- Hong Kong

- /

- Construction

- /

- SEHK:1183

Did MECOM Power and Construction Limited (HKG:1183) Insiders Sell Shares?

It is not uncommon to see companies perform well in the years after insiders buy shares. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So before you buy or sell MECOM Power and Construction Limited (HKG:1183), you may well want to know whether insiders have been buying or selling.

What Is Insider Buying?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, most countries require that the company discloses such transactions to the market.

Insider transactions are not the most important thing when it comes to long-term investing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.

View our latest analysis for MECOM Power and Construction

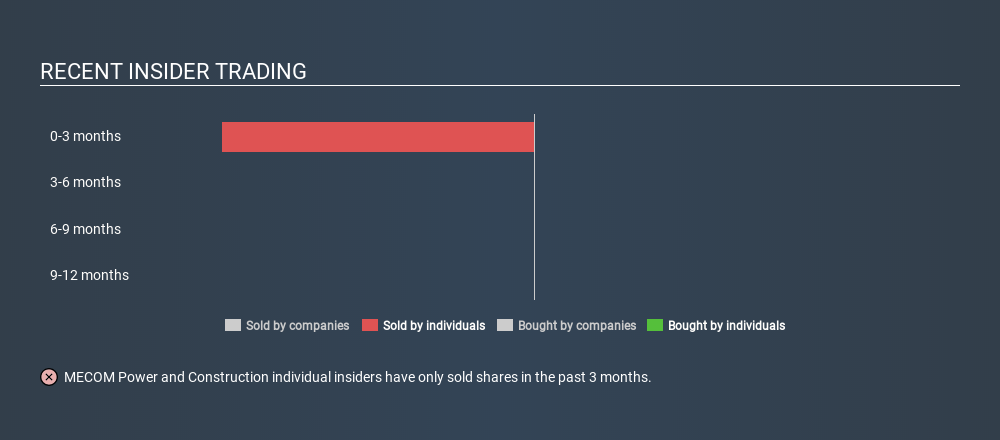

The Last 12 Months Of Insider Transactions At MECOM Power and Construction

Over the last year, we can see that the biggest insider sale was by the insider, Yau Lung Ho, for HK$214m worth of shares, at about HK$0.89 per share. That means that an insider was selling shares at slightly below the current price (HK$1.39). We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. It is worth noting that this sale was 100% of Yau Lung Ho's holding. The only individual insider seller over the last year was Yau Lung Ho.

You can see the insider transactions (by individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

MECOM Power and Construction Insiders Are Selling The Stock

The last quarter saw substantial insider selling of MECOM Power and Construction shares. In total, insider Yau Lung Ho sold HK$214m worth of shares in that time, and we didn't record any purchases whatsoever. This may suggest that some insiders think that the shares are not cheap.

Does MECOM Power and Construction Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. A high insider ownership often makes company leadership more mindful of shareholder interests. Insiders own 3.1% of MECOM Power and Construction shares, worth about HK$52m, according to our data. We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. We do generally prefer see higher levels of insider ownership.

So What Does This Data Suggest About MECOM Power and Construction Insiders?

An insider hasn't bought MECOM Power and Construction stock in the last three months, but there was some selling. And there weren't any purchases to give us comfort, over the last year. Insider ownership isn't particularly high, so this analysis makes us cautious about the company. So we'd only buy after careful consideration. To put this in context, take a look at how a company has performed in the past. You can access this detailed graph of past earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1183

MECOM Power and Construction

Provides construction services in Macau, Hong Kong, Cyprus, and the People’s Republic of China.

Slight with mediocre balance sheet.

Market Insights

Community Narratives