- Philippines

- /

- Hospitality

- /

- PSE:PLUS

DigiPlus Interactive (PSE:PLUS) Doubles Net Income To PHP 4,202 Million

Reviewed by Simply Wall St

DigiPlus Interactive (PSE:PLUS) experienced significant movements this past quarter, with its shares rising by 60%. Key events likely influencing this surge include its first-quarter earnings announcement with net income doubling to PHP 4,202 million and the incorporation of DigiPlus Global in Singapore, signaling ambitious international expansion plans. Governance updates, such as proposed bylaw amendments, demonstrate clear organizational progress. At the same time, broader market conditions, including a 12% rise over the last year, may have provided a supportive backdrop for the stock's performance, aligning DigiPlus's positive trajectory with general market trends amidst global economic uncertainties.

We've spotted 1 warning sign for DigiPlus Interactive you should be aware of.

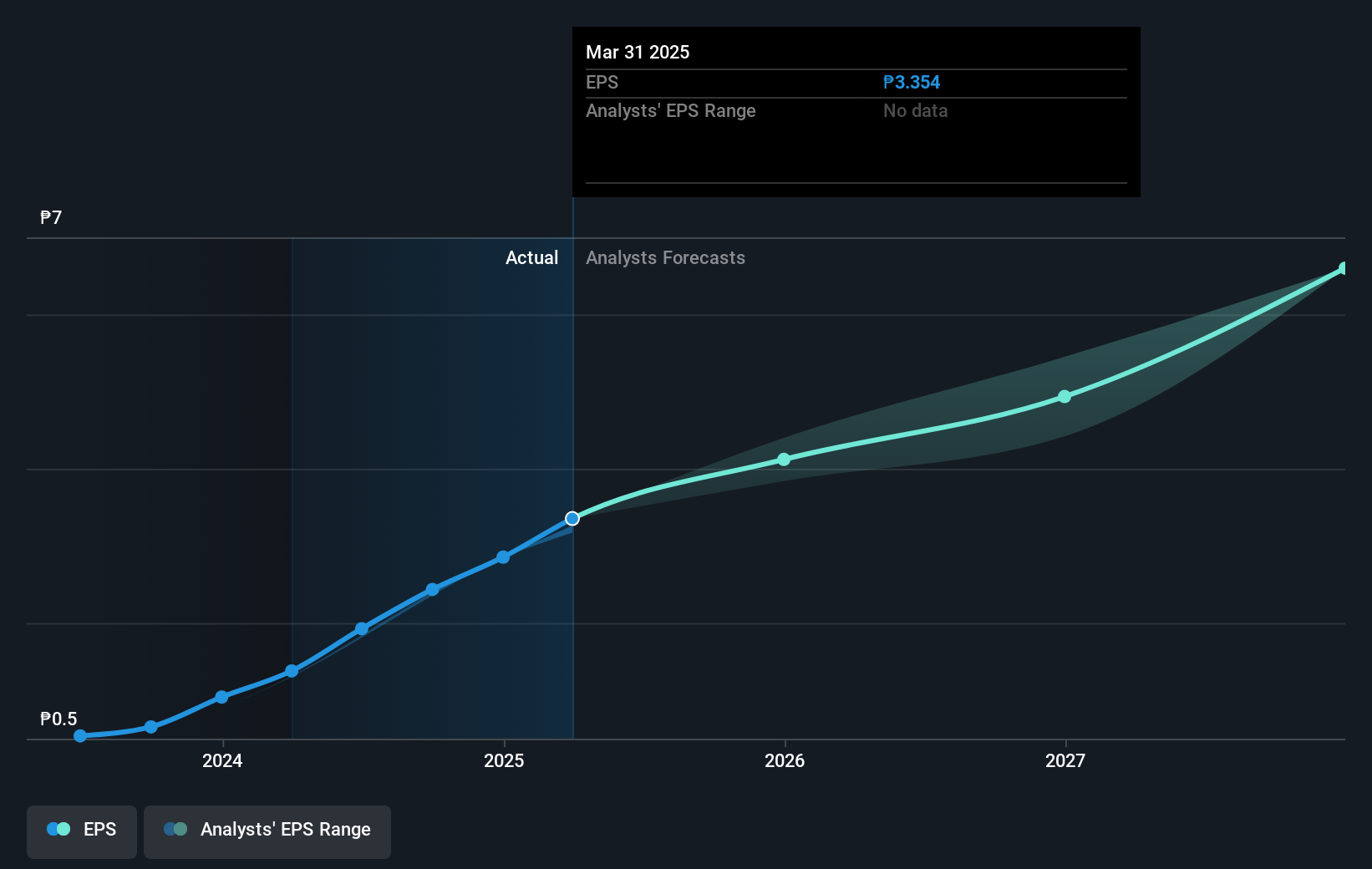

Over the past three years, DigiPlus Interactive (PSE:PLUS) has achieved an exceptional total return of over 4,200%. This long-term performance is remarkable compared to the PH Hospitality industry and PH market's one-year returns of 18.2% and 7.6%, respectively. The recent developments such as doubling net income and the company's expansion into Singapore could drive further revenue and earnings growth, as seen in the reported boost in recent quarters. These factors suggest a strengthened market position and potential future profitability improvements.

Despite the recent 60% rise in share price, PLUS remains 37.2% below its consensus fair value target of ₱88.43, signaling potential room for growth. The ambitious expansion plans and governance updates might enhance investor confidence, while analysts' forecasts suggest robust earnings growth. However, with limited analyst coverage, statistical confidence in meeting the price target remains uncertain. This highlights the need for cautious optimism while considering investment in DigiPlus.

Review our growth performance report to gain insights into DigiPlus Interactive's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:PLUS

DigiPlus Interactive

Through its subsidiaries, operates as a digital entertainment company in the Philippines.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives