David Evans of Audioboom Group plc (LON:BOOM) Just Spent US$130k On Shares

Potential Audioboom Group plc (LON:BOOM) shareholders may wish to note that insider David Evans recently bought UK£130k worth of stock, paying UK£2.70 for each share. That's a very solid buy in our book, and increased their holding by a noteworthy 16%.

See our latest analysis for Audioboom Group

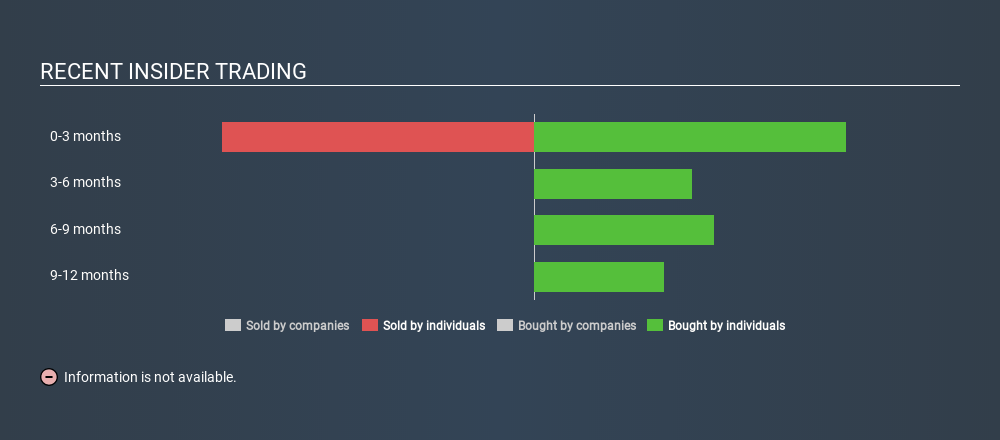

The Last 12 Months Of Insider Transactions At Audioboom Group

Notably, that recent purchase by David Evans is the biggest insider purchase of Audioboom Group shares that we've seen in the last year. That means that even when the share price was higher than UK£2.48 (the recent price), an insider wanted to purchase shares. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. We always take careful note of the price insiders pay when purchasing shares. As a general rule, we feel more positive about a stock if insiders have bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price.

Happily, we note that in the last year insiders paid UK£272k for 119.93k shares. On the other hand they divested 48000 shares, for UK£130k. In total, Audioboom Group insiders bought more than they sold over the last year. Their average price was about UK£2.26. These transactions show that insiders have confidence to invest their own money in the stock, albeit at slightly below the recent price. The chart below shows insider transactions (by individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

Audioboom Group is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Does Audioboom Group Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. I reckon it's a good sign if insiders own a significant number of shares in the company. From our data, it seems that Audioboom Group insiders own 13% of the company, worth about UK£4.5m. Whilst better than nothing, we're not overly impressed by these holdings.

What Might The Insider Transactions At Audioboom Group Tell Us?

Insider buying and selling have balanced each other out in the last three months, so we can't deduct anything useful from these recent trades. But insiders have shown more of an appetite for the stock, over the last year. The transactions are fine but it'd be more encouraging if Audioboom Group insiders bought more shares in the company. I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph.

Of course Audioboom Group may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:BOOM

Audioboom Group

A podcast company, operates a spoken-word audio platform for hosting, distributing, and monetizing content primarily in the United Kingdom and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives