- United Kingdom

- /

- Media

- /

- AIM:SAL

Did You Manage To Avoid SpaceandPeople's (LON:SAL) Devastating 74% Share Price Drop?

We think intelligent long term investing is the way to go. But along the way some stocks are going to perform badly. For example the SpaceandPeople plc (LON:SAL) share price dropped 74% over five years. That's not a lot of fun for true believers. We also note that the stock has performed poorly over the last year, with the share price down 43%. The falls have accelerated recently, with the share price down 14% in the last three months.

See our latest analysis for SpaceandPeople

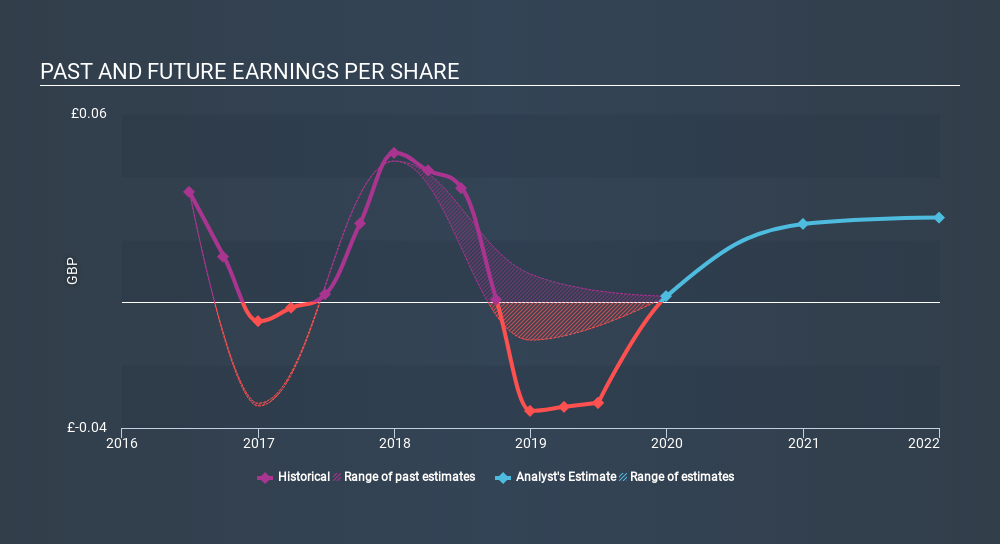

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over five years SpaceandPeople's earnings per share dropped significantly, falling to a loss, with the share price also lower. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. But we would generally expect a lower price, given the situation.

You can see how EPS has changed over time in the image below.

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of SpaceandPeople, it has a TSR of -69% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

While the broader market gained around 9.0% in the last year, SpaceandPeople shareholders lost 41% (even including dividends) . However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 21% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Before forming an opinion on SpaceandPeople you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:SAL

SpaceandPeople

Provides commercial and promotional space and retail solutions for businesses to promote and acquire customers in shopping centers, retail parks, railway stations, and other locations in the United Kingdom and Germany.

Solid track record and good value.

Market Insights

Community Narratives