David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that DaVita Inc. (NYSE:DVA) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for DaVita

How Much Debt Does DaVita Carry?

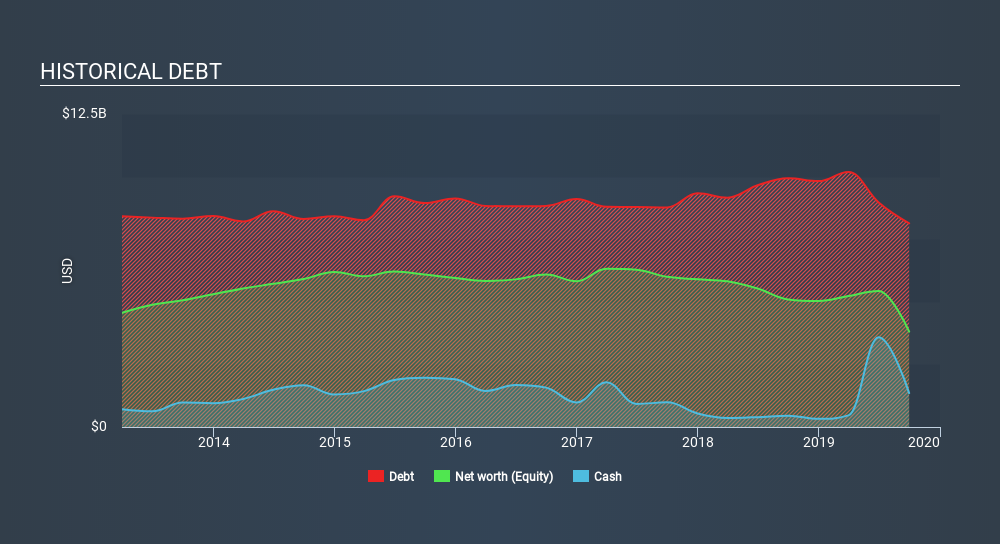

You can click the graphic below for the historical numbers, but it shows that DaVita had US$8.14b of debt in September 2019, down from US$9.94b, one year before. However, it also had US$1.35b in cash, and so its net debt is US$6.78b.

How Healthy Is DaVita's Balance Sheet?

The latest balance sheet data shows that DaVita had liabilities of US$2.21b due within a year, and liabilities of US$11.4b falling due after that. Offsetting this, it had US$1.35b in cash and US$2.39b in receivables that were due within 12 months. So it has liabilities totalling US$9.90b more than its cash and near-term receivables, combined.

This is a mountain of leverage even relative to its gargantuan market capitalization of US$10.2b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

DaVita has a debt to EBITDA ratio of 3.0 and its EBIT covered its interest expense 3.5 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Fortunately, DaVita grew its EBIT by 6.3% in the last year, slowly shrinking its debt relative to earnings. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine DaVita's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Over the most recent three years, DaVita recorded free cash flow worth 66% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Neither DaVita's ability to handle its total liabilities nor its interest cover gave us confidence in its ability to take on more debt. But it seems to be able to convert EBIT to free cash flow without much trouble. It's also worth noting that DaVita is in the Healthcare industry, which is often considered to be quite defensive. We think that DaVita's debt does make it a bit risky, after considering the aforementioned data points together. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for DaVita that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:DVA

DaVita

Provides kidney dialysis services for patients suffering from chronic kidney failure in the United States.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives