- United States

- /

- Hospitality

- /

- NYSE:DIN

Dine Brands Global (NYSE:DIN) Shareholders Booked A 25% Gain In The Last Year

On average, over time, stock markets tend to rise higher. This makes investing attractive. But if you choose that path, you're going to buy some stocks that fall short of the market. Unfortunately for shareholders, while the Dine Brands Global, Inc. (NYSE:DIN) share price is up 25% in the last year, that falls short of the market return. Having said that, the longer term returns aren't so impressive, with stock gaining just 9.3% in three years.

View 3 warning signs we detected for Dine Brands Global

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year, Dine Brands Global actually saw its earnings per share drop 15%.

So we don't think that investors are paying too much attention to EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

However the year on year revenue growth of 21% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

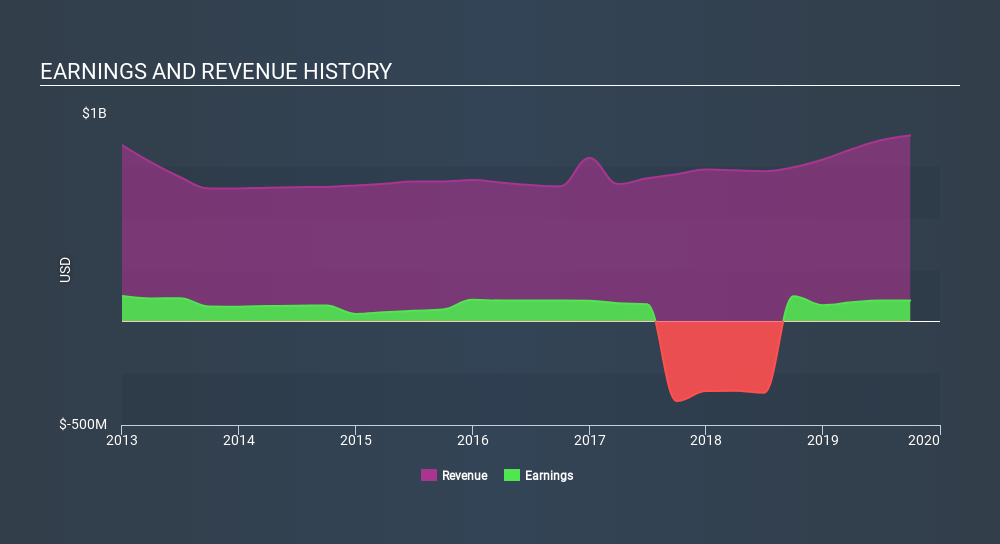

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Dine Brands Global stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Dine Brands Global, it has a TSR of 29% for the last year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Dine Brands Global's TSR for the year was broadly in line with the market average, at 29%. That gain looks pretty satisfying, and it is even better than the five-year TSR of 0.9% per year. It is possible that management foresight will bring growth well into the future, even if the share price slows down. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Dine Brands Global (of which 1 is major) which any shareholder or potential investor should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:DIN

Dine Brands Global

Owns, franchises, and operates restaurants in the United States and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives