Did You Manage To Avoid Front Yard Residential's (NYSE:RESI) Painful 54% Share Price Drop?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Front Yard Residential Corporation (NYSE:RESI) shareholders should be happy to see the share price up 26% in the last quarter. But over the last half decade, the stock has not performed well. After all, the share price is down 54% in that time, significantly under-performing the market.

View our latest analysis for Front Yard Residential

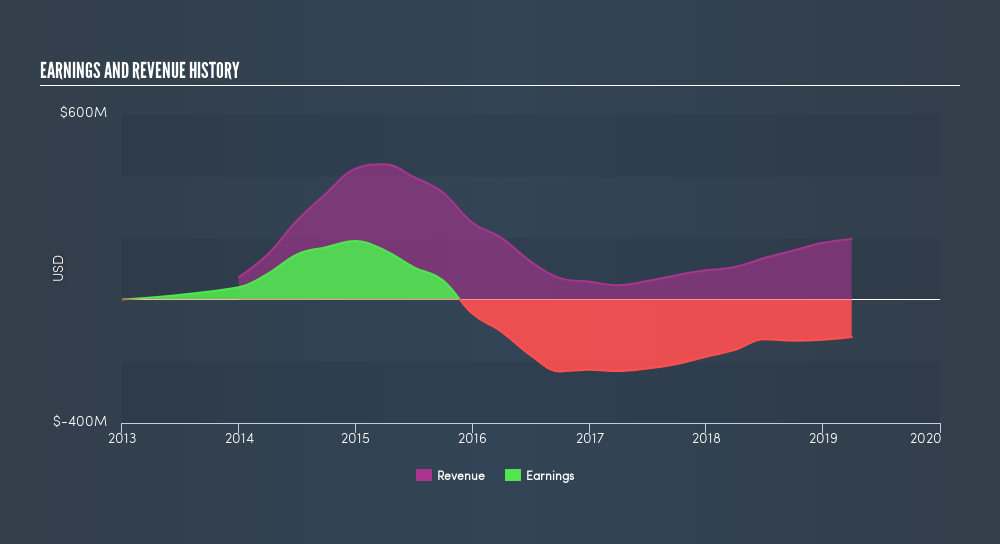

Because Front Yard Residential is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Front Yard Residential reduced its trailing twelve month revenue by 24% for each year. That's definitely a weaker result than most pre-profit companies report. Arguably, the market has responded appropriately to this business performance by sending the share price down 14% (annualized) in the same time period. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. This looks like a really risky stock to buy, at a glance.

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling Front Yard Residential stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Front Yard Residential the TSR over the last 5 years was -34%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Front Yard Residential has rewarded shareholders with a total shareholder return of 25% in the last twelve months. Of course, that includes the dividend. There's no doubt those recent returns are much better than the TSR loss of 7.9% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Community Narratives