- United States

- /

- Transportation

- /

- NasdaqGS:CAR

Did Changing Sentiment Drive Avis Budget Group's (NASDAQ:CAR) Share Price Down A Worrying 59%?

Statistically speaking, long term investing is a profitable endeavour. But that doesn't mean long term investors can avoid big losses. Zooming in on an example, the Avis Budget Group, Inc. (NASDAQ:CAR) share price dropped 59% in the last half decade. We certainly feel for shareholders who bought near the top. We also note that the stock has performed poorly over the last year, with the share price down 30%. Unfortunately the share price momentum is still quite negative, with prices down 31% in thirty days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Check out our latest analysis for Avis Budget Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

While the share price declined over five years, Avis Budget Group actually managed to increase EPS by an average of 12% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

Because of the sharp contrast between the EPS growth rate and the share price growth, we're inclined to look to other metrics to understand the changing market sentiment around the stock.

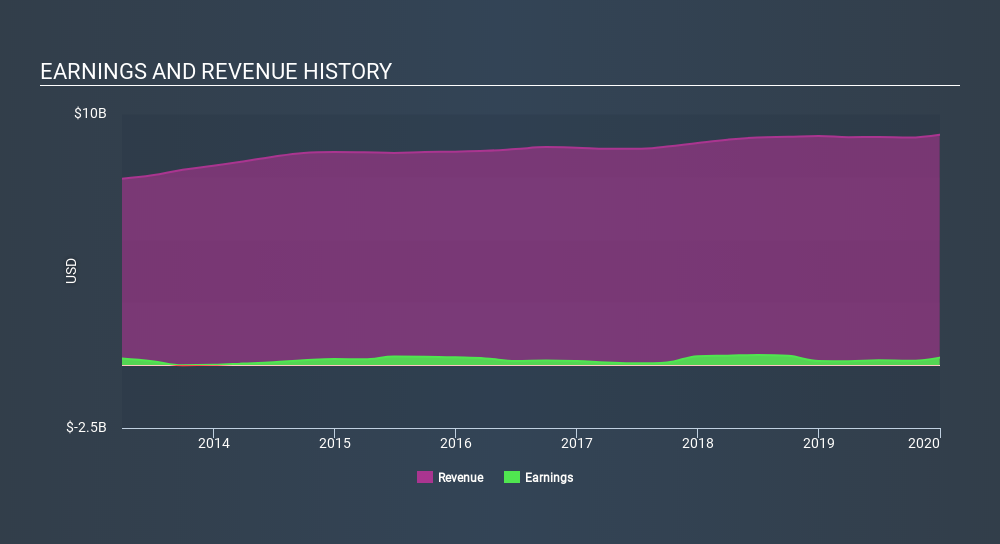

Revenue is actually up 1.8% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So it makes a lot of sense to check out what analysts think Avis Budget Group will earn in the future (free profit forecasts).

A Different Perspective

Investors in Avis Budget Group had a tough year, with a total loss of 30%, against a market gain of about 9.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 16% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with Avis Budget Group (including 2 which is don't sit too well with us) .

Avis Budget Group is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:CAR

Avis Budget Group

Provides car and truck rentals, car sharing, and ancillary products and services to businesses and consumers in the Americas, Europe, the Middle East and Africa, Asia, and Australasia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives