Did You Manage To Avoid High Liner Foods's (TSE:HLF) Painful 65% Share Price Drop?

Generally speaking long term investing is the way to go. But no-one is immune from buying too high. To wit, the High Liner Foods Incorporated (TSE:HLF) share price managed to fall 65% over five long years. That is extremely sub-optimal, to say the least. The silver lining is that the stock is up 2.9% in about a week.

View our latest analysis for High Liner Foods

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

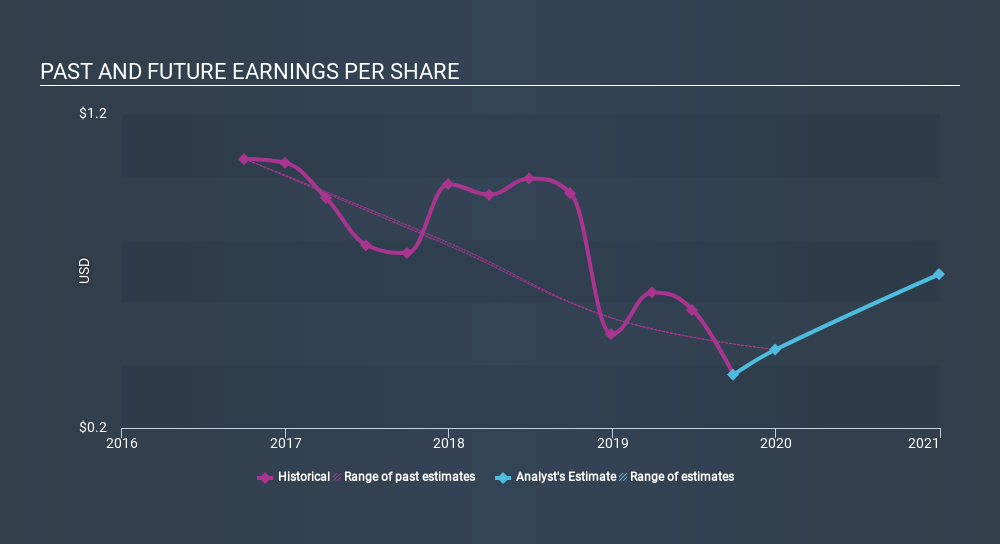

Looking back five years, both High Liner Foods's share price and EPS declined; the latter at a rate of 19% per year. This change in EPS is remarkably close to the 19% average annual decrease in the share price. This implies that the market has had a fairly steady view of the stock. So it's fair to say the share price has been responding to changes in EPS.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on High Liner Foods's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of High Liner Foods, it has a TSR of -58% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that High Liner Foods shareholders have received a total shareholder return of 20% over one year. Of course, that includes the dividend. There's no doubt those recent returns are much better than the TSR loss of 16% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for High Liner Foods you should be aware of, and 1 of them is significant.

But note: High Liner Foods may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:HLF

High Liner Foods

Processes and markets prepared and packaged frozen seafood products in North America.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives