- Switzerland

- /

- Building

- /

- SWX:DOKA

Discover 3 European Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As European markets experience a period of cautious optimism, highlighted by a recent uptick in the STOXX Europe 600 Index following trade negotiation delays and slowing inflation, investors are keenly observing potential opportunities that might arise from these developments. In this context, identifying stocks that may be trading below their estimated value becomes particularly relevant, as such investments could offer attractive prospects amid shifting economic conditions and policy adjustments.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VIGO Photonics (WSE:VGO) | PLN526.00 | PLN1024.74 | 48.7% |

| Vestas Wind Systems (CPSE:VWS) | DKK106.20 | DKK209.54 | 49.3% |

| USU Software (HMSE:OSP2) | €25.485 | €50.86 | 49.9% |

| Sparebank 68° Nord (OB:SB68) | NOK179.40 | NOK358.38 | 49.9% |

| Montana Aerospace (SWX:AERO) | CHF19.72 | CHF38.66 | 49% |

| Micro Systemation (OM:MSAB B) | SEK48.30 | SEK95.13 | 49.2% |

| doValue (BIT:DOV) | €2.31 | €4.50 | 48.7% |

| CTT Systems (OM:CTT) | SEK208.00 | SEK406.70 | 48.9% |

| Absolent Air Care Group (OM:ABSO) | SEK211.00 | SEK416.98 | 49.4% |

| 3U Holding (XTRA:UUU) | €1.495 | €2.99 | 49.9% |

Let's dive into some prime choices out of the screener.

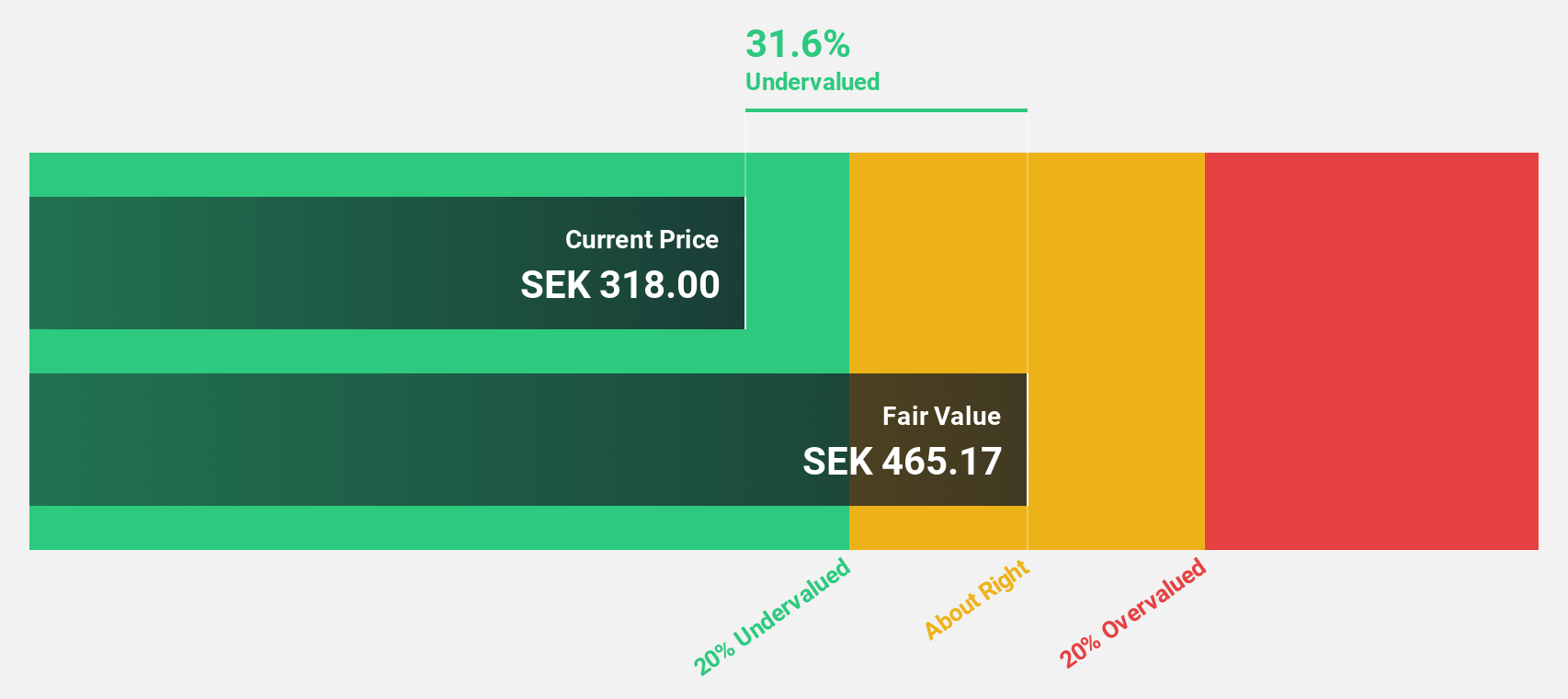

Xvivo Perfusion (OM:XVIVO)

Overview: Xvivo Perfusion AB (publ) is a Swedish medical technology company that develops and markets machines and perfusion solutions for assessing and maintaining organs in optimal condition for transplantation, with a market cap of SEK9.95 billion.

Operations: Xvivo Perfusion generates its revenue from three segments: Services (SEK86.95 million), Thoracic (SEK576.05 million), and Abdominal (SEK191.98 million).

Estimated Discount To Fair Value: 30.7%

Xvivo Perfusion is trading at SEK316, significantly below its estimated fair value of SEK456.08, suggesting potential undervaluation based on cash flows. Analysts forecast robust revenue growth of 29% annually and earnings growth of 48.1%, both outpacing the Swedish market averages. Despite a recent quarterly net loss of SEK12.4 million, the company's long-term growth prospects remain strong with expected significant annual profit increases over the next three years.

- Our earnings growth report unveils the potential for significant increases in Xvivo Perfusion's future results.

- Click to explore a detailed breakdown of our findings in Xvivo Perfusion's balance sheet health report.

dormakaba Holding (SWX:DOKA)

Overview: dormakaba Holding AG offers access and security solutions globally, with a market capitalization of CHF3.07 billion.

Operations: The company's revenue segments include Access Solutions at CHF2.44 billion and Key & Wall Solutions and OEM at CHF496.40 million.

Estimated Discount To Fair Value: 47.9%

Dormakaba Holding is trading at CHF732, well below its estimated fair value of CHF1404.8, indicating it may be undervalued based on cash flows. Analysts anticipate earnings growth of 28.1% annually, surpassing the Swiss market average of 10.7%, though revenue growth is expected to lag slightly behind the market at 4% per year. Despite high debt levels and large one-off items affecting results, strong profit growth prospects enhance its appeal as an investment opportunity in Europe.

- Our expertly prepared growth report on dormakaba Holding implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of dormakaba Holding here with our thorough financial health report.

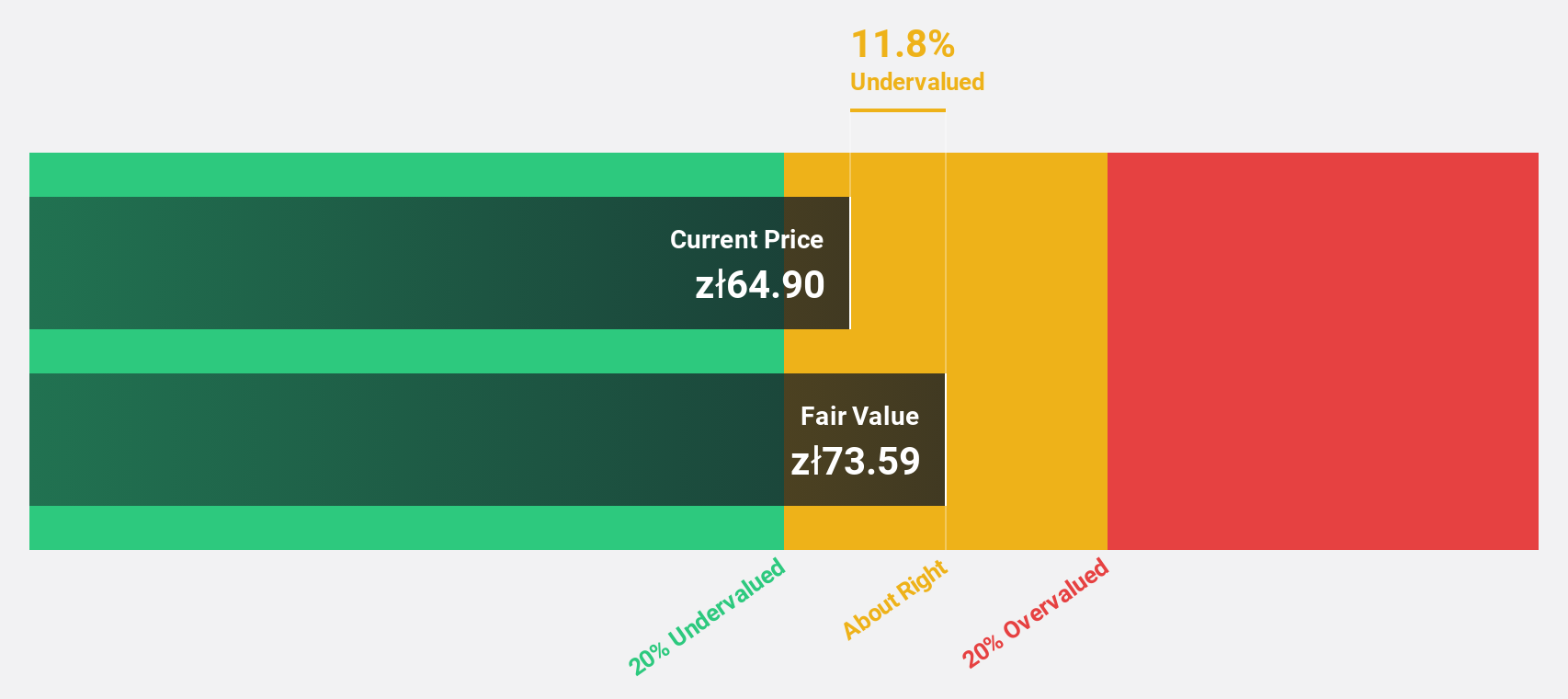

Atal (WSE:1AT)

Overview: Atal S.A. is involved in the development and sale of residential buildings in Poland, with a market cap of PLN2.76 billion.

Operations: The company's revenue is primarily derived from its real estate development activity, amounting to PLN1.22 billion, with additional income from rental services totaling PLN11.16 million.

Estimated Discount To Fair Value: 13.1%

Atal S.A. trades at PLN63.9, below its estimated fair value of PLN73.54, suggesting potential undervaluation based on cash flows. Despite recent declines in earnings and dividends not being well covered by cash flows, Atal's earnings are expected to grow significantly at 21.9% annually, outpacing the Polish market average of 13.8%. However, revenue growth projections remain modest at 15.1%, and debt coverage through operating cash flow is inadequate, presenting some financial challenges.

- The growth report we've compiled suggests that Atal's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Atal stock in this financial health report.

Where To Now?

- Click here to access our complete index of 182 Undervalued European Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:DOKA

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion