Did Changing Sentiment Drive THC Global Group's (ASX:THC) Share Price Down By 41%?

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the THC Global Group Limited (ASX:THC) share price is down 41% in the last year. That's disappointing when you consider the market returned 5.6%. We wouldn't rush to judgement on THC Global Group because we don't have a long term history to look at. Shareholders have had an even rougher run lately, with the share price down 13% in the last 90 days. Of course, this share price action may well have been influenced by the 5.2% decline in the broader market, throughout the period.

Check out our latest analysis for THC Global Group

Given that THC Global Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year THC Global Group saw its revenue grow by 80%. That's a strong result which is better than most other loss making companies. The share price drop of 41% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

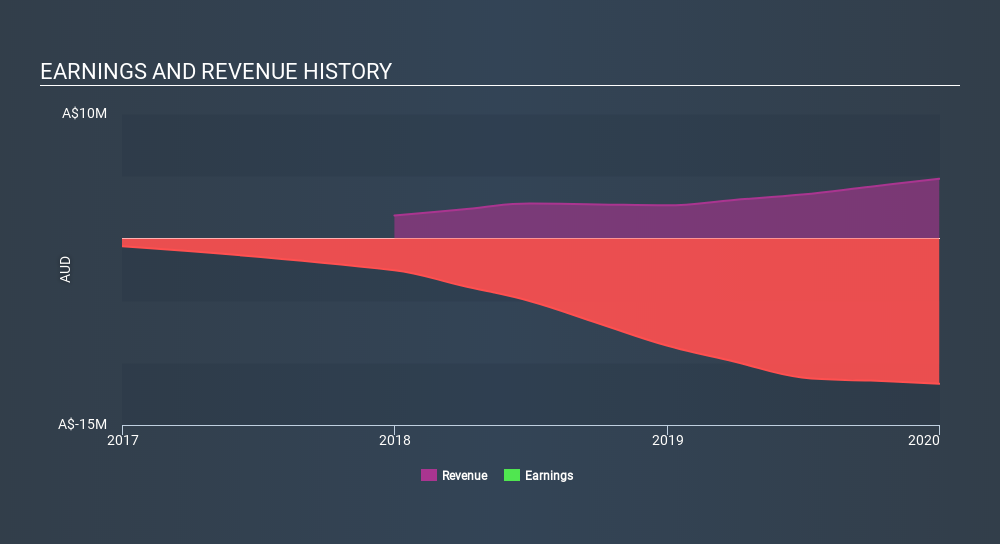

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While THC Global Group shareholders are down 41% for the year, the market itself is up 5.6%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 13%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand THC Global Group better, we need to consider many other factors. Take risks, for example - THC Global Group has 6 warning signs (and 1 which is significant) we think you should know about.

But note: THC Global Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:EPN

Epsilon Healthcare

Engages in the healthcare business in Australia.

Moderate risk and slightly overvalued.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Palo Alto Networks (PANW): Collateral Damage

Paladin Energy will ride the uranium resurgence with increasing production and secure contracts

Rocket Lab (RKLB): A Rising Challenger in the Space Economy

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion