- Sweden

- /

- Medical Equipment

- /

- OM:BIOVIT

Did Changing Sentiment Drive Hemcheck Sweden's (STO:HEMC) Share Price Down By 32%?

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the Hemcheck Sweden AB (publ) (STO:HEMC) share price is down 32% in the last year. That contrasts poorly with the market decline of 0.2%. On the other hand, the stock is actually up 1.0% over three years. The falls have accelerated recently, with the share price down 28% in the last three months. Of course, this share price action may well have been influenced by the 18% decline in the broader market, throughout the period.

See our latest analysis for Hemcheck Sweden

Hemcheck Sweden recorded just kr4,720,272 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. You have to wonder why venture capitalists aren't funding it. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. Investors will be hoping that Hemcheck Sweden can make progress and gain better traction for the business, before it runs low on cash.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt.

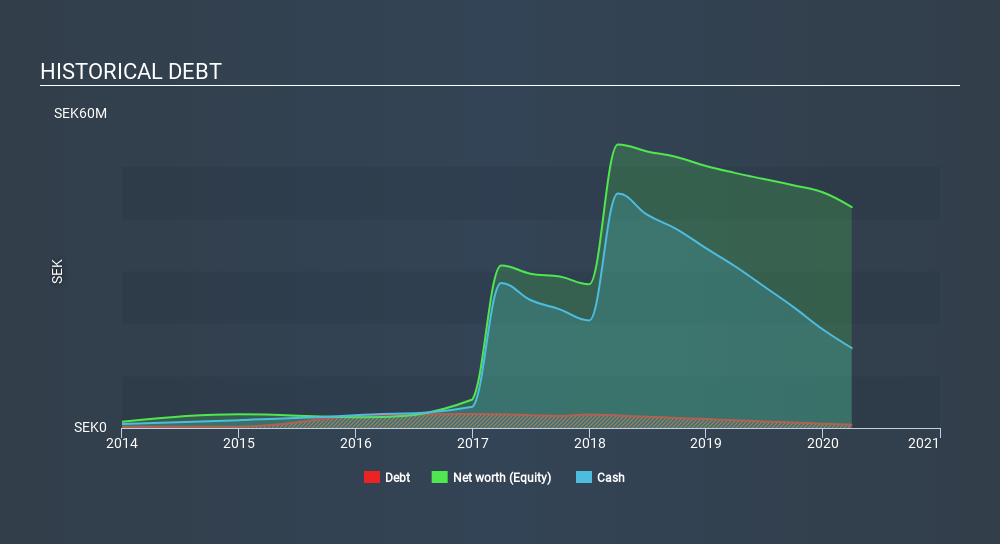

When it reported in March 2020 Hemcheck Sweden had minimal cash in excess of all liabilities consider its expenditure: just kr13m to be specific. So if it hasn't remedied the situation already, it will almost certainly have to raise more capital soon. That probably explains why the share price is down 32% in the last year. You can see in the image below, how Hemcheck Sweden's cash levels have changed over time (click to see the values).

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? I would feel more nervous about the company if that were so. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

Over the last year, Hemcheck Sweden shareholders took a loss of 32%. In contrast the market gained about 0.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Investors are up over three years, booking 0.3% per year, much better than the more recent returns. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Hemcheck Sweden (at least 4 which shouldn't be ignored) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About OM:BIOVIT

Bio Vitos Pharma

Operates as a medical technology company in Sweden and internationally.

Medium-low with mediocre balance sheet.

Market Insights

Community Narratives