- Canada

- /

- Energy Services

- /

- TSX:ACX

Did Changing Sentiment Drive Cathedral Energy Services's (TSE:CET) Share Price Down A Painful 91%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some stocks are best avoided. It hits us in the gut when we see fellow investors suffer a loss. Imagine if you held Cathedral Energy Services Ltd. (TSE:CET) for half a decade as the share price tanked 91%. And some of the more recent buyers are probably worried, too, with the stock falling 62% in the last year. Shareholders have had an even rougher run lately, with the share price down 36% in the last 90 days.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Cathedral Energy Services

Given that Cathedral Energy Services didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Cathedral Energy Services saw its revenue shrink by 15% per year. That's definitely a weaker result than most pre-profit companies report. So it's not altogether surprising to see the share price down 38% per year in the same time period. We don't think this is a particularly promising picture. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

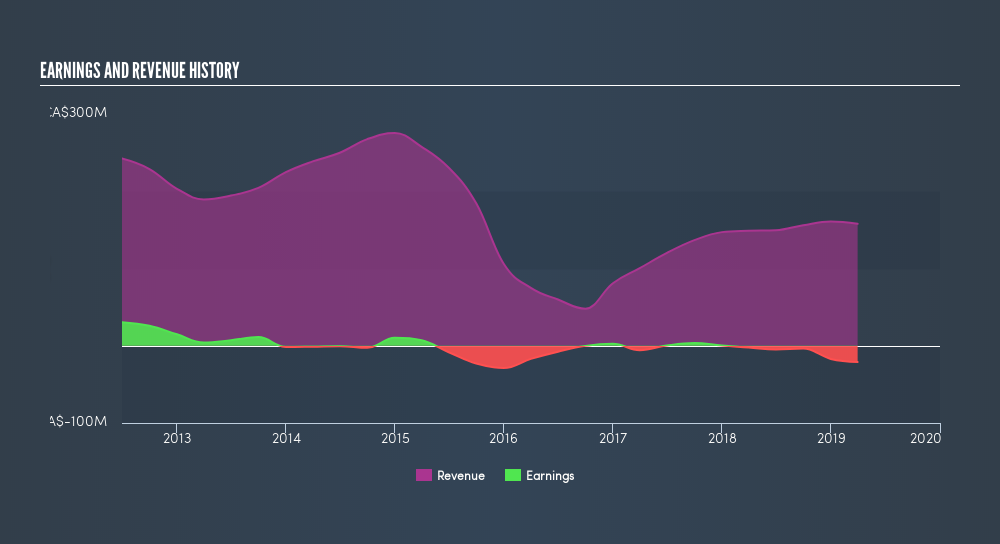

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 0.7% in the last year, Cathedral Energy Services shareholders lost 62%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 36% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:ACX

ACT Energy Technologies

Provides directional drilling services to oil and natural gas companies in Canada and the United States.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives