DBV Technologies S.A. (EPA:DBV) Analysts Just Slashed Next Year's Estimates

The analysts covering DBV Technologies S.A. (EPA:DBV) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Both revenue and earnings per share (EPS) estimates were cut sharply as the analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

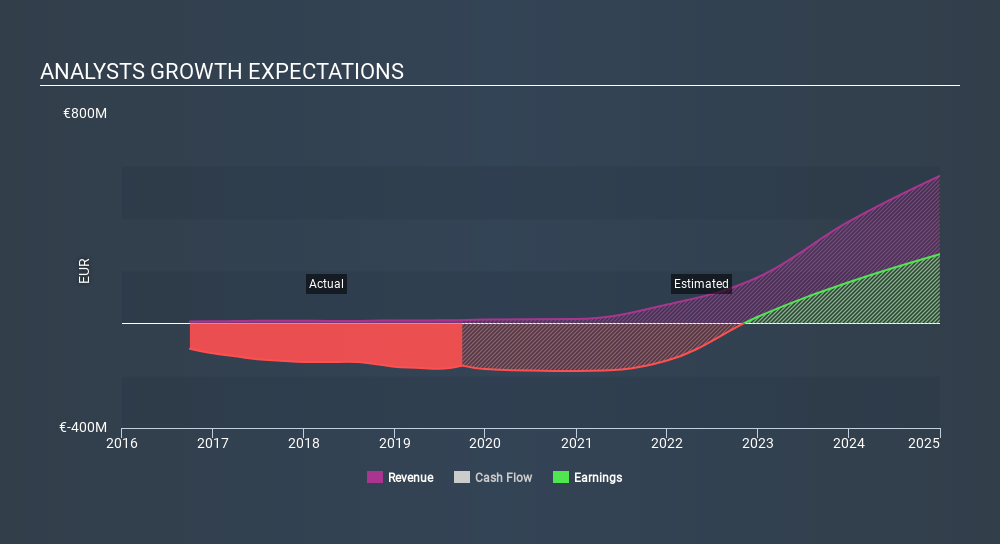

Following the downgrade, the latest consensus from DBV Technologies's seven analysts is for revenues of €16m in 2020, which would reflect a huge 42% improvement in sales compared to the last 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 27% to €3.58. Yet before this consensus update, the analysts had been forecasting revenues of €20m and losses of €2.26 per share in 2020. Ergo, there's been a clear change in sentiment, with the analysts administering a notable cut to this year's revenue estimates, while at the same time increasing their loss per share forecasts.

Check out our latest analysis for DBV Technologies

The consensus price target fell 35% to €21.48, implicitly signalling that lower earnings per share are a leading indicator for DBV Technologies's valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic DBV Technologies analyst has a price target of €30.70 per share, while the most pessimistic values it at €10.00. This is a fairly broad spread of estimates, suggesting that the analysts are forecasting a wide range of possible outcomes for the business.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. The analysts are definitely expecting DBV Technologies's growth to accelerate, with the forecast 42% growth ranking favourably alongside historical growth of 18% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 34% next year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect DBV Technologies to grow faster than the wider industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at DBV Technologies. Unfortunately, analysts also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. Given the scope of the downgrades, it would not be a surprise to see the market become more wary of the business.

There might be good reason for analyst bearishness towards DBV Technologies, like a short cash runway. Learn more, and discover the 3 other concerns we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTPA:DBV

DBV Technologies

A clinical-stage biopharmaceutical company, engages in the research and development of epicutaneous immunotherapy products in France.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Air New Zealand (NZX:AIR)

Rhythm Pharmaceuticals (RYTM): The Rare Obesity Monopoly – Countdown to the March 20th PDUFA Catalyst.

Walmart Inc. (WMT): The Omnichannel Flywheel – Dominating High-Income Households and AI-Driven Media.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026