Despite Its High P/E Ratio, Is Sanofi (EPA:SAN) Still Undervalued?

This article is for investors who would like to improve their understanding of price to earnings ratios (P/E ratios). We'll apply a basic P/E ratio analysis to Sanofi's (EPA:SAN), to help you decide if the stock is worth further research. Sanofi has a P/E ratio of 36.12, based on the last twelve months. That is equivalent to an earnings yield of about 2.8%.

See our latest analysis for Sanofi

How Do I Calculate Sanofi's Price To Earnings Ratio?

The formula for P/E is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for Sanofi:

P/E of 36.12 = €92.00 ÷ €2.55 (Based on the year to September 2019.)

Is A High P/E Ratio Good?

The higher the P/E ratio, the higher the price tag of a business, relative to its trailing earnings. That isn't necessarily good or bad, but a high P/E implies relatively high expectations of what a company can achieve in the future.

Does Sanofi Have A Relatively High Or Low P/E For Its Industry?

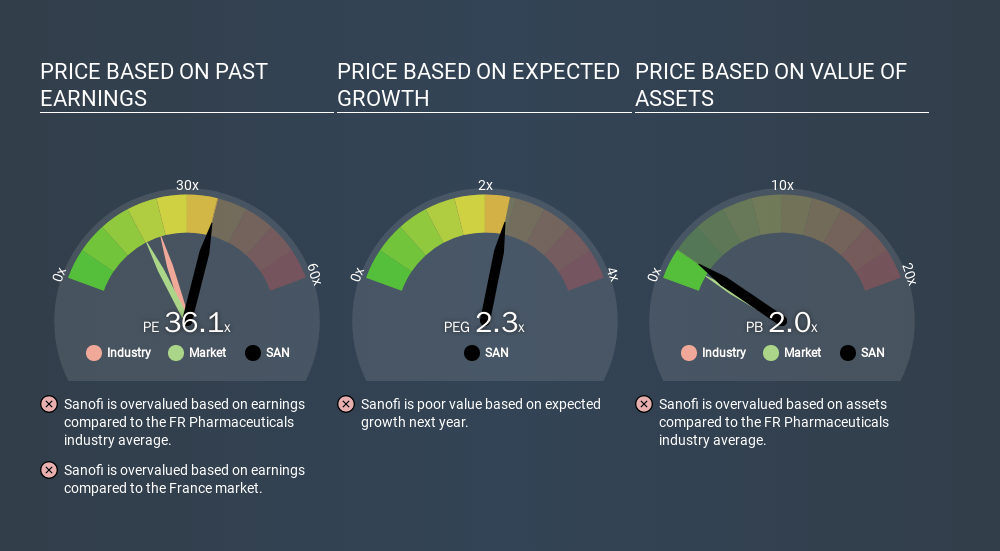

The P/E ratio essentially measures market expectations of a company. The image below shows that Sanofi has a higher P/E than the average (22.1) P/E for companies in the pharmaceuticals industry.

That means that the market expects Sanofi will outperform other companies in its industry. Clearly the market expects growth, but it isn't guaranteed. So further research is always essential. I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

If earnings fall then in the future the 'E' will be lower. Therefore, even if you pay a low multiple of earnings now, that multiple will become higher in the future. A higher P/E should indicate the stock is expensive relative to others -- and that may encourage shareholders to sell.

Sanofi saw earnings per share decrease by 21% last year. And EPS is down 4.0% a year, over the last 5 years. This growth rate might warrant a below average P/E ratio.

Remember: P/E Ratios Don't Consider The Balance Sheet

The 'Price' in P/E reflects the market capitalization of the company. So it won't reflect the advantage of cash, or disadvantage of debt. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

Sanofi's Balance Sheet

Sanofi's net debt is 16% of its market cap. This could bring some additional risk, and reduce the number of investment options for management; worth remembering if you compare its P/E to businesses without debt.

The Verdict On Sanofi's P/E Ratio

Sanofi trades on a P/E ratio of 36.1, which is above its market average of 18.5. With a bit of debt, but a lack of recent growth, it's safe to say the market is expecting improved profit performance from the company, in the next few years.

Investors have an opportunity when market expectations about a stock are wrong. People often underestimate remarkable growth -- so investors can make money when fast growth is not fully appreciated. So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

Of course you might be able to find a better stock than Sanofi. So you may wish to see this free collection of other companies that have grown earnings strongly.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTPA:SAN

Sanofi

Engages in the research, development, manufacture, and marketing of therapeutic solutions.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Swiped Left by Wall Street: The BMBL Rebound Trade

Bayer to Achieve Fair Value of €40 Boosting Growth and Investor Confidence

Despite short-term challenges, Chipotle is well positioned for sustainable long-term growth.

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Trending Discussion

Key Terms of the Private Placement • Offer Size: Up to ₦10 billion • Shares to be Issued: 125,000,000 ordinary shares • Nominal Value: 50 kobo per share • Issue Price: ₦80 per share • Structure: Best-efforts private placement (not underwritten) • Closing Date: December 31, 2025 • Conditions: Subject to receipt of all necessary regulatory approvals and fulfilment of conditions precedent Professional advisers have agreed to use reasonable endeavours to procure placees for the shares. Financial Performance and Balance Sheet Strength GTCO’s recent financial performance underscores that the capital raise is strategic rather than defensive: • Profit Before Tax (9M 2025): ₦900.8 billion • Interest Income Growth (y/y): +25.6% • Fee Income Growth (y/y): +16.8% • Total Assets: ₦16.7 trillion • Shareholders’ Funds: ₦3.3 trillion • Capital Adequacy Ratio (CAR): 36.5% • IFRS 9 Stage 3 Loans: o Bank: 3.3% o Group: 4.4% • Cost of Risk: Improved to 2.2% from 4.9% (Dec 2024) • Loan Book Growth: +16.5% y/y to ₦3.24 trillion • Deposit Growth: +16.0% y/y to ₦12.06 trillion These metrics reflect strong earnings capacity, improving asset quality, and robust capital buffers. Analyst Commentary GTCO’s ₦10 billion private placement should be viewed as a regulatory-alignment and capital optimisation exercise, rather than a response to financial weakness. Key observations include: • Proactive Capital Management: The Group is addressing FHC-level regulatory requirements well ahead of any pressure points. • Limited Dilution Risk: Relative to GTCO’s balance sheet size and shareholders’ funds, the transaction is modest. • Strong Underlying Fundamentals: Robust profitability, asset quality improvement, and high CAR provide strong support for investor confidence. • Strategic Optionality: The broader $750 million capital-raising mandate preserves flexibility for future growth initiatives.