- Hong Kong

- /

- Real Estate

- /

- SEHK:21

Did You Manage To Avoid Great China Properties Holdings's (HKG:21) Painful 62% Share Price Drop?

If you love investing in stocks you're bound to buy some losers. But the last three years have been particularly tough on longer term Great China Properties Holdings Limited (HKG:21) shareholders. Unfortunately, they have held through a 62% decline in the share price in that time. And over the last year the share price fell 30%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 17% in the last 90 days.

View 1 warning sign we detected for Great China Properties Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

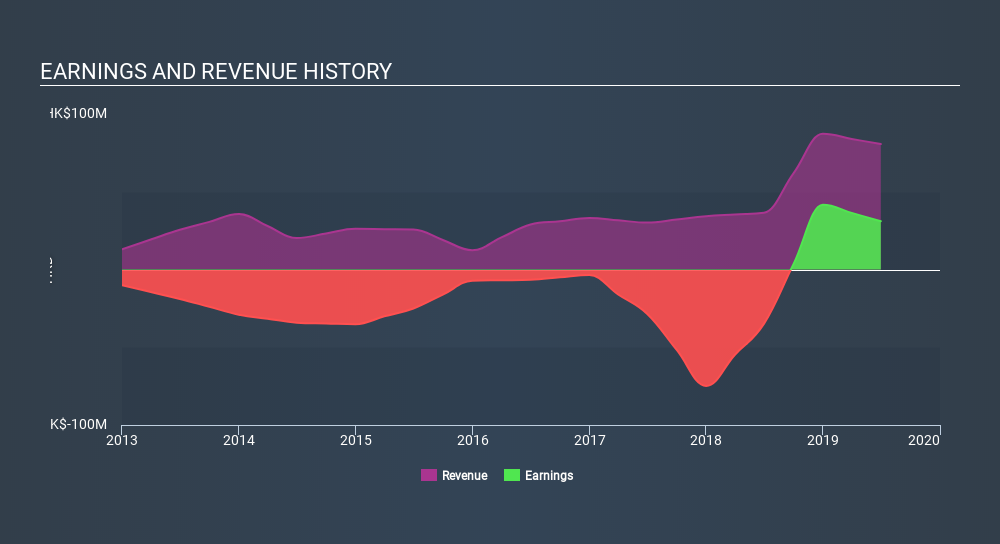

During five years of share price growth, Great China Properties Holdings moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

We note that, in three years, revenue has actually grown at a 42% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating Great China Properties Holdings further; while we may be missing something on this analysis, there might also be an opportunity.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Great China Properties Holdings's financial health with this free report on its balance sheet.

A Different Perspective

Investors in Great China Properties Holdings had a tough year, with a total loss of 30%, against a market gain of about 2.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 16% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Before deciding if you like the current share price, check how Great China Properties Holdings scores on these 3 valuation metrics.

But note: Great China Properties Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:21

Great China Holdings (Hong Kong)

An investment holding company, engages in property development and investment business in the People’s Republic of China.

Mediocre balance sheet low.

Market Insights

Community Narratives