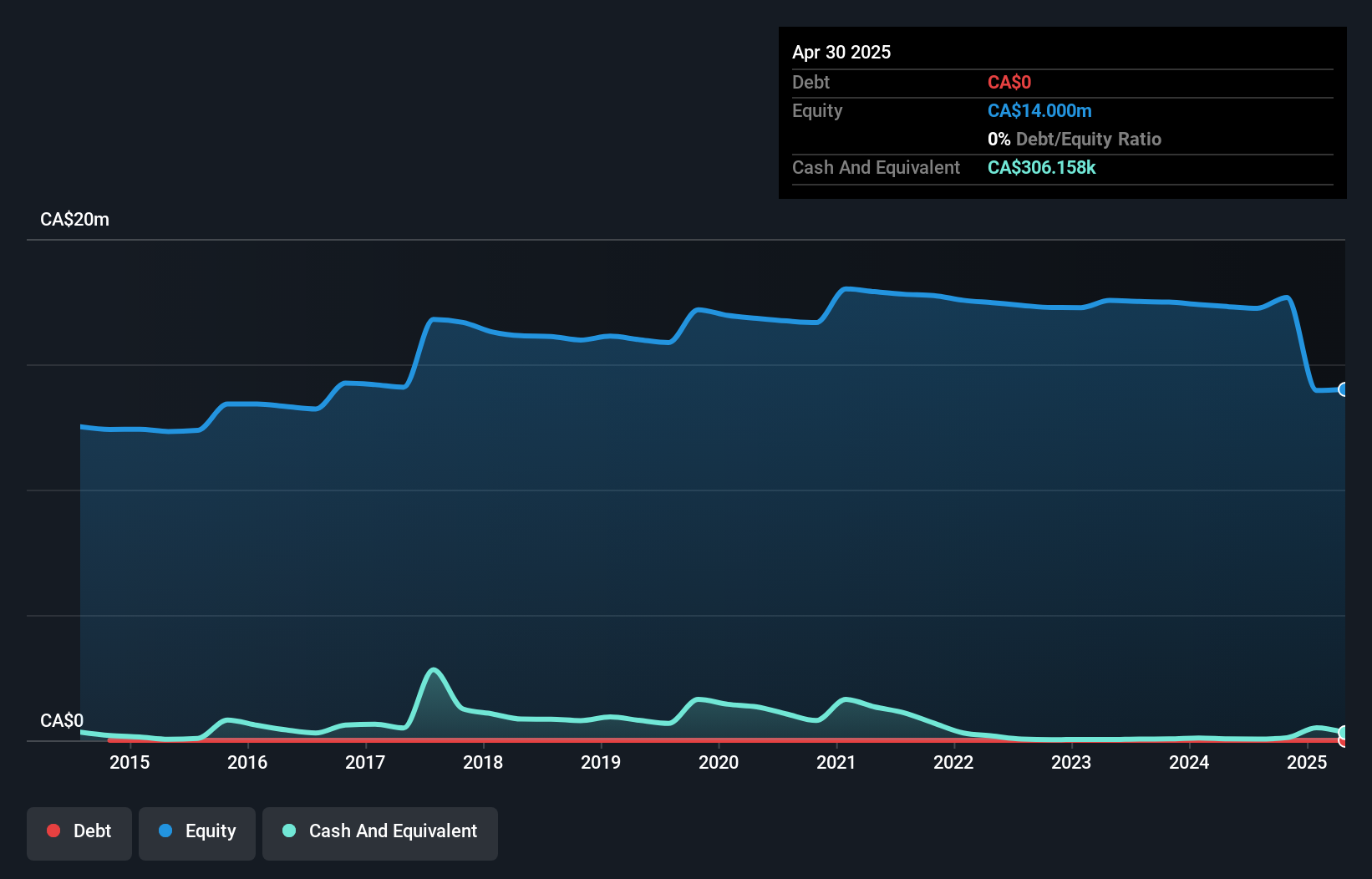

Happy Creek Minerals, with a market cap of CA$12.54 million, is pre-revenue and has faced increasing losses over the past five years. The company is debt-free and recently raised CA$3.25 million through a private placement to bolster its short cash runway. Despite experienced management and board members, Happy Creek's high share price volatility poses risks for investors. Recent earnings showed improvement from a net loss to slight net income in Q1 2025; however, substantial annual losses persist, leading auditors to express concern about its ability to continue as a going concern.

- Navigate through the intricacies of Happy Creek Minerals with our comprehensive balance sheet health report here.

- Learn about Happy Creek Minerals' historical performance here.

SPARQ Systems (TSXV:SPRQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SPARQ Systems Inc. designs, manufactures, and sells single-phase microinverters for residential and commercial solar electric applications with a market cap of CA$87.70 million.

Operations: SPARQ Systems Inc. has not reported any specific revenue segments.

Market Cap: CA$87.7M

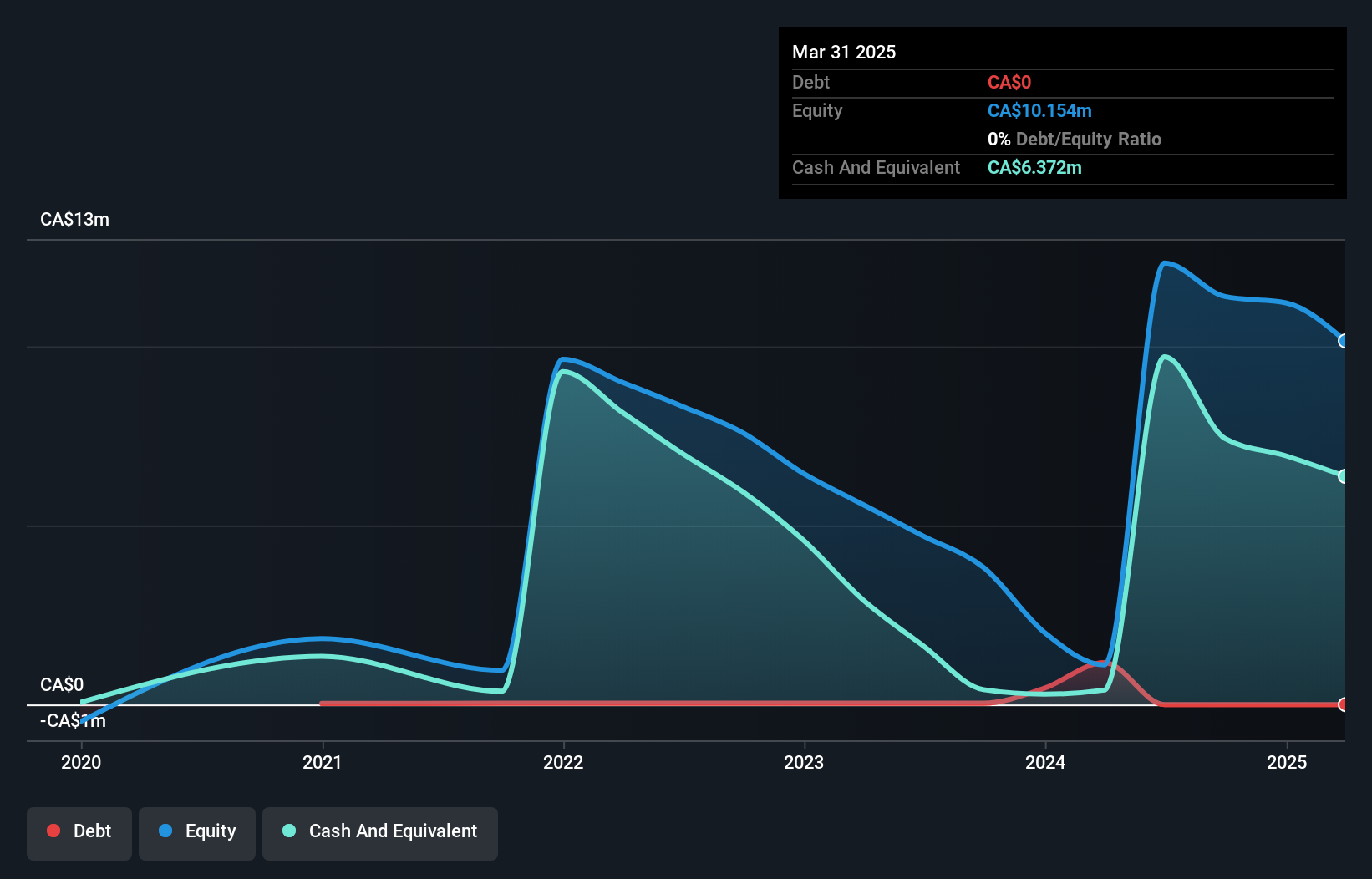

SPARQ Systems, with a market cap of CA$87.70 million, is a pre-revenue company facing challenges typical of penny stocks. It recently commenced commercial production of microinverters in India, marking a significant operational milestone. Despite being debt-free and having short-term assets exceeding liabilities, it reported a net loss of CA$1.07 million for Q1 2025 and continues to face going concern doubts from auditors due to ongoing losses. The company's cash runway extends just over a year if current cash flow trends persist, highlighting the financial pressures it faces amidst its expansion efforts.

- Get an in-depth perspective on SPARQ Systems' performance by reading our balance sheet health report here.

- Understand SPARQ Systems' track record by examining our performance history report.

Northern Superior Resources (TSXV:SUP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Northern Superior Resources Inc. is a junior mining company focused on exploring and evaluating gold properties in Ontario and Québec, Canada, with a market cap of CA$184.06 million.

Operations: Northern Superior Resources Inc. does not have any reported revenue segments.

Market Cap: CA$184.06M

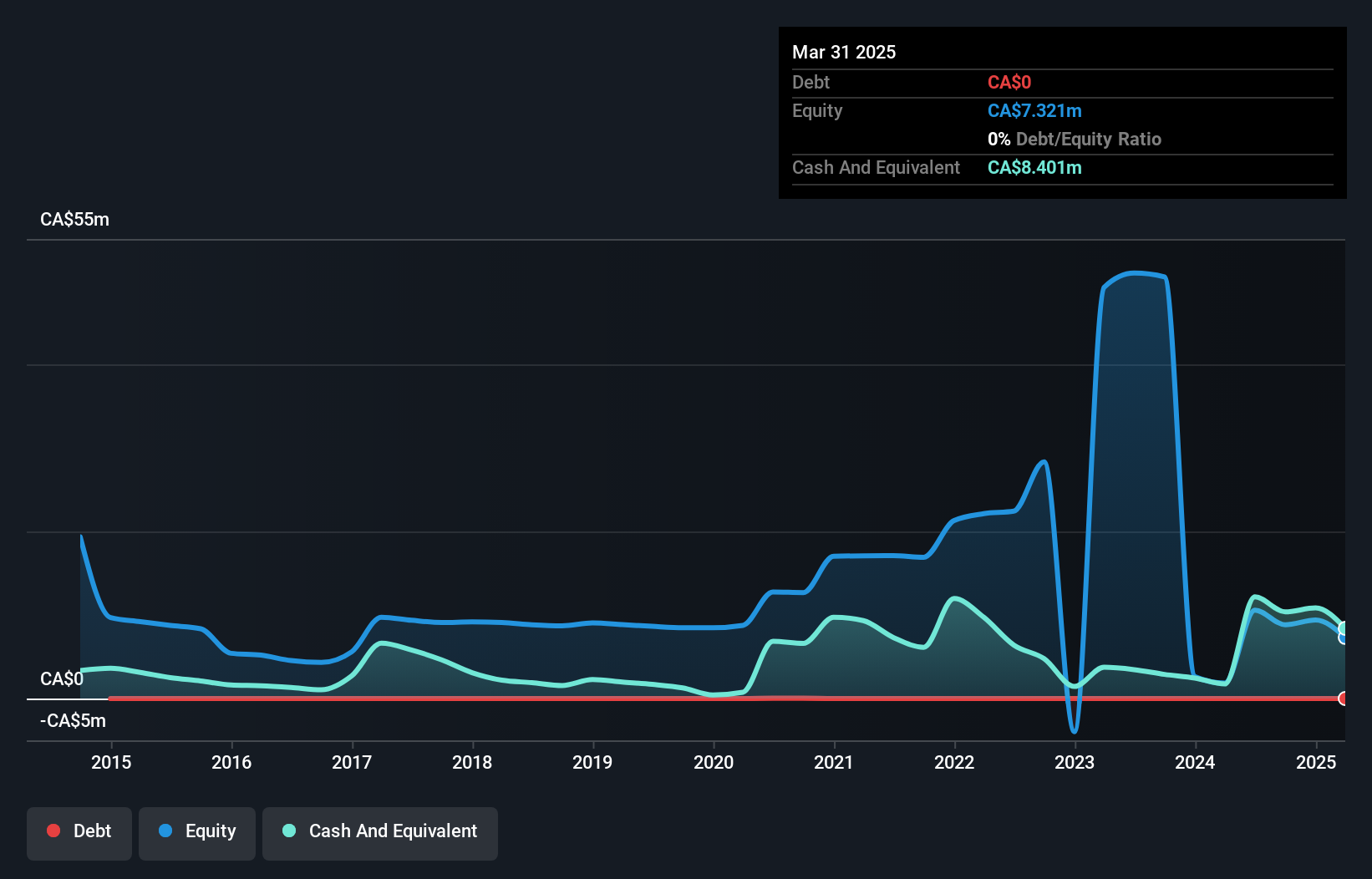

Northern Superior Resources, with a market cap of CA$184.06 million, is pre-revenue and focused on expanding its gold exploration footprint in Ontario and Québec. Recent acquisitions have increased its land position in the Chibougamau Gold Camp, enhancing potential for resource expansion at the Philibert Project. Despite no meaningful revenue, it remains debt-free with short-term assets covering liabilities. The company has a cash runway exceeding one year but faces financial challenges typical of junior miners. Recent drilling results indicate promising high-grade gold zones, suggesting potential growth opportunities as part of its strategic exploration initiatives.

- Click here and access our complete financial health analysis report to understand the dynamics of Northern Superior Resources.

- Examine Northern Superior Resources' past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Click this link to deep-dive into the 450 companies within our TSX Penny Stocks screener.

- Looking For Alternative Opportunities? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Superior Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SUP

Northern Superior Resources

An exploration stage junior mining company, engages in the identification, acquisition, evaluation, and exploration of gold properties in Ontario and Québec, Canada.

Flawless balance sheet very low.

Market Insights

Community Narratives