As global markets navigate a landscape shaped by rate cut expectations and AI optimism, major U.S. stock indexes have reached new heights, buoyed by the anticipation of monetary easing and technological advancements. In such a climate, investors often seek opportunities that combine growth potential with financial stability. Penny stocks, though an older term, continue to offer intriguing possibilities for those looking to capitalize on smaller or newer companies with robust fundamentals. In this article, we explore three penny stocks that stand out for their balance sheet strength and potential for significant returns.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.61 | HK$1.01B | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.69 | A$402.03M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.575 | MYR292.38M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.49 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.40 | MYR562.17M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.19 | SGD12.55B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.60 | $348.8M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.215 | £193.43M | ✅ 4 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.932 | €31.43M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,732 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Baoxiniao Holding (SZSE:002154)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Baoxiniao Holding Co., Ltd. is involved in the research, development, production, and sale of branded men's and women's clothing products in China, with a market cap of CN¥5.62 billion.

Operations: Baoxiniao Holding generates its revenue primarily from its Textile and Apparel segment, which accounts for CN¥4.92 billion.

Market Cap: CN¥5.62B

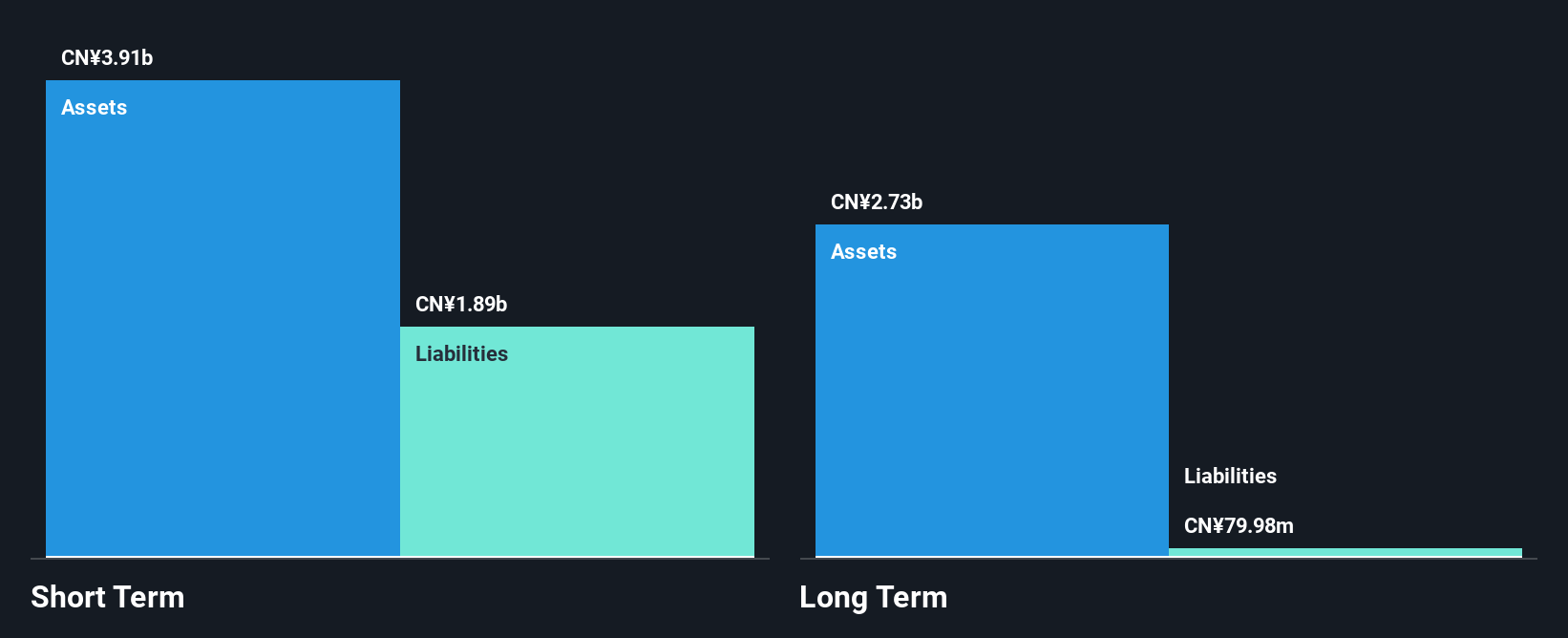

Baoxiniao Holding Co., Ltd. has demonstrated some financial resilience, with short-term assets of CN¥3.9 billion exceeding both its long-term liabilities and short-term liabilities, indicating solid liquidity management. The company's debt is well covered by operating cash flow, and it holds more cash than total debt, suggesting a strong balance sheet position. However, recent earnings have declined significantly by 45.1% over the past year compared to the luxury industry average decline of 10%, impacting net profit margins which fell from 12.1% to 6.9%. Despite these challenges, the company trades at a favorable price-to-earnings ratio relative to peers in China (17.8x vs market's 45.3x). Recent amendments to its articles of association suggest ongoing corporate governance adjustments that may influence future operations and strategy execution.

- Unlock comprehensive insights into our analysis of Baoxiniao Holding stock in this financial health report.

- Examine Baoxiniao Holding's earnings growth report to understand how analysts expect it to perform.

HARBIN GLORIA PHARMACEUTICALS (SZSE:002437)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Harbin Gloria Pharmaceuticals Co., Ltd focuses on the research, development, production, and sale of pharmaceutical products primarily in China with a market cap of CN¥7.77 billion.

Operations: The company generates revenue from two main segments: Chemical Medicine, contributing CN¥2.12 billion, and Traditional Chinese Medicine, contributing CN¥190.33 million.

