- Hungary

- /

- Electric Utilities

- /

- BUSE:ENEFI

Did You Miss ENEFI Energiahatékonysági Nyrt's (BUSE:ENEFI) Impressive 258% Share Price Gain?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. One great example is ENEFI Energiahatékonysági Nyrt. (BUSE:ENEFI) which saw its share price drive 258% higher over five years. It's also good to see the share price up 86% over the last quarter.

Check out our latest analysis for ENEFI Energiahatékonysági Nyrt

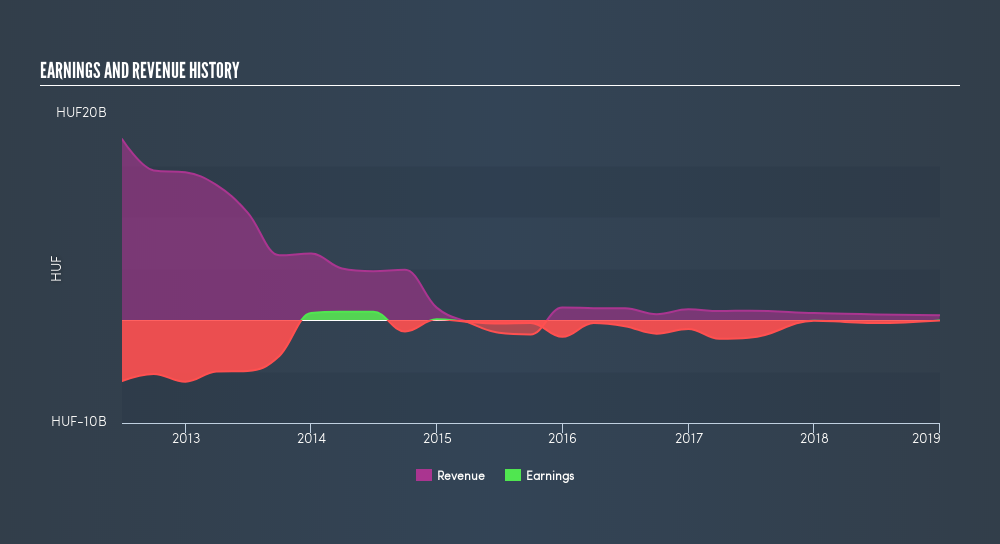

Because ENEFI Energiahatékonysági Nyrt is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last half decade ENEFI Energiahatékonysági Nyrt's revenue has actually been trending down at about 46% per year. On the other hand, the share price done the opposite, gaining 29%, compound, each year. It just goes to show tht the market is forward looking, and it's not always easy to predict the future based on past trends. Still, this situation makes us a little wary of the stock.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that ENEFI Energiahatékonysági Nyrt has rewarded shareholders with a total shareholder return of 132% in the last twelve months. That gain is better than the annual TSR over five years, which is 29%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course ENEFI Energiahatékonysági Nyrt may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BUSE:ENEFI

ENEFI Vagyonkezelo Nyrt

ENEFI Vagyonkezelo Nyrt. operating in the energy sector.

Excellent balance sheet moderate.

Market Insights

Community Narratives