By buying an index fund, investors can approximate the average market return. But if you choose individual stocks with prowess, you can make superior returns. Just take a look at Haier Electronics Group Co., Ltd. (HKG:1169), which is up 68%, over three years, soundly beating the market return of 1.6% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 3.1% in the last year , including dividends .

View our latest analysis for Haier Electronics Group

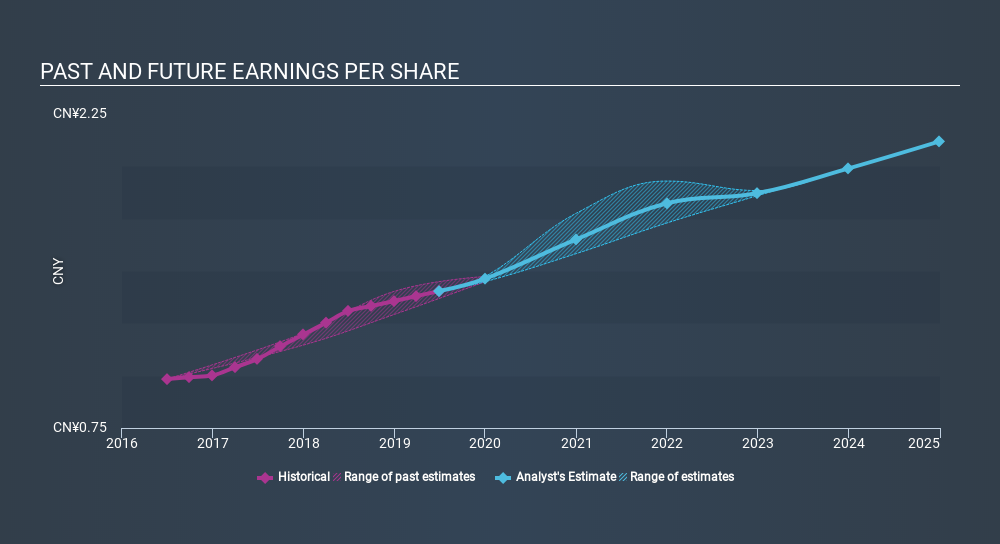

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During three years of share price growth, Haier Electronics Group achieved compound earnings per share growth of 13% per year. This EPS growth is lower than the 19% average annual increase in the share price. This indicates that the market is feeling more optimistic on the stock, after the last few years of progress. It's not unusual to see the market 're-rate' a stock, after a few years of growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Haier Electronics Group's TSR for the last 3 years was 75%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Haier Electronics Group shareholders have received a total shareholder return of 3.1% over the last year. And that does include the dividend. However, that falls short of the 3.6% TSR per annum it has made for shareholders, each year, over five years. Is Haier Electronics Group cheap compared to other companies? These 3 valuation measures might help you decide.

We will like Haier Electronics Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Community Narratives