Market Cap: CN¥7.77B

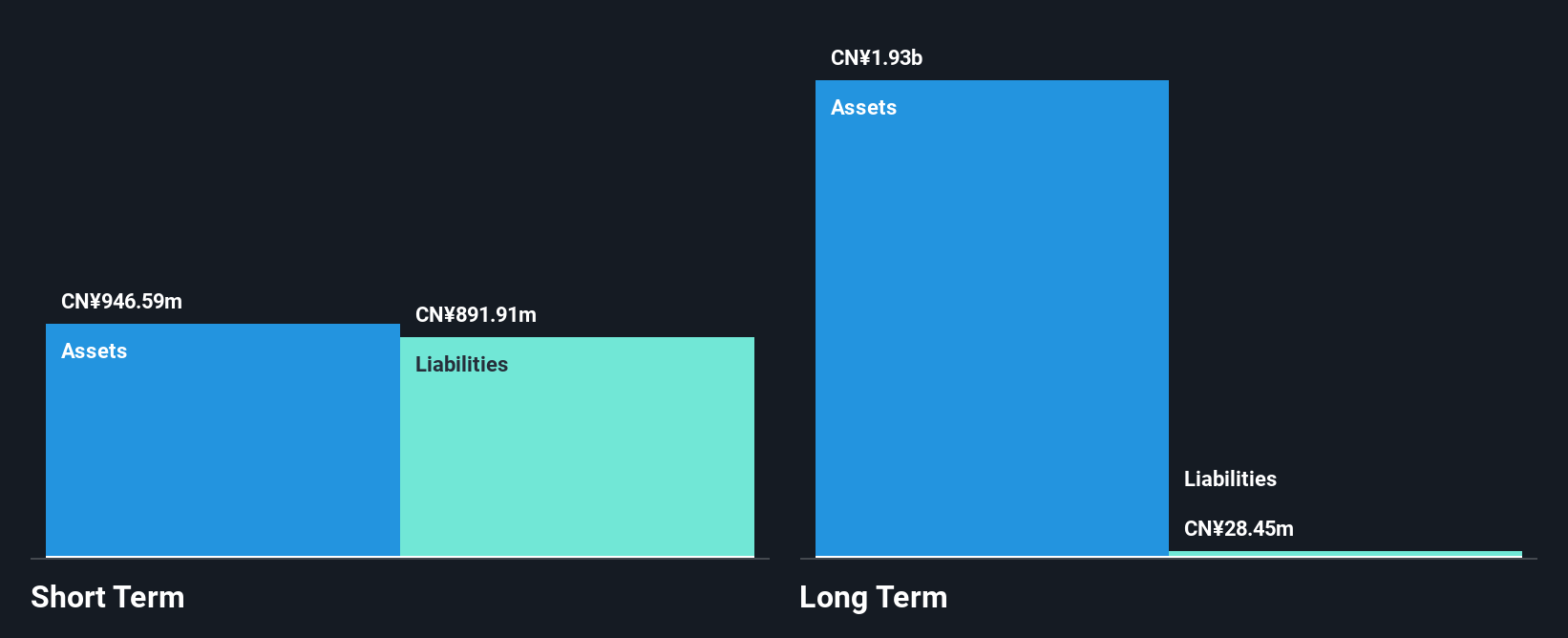

Harbin Gloria Pharmaceuticals Co., Ltd. has shown financial stability with short-term assets of CN¥988.8 million surpassing both its short and long-term liabilities, indicating strong liquidity management. The company has more cash than debt, and its operating cash flow covers debt obligations well, pointing to a robust balance sheet. Despite a one-off gain impacting recent results, earnings grew by 11.6% over the past year, outpacing the industry average decline of -0.8%. Recent corporate governance changes could impact strategic direction as they address amendments in several procedural rules at an extraordinary shareholders meeting held recently.

- Take a closer look at HARBIN GLORIA PHARMACEUTICALS' potential here in our financial health report.

- Examine HARBIN GLORIA PHARMACEUTICALS' past performance report to understand how it has performed in prior years.

Zhejiang Reclaim Construction Group (SZSE:002586)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Reclaim Construction Group Co., Ltd. operates in the construction industry and has a market cap of CN¥4.14 billion.

Operations: The company's revenue is primarily derived from Building Construction, which generated CN¥2.20 billion, and Design and Technical Services, contributing CN¥247.53 million.

Market Cap: CN¥4.14B

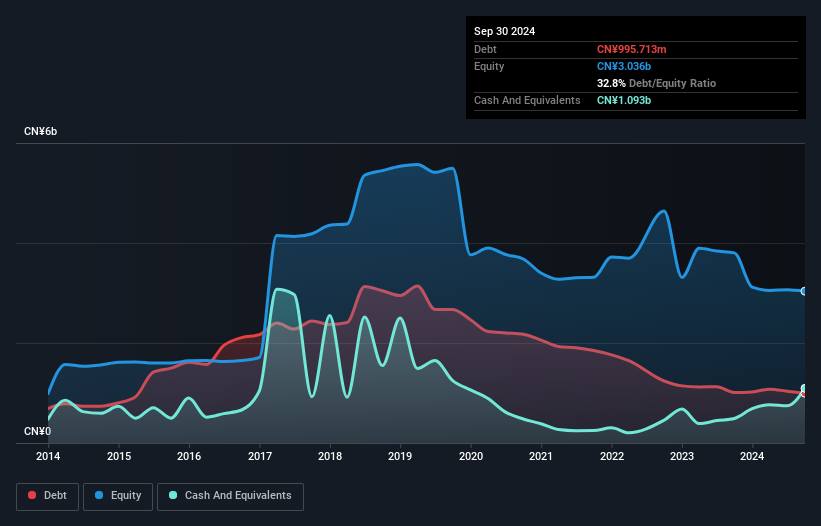

Zhejiang Reclaim Construction Group Co., Ltd. has demonstrated financial resilience despite its current unprofitability, with short-term assets of CN¥3.9 billion exceeding both short and long-term liabilities, suggesting solid liquidity management. The company reported a net income of CN¥8.33 million for the first half of 2025, reversing a loss from the previous year, indicating progress in reducing losses at an annual rate of 45.1% over five years. Additionally, it maintains more cash than debt and possesses a sufficient cash runway to cover over three years based on current free cash flow levels.

- Dive into the specifics of Zhejiang Reclaim Construction Group here with our thorough balance sheet health report.

- Gain insights into Zhejiang Reclaim Construction Group's past trends and performance with our report on the company's historical track record.

Seize The Opportunity

- Jump into our full catalog of 3,732 Global Penny Stocks here.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baoxiniao Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002154

Baoxiniao Holding

Engages in the research and development, production, and sale of branded men and women clothing products in China.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives