- Hong Kong

- /

- Construction

- /

- SEHK:1757

Did You Manage To Avoid Affluent Foundation Holdings's (HKG:1757) 30% Share Price Drop?

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the Affluent Foundation Holdings Limited (HKG:1757) share price slid 30% over twelve months. That falls noticeably short of the market return of around -1.5%. Because Affluent Foundation Holdings hasn't been listed for many years, the market is still learning about how the business performs. Shareholders have had an even rougher run lately, with the share price down 17% in the last 90 days.

View our latest analysis for Affluent Foundation Holdings

Affluent Foundation Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In just one year Affluent Foundation Holdings saw its revenue fall by 49%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 30% in that time. What would you expect when revenue is falling, and it doesn't make a profit? It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

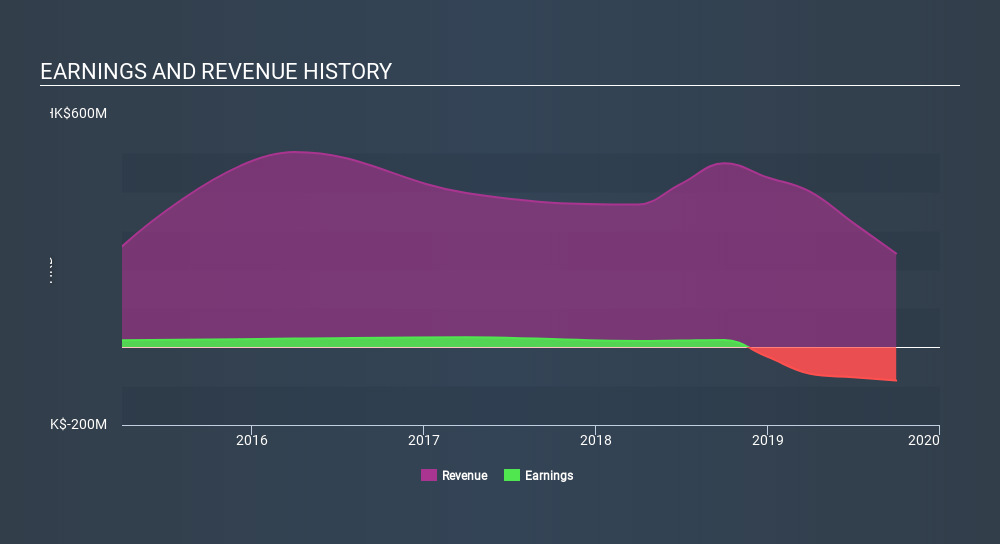

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

We doubt Affluent Foundation Holdings shareholders are happy with the loss of 30% over twelve months. That falls short of the market, which lost 1.5%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 17%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Affluent Foundation Holdings has 6 warning signs (and 2 which are significant) we think you should know about.

Of course Affluent Foundation Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1757

Affluent Foundation Holdings

An investment holding company, provides services related to foundation works in Hong Kong.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives