- United States

- /

- Airlines

- /

- NYSE:DAL

Delta Air Lines (NYSE:DAL) Appoints Multiple Co-Lead Underwriters for Fixed-Income Offering

Reviewed by Simply Wall St

On June 5, 2025, Delta Air Lines (NYSE:DAL) announced the addition of several financial institutions, including Deutsche Bank Securities Inc. and Goldman Sachs & Co. LLC, as Co-Lead Underwriters for its fixed-income offering, suggesting an effort to bolster financial stability. This development comes as the S&P 500 reached 6,000 points for the first time since February, buoyed by a strong May jobs report and easing tariff concerns. Delta's share price increased by approximately 9% over the last month, aligning with the broader market uptrend, as these financial changes potentially reinforced investor confidence amidst a favorable economic backdrop.

You should learn about the 2 risks we've spotted with Delta Air Lines.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

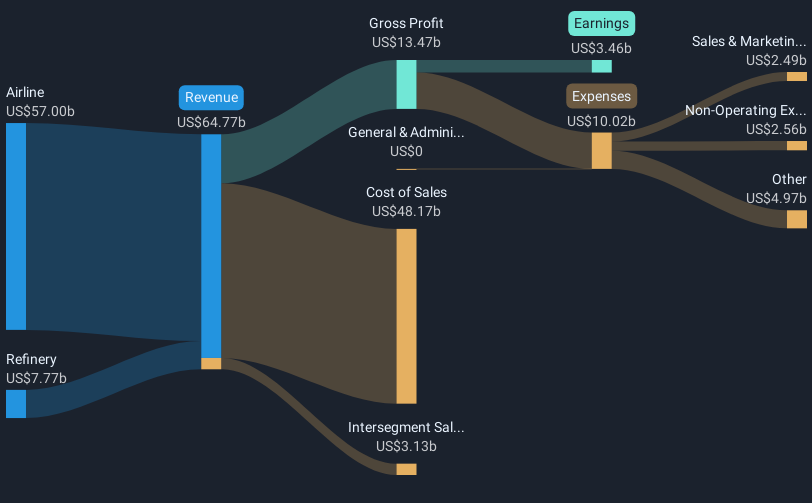

The recent addition of financial heavyweights like Deutsche Bank and Goldman Sachs as Co-Lead Underwriters for Delta Air Lines' fixed-income offering signals a tightened focus on enhancing financial stability. This move could contribute positively to Delta's ongoing strategy of cost management and capacity alignment, potentially strengthening its net margins. Over the past five years, Delta's total return, combining share price appreciation and dividends, was 83.36%. Despite a decline in annual earnings growth of 26.9% last year, Delta outperformed historically, indicating resilience in its longer-term performance.

Over the past year, Delta underperformed both the US Airlines industry and the broader market, achieving lower returns compared to industry and market averages of 15.5% and 11%, respectively. This underscores the need for Delta to effectively leverage upcoming opportunities, including improvements in premium services and strategic partnerships, which could bolster revenue streams such as international segments and MRO agreements with UPS. The recent financial measures may support earnings and revenue forecasts, aiming for earnings of US$4.6 billion and revenue of US$66.9 billion by May 2028.

Delta's current share price stands at US$44.81, reflecting an overall increase amid recent positive developments. However, it still trades at a discount to the consensus analyst price target of US$56.60, suggesting further upside potential if Delta's strategic initiatives succeed. The expected improvements in revenue growth and profit margins, coupled with effective cost management, will be crucial as Delta seeks to build on its long-term shareholder returns and achieve favorable valuation metrics.

Our valuation report unveils the possibility Delta Air Lines' shares may be trading at a discount.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAL

Delta Air Lines

Provides scheduled air transportation for passengers and cargo in the United States and internationally.

Good value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion