- Australia

- /

- Energy Services

- /

- ASX:MCE

Did You Manage To Avoid Matrix Composites & Engineering's (ASX:MCE) Painful 68% Share Price Drop?

We think intelligent long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example, after five long years the Matrix Composites & Engineering Ltd (ASX:MCE) share price is a whole 68% lower. That's not a lot of fun for true believers. We also note that the stock has performed poorly over the last year, with the share price down 42%. The falls have accelerated recently, with the share price down 40% in the last three months.

Check out our latest analysis for Matrix Composites & Engineering

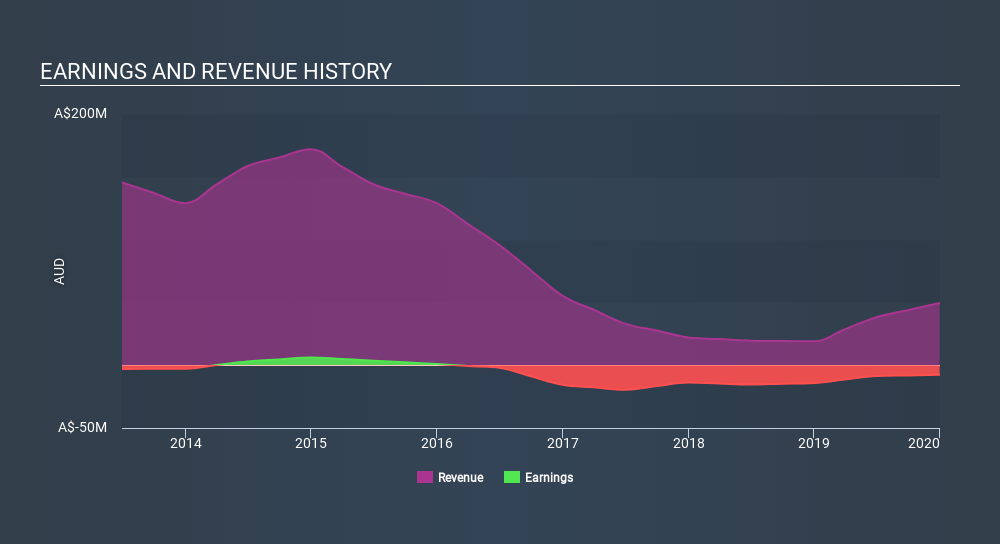

Matrix Composites & Engineering isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Matrix Composites & Engineering reduced its trailing twelve month revenue by 42% for each year. That puts it in an unattractive cohort, to put it mildly. It seems appropriate, then, that the share price slid about 20% annually during that time. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. You'd want to research this company pretty thoroughly before buying, it looks a bit too risky for us.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We regret to report that Matrix Composites & Engineering shareholders are down 42% for the year. Unfortunately, that's worse than the broader market decline of 7.0%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 20% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Matrix Composites & Engineering better, we need to consider many other factors. For instance, we've identified 3 warning signs for Matrix Composites & Engineering that you should be aware of.

Matrix Composites & Engineering is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ASX:MCE

Matrix Composites & Engineering

Engages in the design, engineering, and manufacturing of engineered polymer products for the energy, mining and resource, and defence industries.

Moderate and good value.

Market Insights

Community Narratives