- Hong Kong

- /

- Communications

- /

- SEHK:1720

Did Changing Sentiment Drive Putian Communication Group's (HKG:1720) Share Price Down By 42%?

It's easy to match the overall market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in Putian Communication Group Limited (HKG:1720) have tasted that bitter downside in the last year, as the share price dropped 42%. That contrasts poorly with the market decline of 8.8%. Putian Communication Group may have better days ahead, of course; we've only looked at a one year period. It's down 3.8% in the last seven days.

Check out our latest analysis for Putian Communication Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

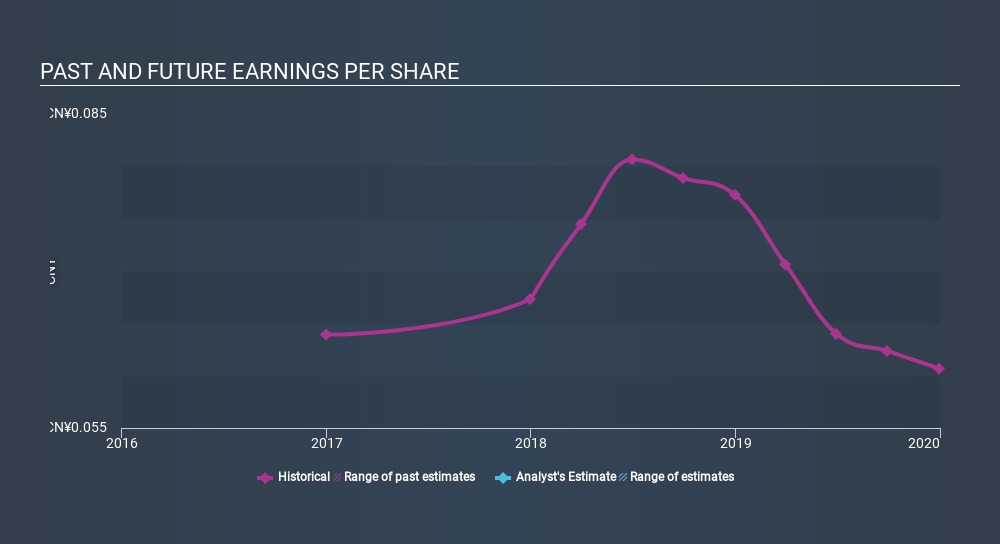

Unhappily, Putian Communication Group had to report a 21% decline in EPS over the last year. The share price decline of 42% is actually more than the EPS drop. This suggests the EPS fall has made some shareholders are more nervous about the business.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Putian Communication Group's earnings, revenue and cash flow.

A Different Perspective

We doubt Putian Communication Group shareholders are happy with the loss of 42% over twelve months. That falls short of the market, which lost 8.8%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's great to see a nice little 0.8% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Putian Communication Group has 3 warning signs (and 2 which don't sit too well with us) we think you should know about.

We will like Putian Communication Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1720

Putian Communication Group

An investment holding company, produces and sells optical fiber cables, communication copper cables, and structured cabling system products under the Hanphy brand name in the People's Republic of China, Hong Kong, and internationally.

Good value with proven track record.

Market Insights

Community Narratives