- Hong Kong

- /

- Metals and Mining

- /

- SEHK:581

Did Changing Sentiment Drive China Oriental Group's (HKG:581) Share Price Down By 48%?

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. For example, the China Oriental Group Company Limited (HKG:581) share price is down 48% in the last year. That contrasts poorly with the market decline of 2.5%. Longer term investors have fared much better, since the share price is up 3.1% in three years.

See our latest analysis for China Oriental Group

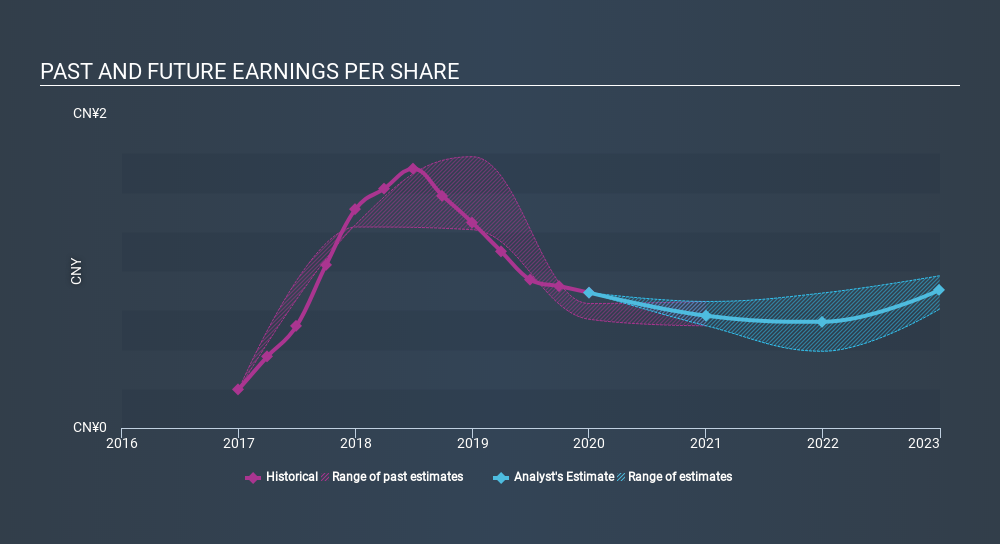

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unfortunately China Oriental Group reported an EPS drop of 34% for the last year. The share price decline of 48% is actually more than the EPS drop. This suggests the EPS fall has made some shareholders are more nervous about the business. The less favorable sentiment is reflected in its current P/E ratio of 2.46.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that China Oriental Group has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for China Oriental Group the TSR over the last year was -43%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

The last twelve months weren't great for China Oriental Group shares, which performed worse than the market, costing holders 43% , including dividends . The market shed around 2.5%, no doubt weighing on the stock price. Investors are up over three years, booking 8.0% per year, much better than the more recent returns. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for China Oriental Group (1 shouldn't be ignored!) that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SEHK:581

China Oriental Group

Manufactures and sells iron and steel products for downstream steel manufacturers in the People’s Republic of China.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives