Did Changing Sentiment Drive Mangata Holding's (WSE:MGT) Share Price Down By 44%?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term Mangata Holding S.A. (WSE:MGT) shareholders, since the share price is down 44% in the last three years, falling well short of the market return of around 7.8%. And more recent buyers are having a tough time too, with a drop of 25% in the last year. The good news is that the stock is up 1.5% in the last week.

See our latest analysis for Mangata Holding

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, Mangata Holding actually managed to grow EPS by 4.7% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past. After considering the numbers, we'd posit that the the market had higher expectations of EPS growth, three years back. However, taking a look at other business metrics might shed a bit more light on the share price action.

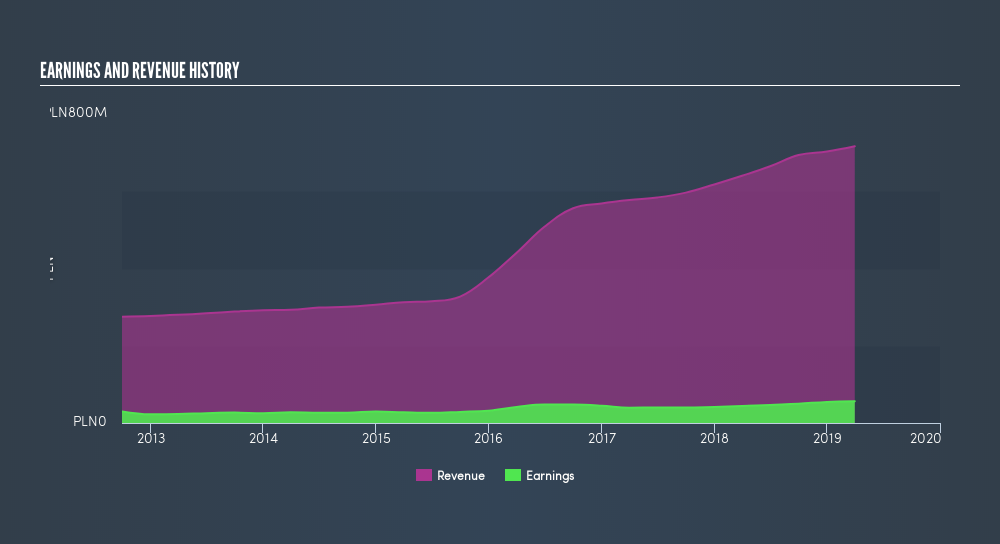

We note that the dividend has declined - a likely contributor to the share price drop. It doesn't seem like the changes in revenue would have impacted the share price much, but a closer inspection of the data might reveal something.

We know that Mangata Holding has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Mangata Holding stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Mangata Holding's TSR for the last 3 years was -31%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

While the broader market lost about 5.3% in the twelve months, Mangata Holding shareholders did even worse, losing 20% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 6.4%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Importantly, we haven't analysed Mangata Holding's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

Of course Mangata Holding may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About WSE:MGT

Mangata Holding

Operates as an industrial holding company in Poland and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives