- United States

- /

- Real Estate

- /

- NasdaqGS:STRS

Did Stratus Properties's (NASDAQ:STRS) Share Price Deserve to Gain 56%?

The simplest way to invest in stocks is to buy exchange traded funds. But you can do a lot better than that by buying good quality businesses for attractive prices. For example, the Stratus Properties Inc. (NASDAQ:STRS) share price is 56% higher than it was five years ago, which is more than the market average. In comparison, the share price is down 16% in a year.

Check out our latest analysis for Stratus Properties

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Stratus Properties's earnings per share are down 30% per year, despite strong share price performance over five years. Essentially, it doesn't seem likely that investors are focused on EPS. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

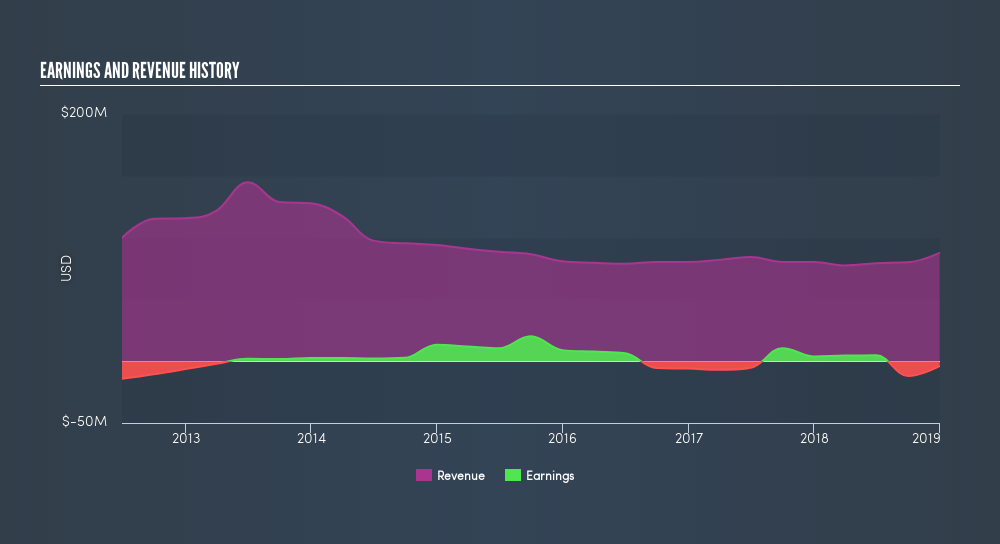

It is not great to see that revenue has dropped by 6.9% per year over five years. So it seems one might have to take closer look at earnings and revenue trends to see how they might influence the share price.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

Balance sheet strength is crucual. It might be well worthwhile taking a look at our freereport on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Stratus Properties's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that Stratus Properties's TSR, at 62% is higher than its share price return of 56%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Investors in Stratus Properties had a tough year, with a total loss of 16%, against a market gain of about 12%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 10%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. You could get a better understanding of Stratus Properties's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you are like me, then you will not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:STRS

Stratus Properties

A real estate company, engages in the entitlement, development, management, leasing, and sale of multi and single family residential and commercial real estate properties in the Austin, Texas area and other select markets in Texas.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives