- Hong Kong

- /

- Construction

- /

- SEHK:2663

Did Changing Sentiment Drive KPa-BM Holdings's (HKG:2663) Share Price Down By 42%?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But if you try your hand at stock picking, your risk returning less than the market. We regret to report that long term KPa-BM Holdings Limited (HKG:2663) shareholders have had that experience, with the share price dropping 42% in three years, versus a market return of about 29%. Unfortunately the share price momentum is still quite negative, with prices down 8.6% in thirty days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

View 2 warning signs we detected for KPa-BM Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate three years of share price decline, KPa-BM Holdings actually saw its earnings per share (EPS) improve by 4.3% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

It looks to us like the market was probably too optimistic around growth three years ago. However, taking a look at other business metrics might shed a bit more light on the share price action.

We note that the dividend seems healthy enough, so that probably doesn't explain the share price drop. We like that KPa-BM Holdings has actually grown its revenue over the last three years. If the company can keep growing revenue, there may be an opportunity for investors. You might have to dig deeper to understand the recent share price weakness.

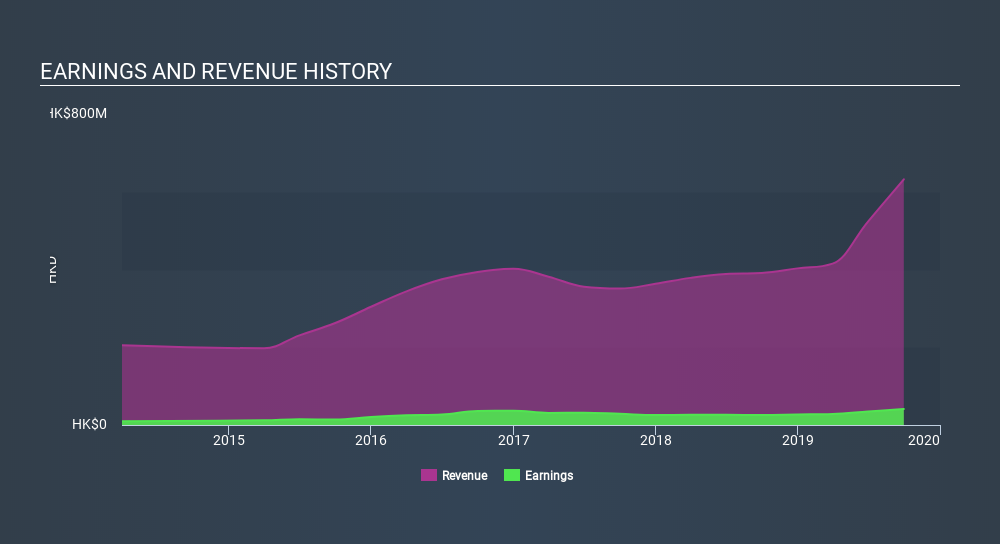

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on KPa-BM Holdings's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, KPa-BM Holdings's TSR for the last 3 years was -34%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Over the last year, KPa-BM Holdings shareholders took a loss of 17% , including dividends . In contrast the market gained about 9.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 13% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for KPa-BM Holdings which any shareholder or potential investor should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:2663

KPa-BM Holdings

An investment holding company, provides structural engineering works with a focus on design and build projects to the private and public sectors primarily in Hong Kong and Mainland China.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives