- Australia

- /

- Professional Services

- /

- ASX:SOP

Did You Manage To Avoid Synertec's (ASX:SOP) Painful 51% Share Price Drop?

The nature of investing is that you win some, and you lose some. Unfortunately, shareholders of Synertec Corporation Limited (ASX:SOP) have suffered share price declines over the last year. The share price is down a hefty 51% in that time. We wouldn't rush to judgement on Synertec because we don't have a long term history to look at. The share price has dropped 54% in three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Check out our latest analysis for Synertec

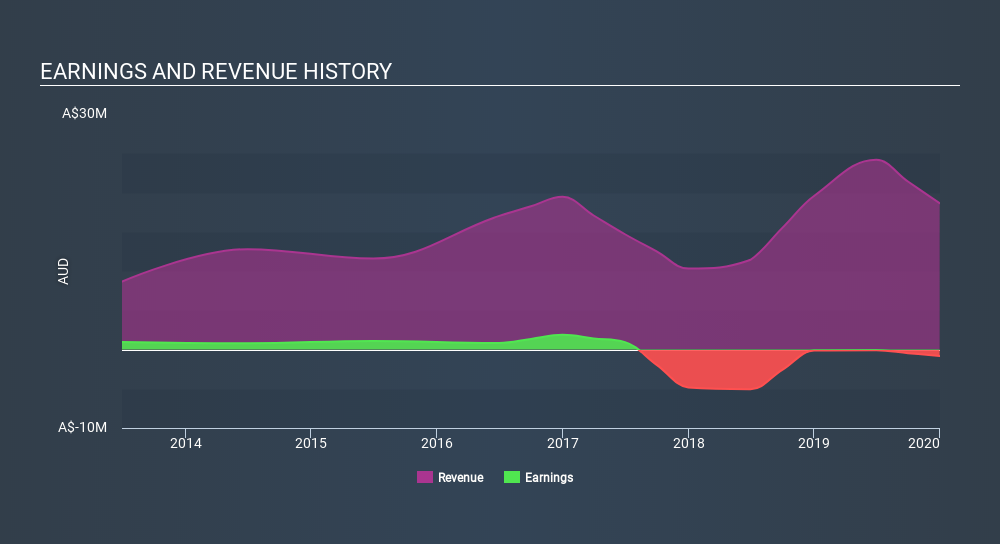

Given that Synertec didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In just one year Synertec saw its revenue fall by 4.7%. That's not what investors generally want to see. The share price drop of 51% is understandable given the company doesn't have profits to boast of. Fingers crossed this is the low ebb for the stock. We have a natural aversion to companies that are losing money and shrinking revenue. But perhaps that is being too careful.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Synertec's financial health with this free report on its balance sheet.

A Different Perspective

While Synertec shareholders are down 51% for the year, the market itself is up 4.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's worth noting that the last three months did the real damage, with a 54% decline. This probably signals that the business has recently disappointed shareholders - it will take time to win them back. It's always interesting to track share price performance over the longer term. But to understand Synertec better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 6 warning signs with Synertec (at least 3 which are potentially serious) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:SOP

Synertec

Operates as a diversified technology design and development company in Australia.

Adequate balance sheet slight.

Market Insights

Community Narratives