- United States

- /

- Machinery

- /

- NasdaqCM:NNDM

Did You Manage To Avoid Nano Dimension's (NASDAQ:NNDM) 96% Share Price Wipe Out?

It's not possible to invest over long periods without making some bad investments. But you want to avoid the really big losses like the plague. So consider, for a moment, the misfortune of Nano Dimension Ltd. (NASDAQ:NNDM) investors who have held the stock for three years as it declined a whopping 96%. That'd be enough to cause even the strongest minds some disquiet. And over the last year the share price fell 77%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 17% in the last 90 days.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View 6 warning signs we detected for Nano Dimension

Because Nano Dimension is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, Nano Dimension saw its revenue grow by 101% per year, compound. That is faster than most pre-profit companies. So on the face of it we're really surprised to see the share price down 65% a year in the same time period. The share price makes us wonder if there is an issue with profitability. Sometimes fast revenue growth doesn't lead to profits. If the company is low on cash, it may have to raise capital soon.

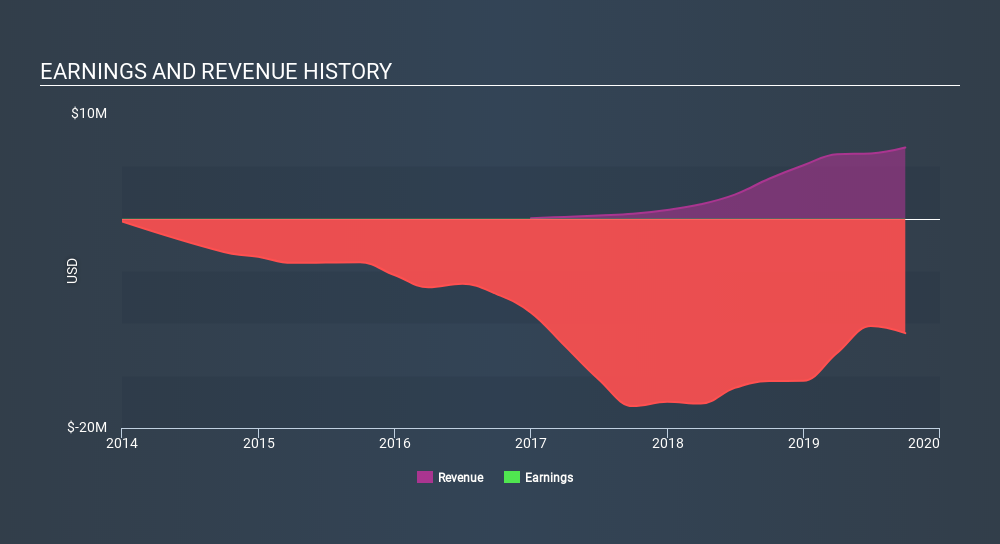

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Nano Dimension's earnings, revenue and cash flow.

A Different Perspective

Nano Dimension shareholders are down 77% for the year, but the broader market is up 28%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 65% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. You could get a better understanding of Nano Dimension's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:NNDM

Nano Dimension

Designs and manufactures systems useful in the electronic fabrication in Israel and Internationally.

Flawless balance sheet minimal.

Market Insights

Community Narratives