- United States

- /

- Tech Hardware

- /

- NYSE:DELL

Dell Technologies (NYSE:DELL) Wins USAF SPOC Processor Deal With Ultra I&C

Reviewed by Simply Wall St

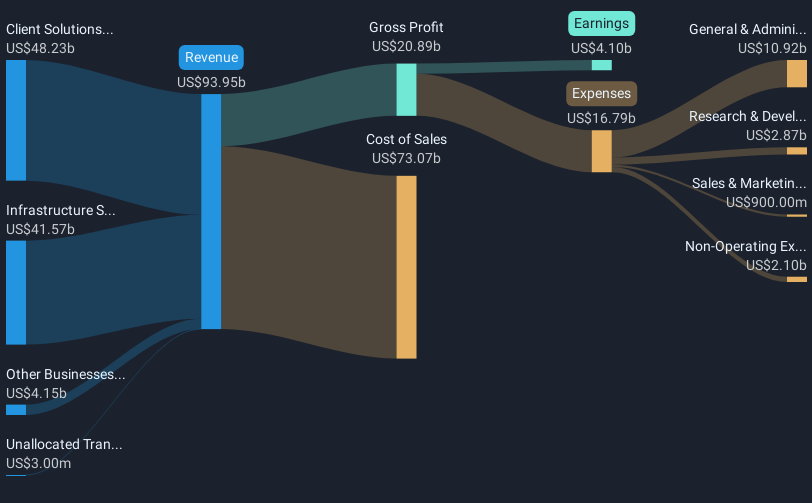

Dell Technologies (NYSE:DELL) saw an 18% rise in its share price over the last month, coinciding with its partnership announcement with Ultra Electronics I&C for a U.S. Air Force contract focused on the SPOC processor. This collaboration emphasizes software development and cybersecurity, potentially boosting investor confidence. Additionally, Dell's recent Q1 earnings report showcased solid revenue of $23.4 billion, aligning well with the overall market's 13% growth in the past year. These developments possibly added weight to the positive sentiment around Dell, indicating a favorable performance trend despite a generally flat market recently.

We've spotted 2 possible red flags for Dell Technologies you should be aware of.

The recent partnership between Dell Technologies and Ultra Electronics could significantly enhance the company's strategic positioning in the defense technology market, potentially impacting Dell's revenue and earnings forecasts. This collaboration, particularly focusing on cybersecurity and software development, aligns well with Dell's broader goals of expanding its AI and storage technology initiatives. The increased investor confidence, seen in an 18% rise in its share price over the last month, could further support the company's growth trajectory.

Over the past five years, Dell's total shareholder returns, including share price and dividends, reached 378.64%, showcasing strong long-term growth. This remarkable performance contrasts with its underperformance against the broader U.S. market, which returned 12.6% over the past year. Dell's recent price movement positions it at a 25.4% discount to the analyst consensus price target of US$125.98, signaling potential upside if analyst expectations hold true.

Looking forward, Dell's revenue, projected to grow annually by 5.8% over the next three years, could be positively influenced by new business opportunities stemming from the Windows 10 end-of-life cycle and advancements in AI technology. Despite competitive pressures, the anticipated growth in AI server shipments to at least US$15 billion could bolster operating profits. While challenges remain in maintaining ISG margins amid potential lower-margin AI server sales, Dell's focus on operational optimizations and capital return initiatives could support improved profitability, with earnings expected to rise from US$4.56 billion to US$6.8 billion by 2028.

Understand Dell Technologies' track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DELL

Dell Technologies

Designs, develops, manufactures, markets, sells, and supports various comprehensive and integrated solutions, products, and services in the Americas, Europe, the Middle East, Asia, and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives