Long term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut when we see fellow investors suffer a loss. Imagine if you held AuStar Gold Limited (ASX:AUL) for half a decade as the share price tanked 79%. And some of the more recent buyers are probably worried, too, with the stock falling 38% in the last year. Even worse, it's down 38% in about a month, which isn't fun at all.

See our latest analysis for AuStar Gold

AuStar Gold recorded just AU$2,247,102 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, investors may be hoping that AuStar Gold finds some valuable resources, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. It certainly is a dangerous place to invest, as AuStar Gold investors might realise.

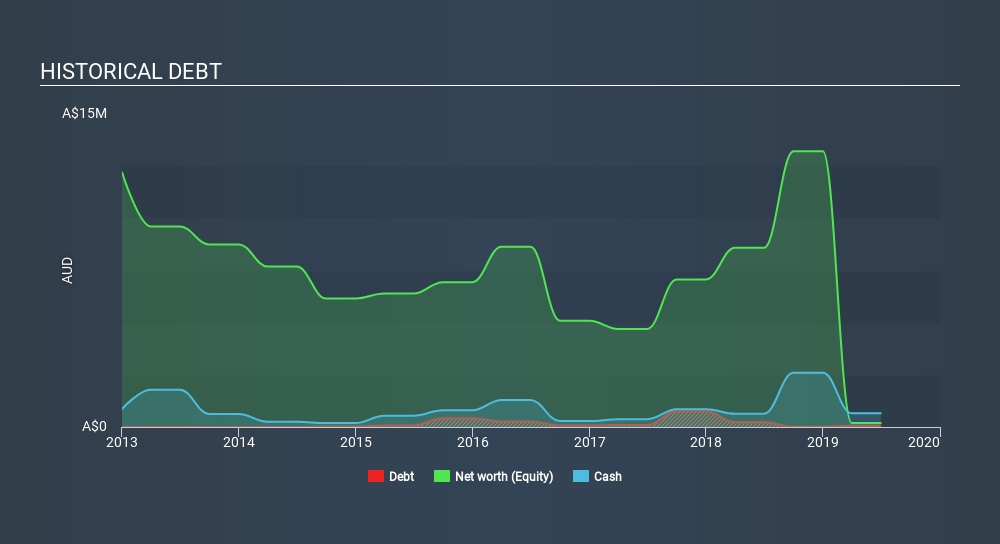

AuStar Gold had liabilities exceeding cash by AU$695k when it last reported in June 2019, according to our data. That puts it in the highest risk category, according to our analysis. But with the share price diving 27% per year, over 5 years , it's probably fair to say that some shareholders no longer believe the company will succeed. The image below shows how AuStar Gold's balance sheet has changed over time; if you want to see the precise values, simply click on the image. You can see in the image below, how AuStar Gold's cash levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit, making the share price more sensitive to other factors. For example, we've discovered 7 warning signs for AuStar Gold (of which 4 are major) which any shareholder or potential investor should be aware of.

A Different Perspective

AuStar Gold shareholders are down 38% for the year, but the market itself is up 27%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 27% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. If you would like to research AuStar Gold in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like AuStar Gold better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Community Narratives