Did You Manage To Avoid Grupo Security's (SNSE:SECURITY) 35% Share Price Drop?

It's easy to match the overall market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. That downside risk was realized by Grupo Security S.A. (SNSE:SECURITY) shareholders over the last year, as the share price declined 35%. That contrasts poorly with the market return of -11%. However, the longer term returns haven't been so bad, with the stock down 17% in the last three years. The falls have accelerated recently, with the share price down 27% in the last three months.

View our latest analysis for Grupo Security

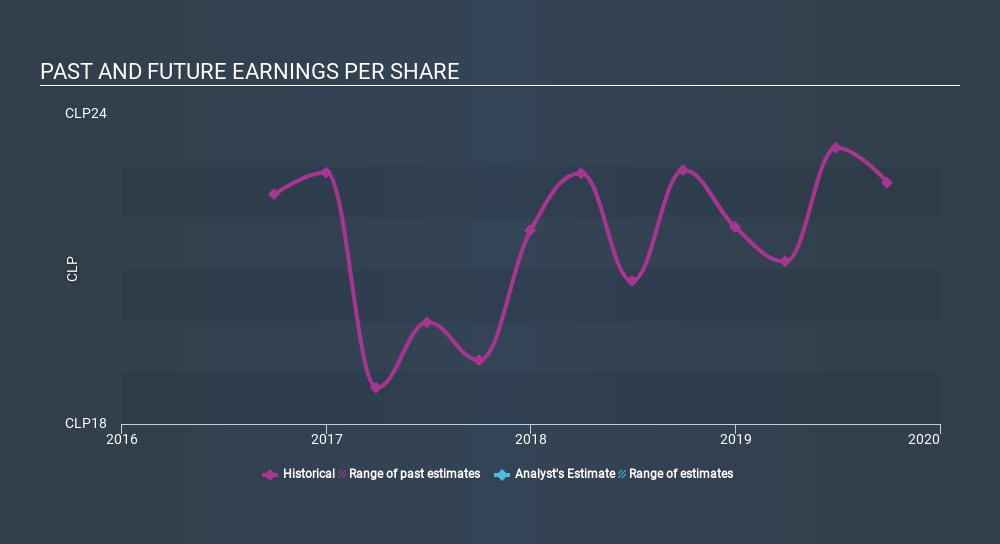

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unhappily, Grupo Security had to report a 1.1% decline in EPS over the last year. The share price decline of 35% is actually more than the EPS drop. This suggests the EPS fall has made some shareholders are more nervous about the business. The P/E ratio of 8.32 also points to the negative market sentiment.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Grupo Security the TSR over the last year was -32%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market lost about 11% in the twelve months, Grupo Security shareholders did even worse, losing 32% (even including dividends) . Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 4.6% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Grupo Security better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Grupo Security , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CL exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SNSE:SECURITY

Grupo Security

A diversified financial holding company, provides commercial and retail banking, insurance, factoring, asset management, and other products and services to large and medium-sized companies, and high-income individuals in Chile.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives