- Canada

- /

- Industrial REITs

- /

- TSX:NXR.UN

Did You Miss Nexus Real Estate Investment Trust's (CVE:NXR.UN) 22% Share Price Gain?

By buying an index fund, investors can approximate the average market return. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, the Nexus Real Estate Investment Trust (CVE:NXR.UN) share price is up 22% in the last three years, clearly besting the market return of around 5.6% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 15% , including dividends .

Check out our latest analysis for Nexus Real Estate Investment Trust

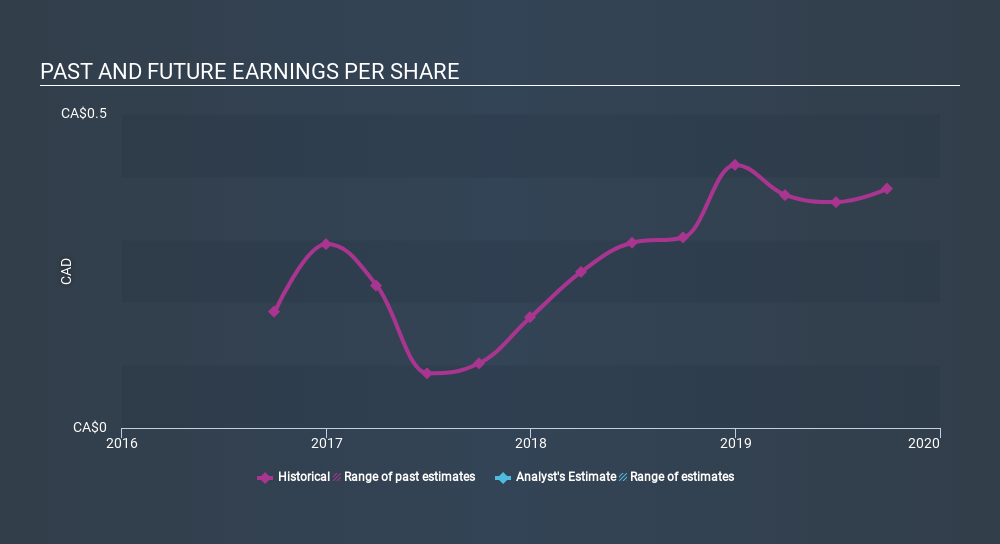

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Nexus Real Estate Investment Trust was able to grow its EPS at 27% per year over three years, sending the share price higher. The average annual share price increase of 6.8% is actually lower than the EPS growth. So it seems investors have become more cautious about the company, over time. This cautious sentiment is reflected in its (fairly low) P/E ratio of 5.56.

You can see below how EPS has changed over time.

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Nexus Real Estate Investment Trust's TSR for the last 3 years was 55%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Nexus Real Estate Investment Trust's TSR for the year was broadly in line with the market average, at 15%. That gain looks pretty satisfying, and it is even better than the five-year TSR of 13% per year. It is possible that management foresight will bring growth well into the future, even if the share price slows down. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Nexus Real Estate Investment Trust by clicking this link.

Nexus Real Estate Investment Trust is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:NXR.UN

Nexus Industrial REIT

A growth-oriented real estate investment trust focused on increasing unitholder value through the acquisition of industrial properties located in primary and secondary markets in Canada, and the ownership and management of its portfolio of properties.

Established dividend payer moderate.

Market Insights

Community Narratives