- Finland

- /

- Entertainment

- /

- HLSE:NXTGMS

Did Changing Sentiment Drive Next Games Oyj's (HEL:NXTGMS) Share Price Down A Painful 76%?

As every investor would know, you don't hit a homerun every time you swing. But it's not unreasonable to try to avoid truly shocking capital losses. It must have been painful to be a Next Games Oyj (HEL:NXTGMS) shareholder over the last year, since the stock price plummeted 76% in that time. That'd be a striking reminder about the importance of diversification. We wouldn't rush to judgement on Next Games Oyj because we don't have a long term history to look at. The falls have accelerated recently, with the share price down 37% in the last three months.

See our latest analysis for Next Games Oyj

Given that Next Games Oyj didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Next Games Oyj grew its revenue by 87% over the last year. That's a strong result which is better than most other loss making companies. So on the face of it we're really surprised to see the share price down 76% over twelve months. There's clearly something unusual going on here such as an acquisition that hasn't delivered expected profits. What is clear is that the market is not judging the company on its revenue growth right now. Of course, investors do over-react when they are stressed out, so the sell-off could be unjustifiably severe.

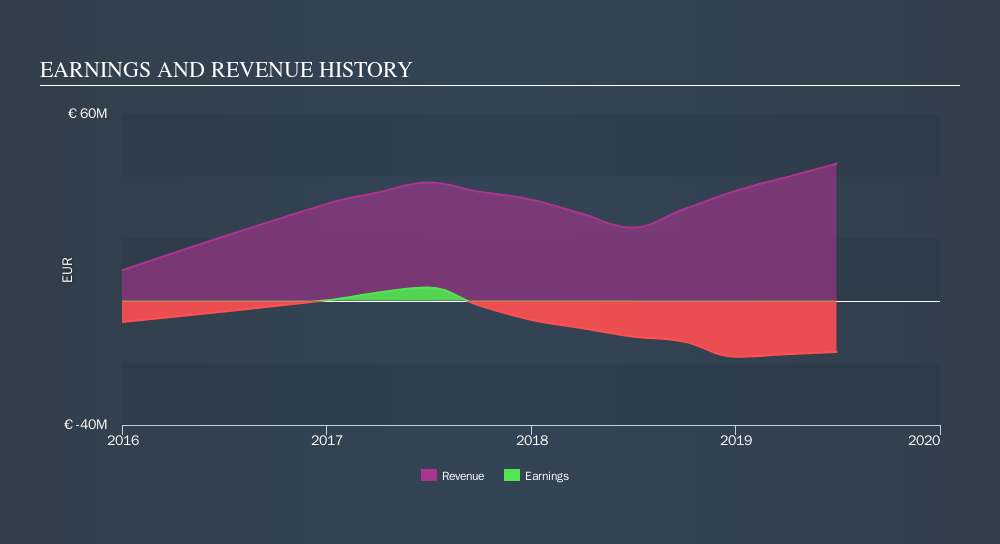

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While Next Games Oyj shareholders are down 75% for the year, the market itself is up 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 37% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

But note: Next Games Oyj may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About HLSE:NXTGMS

Next Games Oyj

Next Games Oyj develops and publishes mobile games in North America, Finland, rest of Europe, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives