- Turkey

- /

- Renewable Energy

- /

- IBSE:HUNER

Discover Middle Eastern Opportunities: Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

As Gulf stock markets remain steady amid recent interest rate cuts, investors are closely watching the regional indices for potential opportunities. The Middle East's economic landscape presents a unique backdrop for exploring investment options, particularly in smaller or newer companies that can offer both value and growth potential. While the term 'penny stocks' might seem outdated, it still points to these promising ventures; here we examine three such stocks with strong financial foundations that could appeal to those interested in tapping into emerging market opportunities.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| E.E.A.M.I (TASE:EEAM-M) | ₪0.074 | ₪7.26M | ✅ 2 ⚠️ 4 View Analysis > |

| Maharah for Human Resources (SASE:1831) | SAR4.57 | SAR2.06B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.65 | SAR1.46B | ✅ 2 ⚠️ 1 View Analysis > |

| Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP) | TRY4.70 | TRY1.29B | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.06 | AED2.12B | ✅ 5 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.30 | AED683.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.11 | AED359.2M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.03 | AED13.01B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.86 | AED521.88M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.67 | ₪209.59M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 79 stocks from our Middle Eastern Penny Stocks screener.

We'll examine a selection from our screener results.

Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi (IBSE:ARSAN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi, along with its subsidiaries, is involved in the production and sale of cotton and synthetic yarn both in Turkey and internationally, with a market cap of TRY5.29 billion.

Operations: The company generates revenue through its textile segment, which accounts for TRY48.12 million, and its tourism segment, contributing TRY60.49 million.

Market Cap: TRY5.29B

Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi, with a market cap of TRY5.29 billion, faces challenges as it is currently unprofitable despite generating revenue from its textile and tourism segments. Recent earnings showed a net loss of TRY66.91 million for Q2 2025, contrasting sharply with the previous year's net income. However, the company maintains financial stability with short-term assets exceeding both short and long-term liabilities and has significantly reduced its debt-to-equity ratio over five years. While volatility remains stable, insufficient data on management experience may concern potential investors in this penny stock space.

- Get an in-depth perspective on Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi's performance by reading our balance sheet health report here.

- Understand Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi's track record by examining our performance history report.

Hun Yenilenebilir Enerji Üretim (IBSE:HUNER)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hun Yenilenebilir Enerji Üretim A.S. operates in the renewable energy sector by establishing, constructing, commissioning, renting, generating, and selling electrical energy and capacity both in Turkey and internationally with a market capitalization of TRY3.94 billion.

Operations: The company generates revenue of TRY946.13 million from its production and sales activities in the renewable energy sector.

Market Cap: TRY3.94B

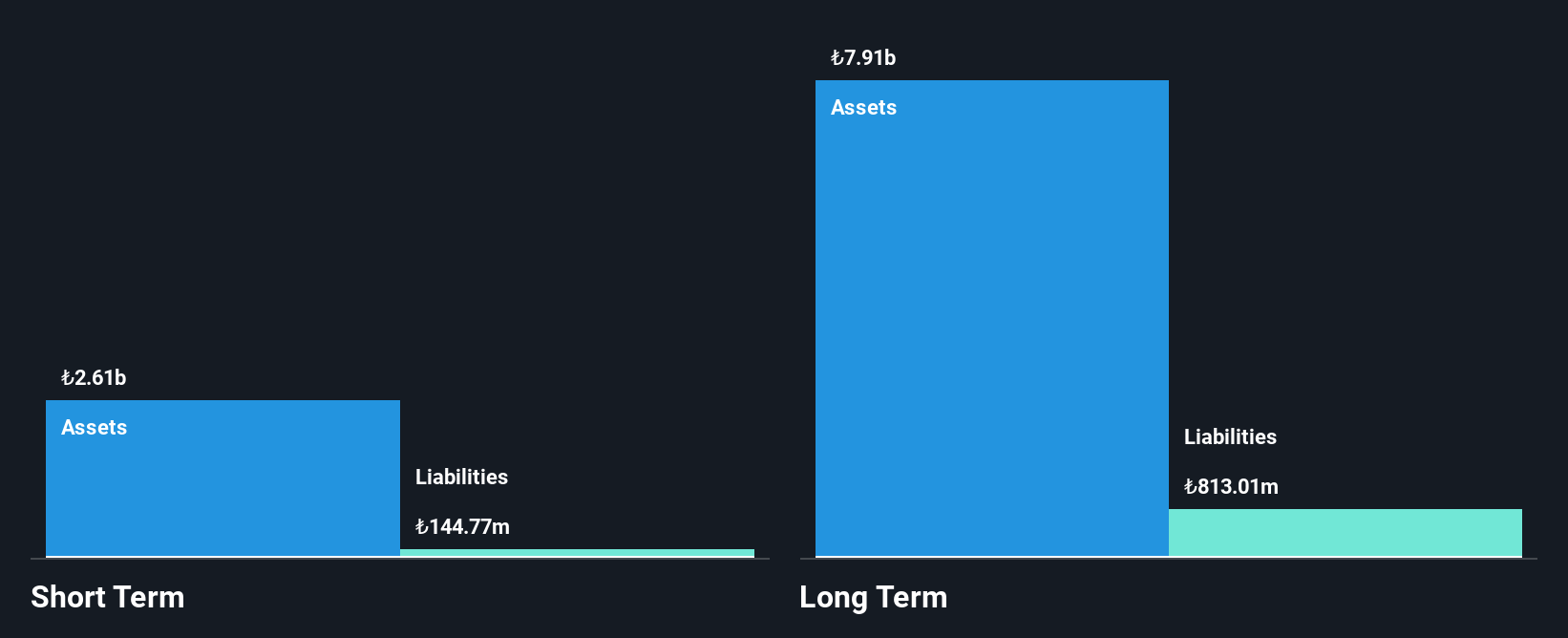

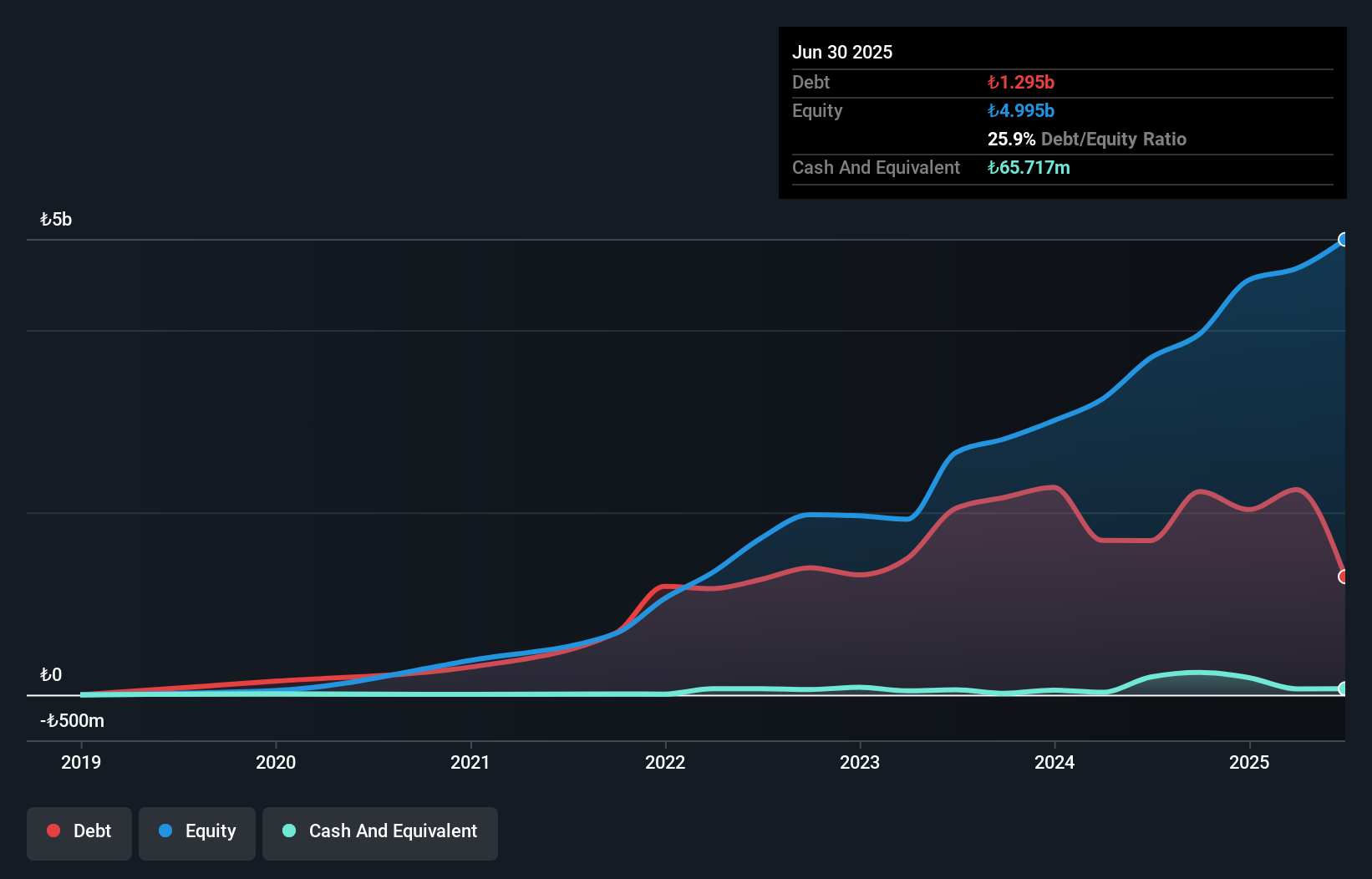

Hun Yenilenebilir Enerji Üretim A.S. has shown resilience in the renewable energy sector, reporting TRY308.45 million in Q2 2025 sales, up from TRY263.12 million a year earlier, though net income decreased to TRY55.04 million from TRY128.77 million due to unspecified factors. The company became profitable last year and maintains satisfactory debt levels with a net debt-to-equity ratio of 39.3%. However, short-term assets of TRY428.5 million fall short of covering both long-term liabilities (TRY2.6 billion) and short-term liabilities (TRY1.1 billion), which may pose financial challenges despite stable volatility and high-quality earnings.

- Jump into the full analysis health report here for a deeper understanding of Hun Yenilenebilir Enerji Üretim.

- Examine Hun Yenilenebilir Enerji Üretim's past performance report to understand how it has performed in prior years.

Tarya Israel (TASE:TRA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tarya Israel Ltd, with a market cap of ₪183.16 million, operates an internet platform in Israel through its subsidiaries.

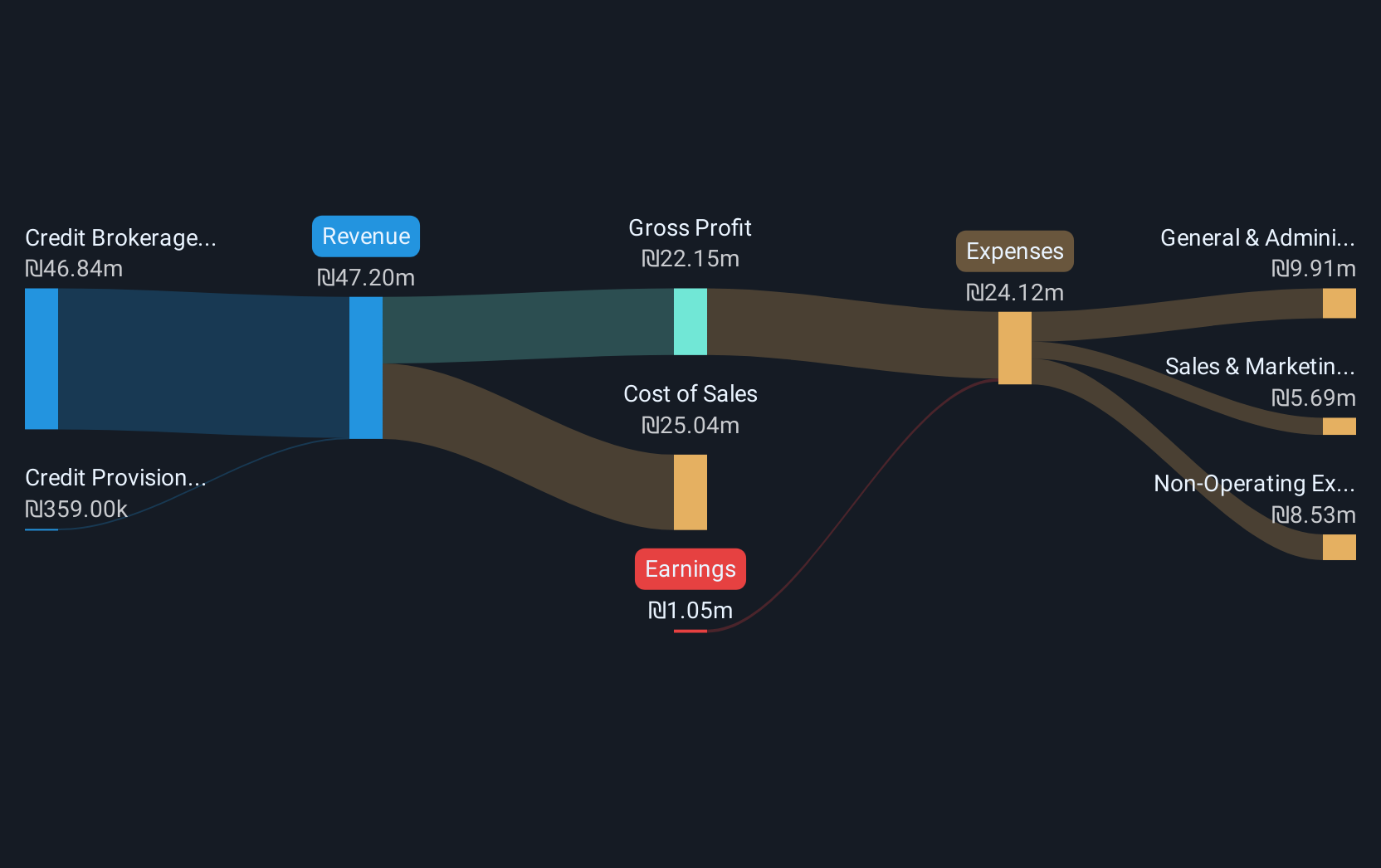

Operations: Tarya generates revenue from two main segments: Credit Brokerage, contributing ₪41.13 million, and Credit Provision, adding ₪0.30 million.

Market Cap: ₪183.16M

Tarya Israel Ltd, with a market cap of ₪183.16 million, operates in the credit brokerage and provision sectors. The company reported a decline in sales to ₪18.04 million for the first half of 2025 from ₪29.5 million a year earlier, resulting in a net loss of ₪3.35 million compared to last year's net income. Despite being unprofitable, Tarya has reduced losses over five years by 42.8% annually and maintains more cash than total debt, indicating financial resilience with short-term assets exceeding liabilities significantly. However, its share price remains highly volatile with negative return on equity at -12.36%.

- Dive into the specifics of Tarya Israel here with our thorough balance sheet health report.

- Explore historical data to track Tarya Israel's performance over time in our past results report.

Key Takeaways

- Embark on your investment journey to our 79 Middle Eastern Penny Stocks selection here.

- Seeking Other Investments? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hun Yenilenebilir Enerji Üretim might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:HUNER

Hun Yenilenebilir Enerji Üretim

Engages in the establishment, construction, commissioning, renting, generation, and sale of electrical energy and/or capacity to transmission and distribution companies in Turkey and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives