- United States

- /

- Software

- /

- NYSE:QBTS

D-Wave Quantum (QBTS) Reports US$3 Million Sales With Increased US$167 Million Net Loss

Reviewed by Simply Wall St

D-Wave Quantum (QBTS) recently experienced a 55% increase in its stock price over the last quarter, driven by several important corporate announcements. Despite reporting increased net losses for the second quarter and the first half of 2025, the company unveiled a new quantum AI toolkit and strategic partnerships, potentially boosting investor confidence. Furthermore, the timing of product integrations with platforms such as PyTorch could align well with investor interest in the tech sector, given the broader market trends where major indexes such as Nasdaq saw significant gains influenced by tech stocks, which could have added momentum to D-Wave's positive price move.

Over the past year, D-Wave Quantum's share price experienced an exceptionally large increase of 2046.25%, which adds a significant context beyond the recent quarterly gain. This surge highlighted D-Wave's performance relative to the US market, which saw a 19.9% return over the same period, and outpaced the US Software industry's 34.7% return.

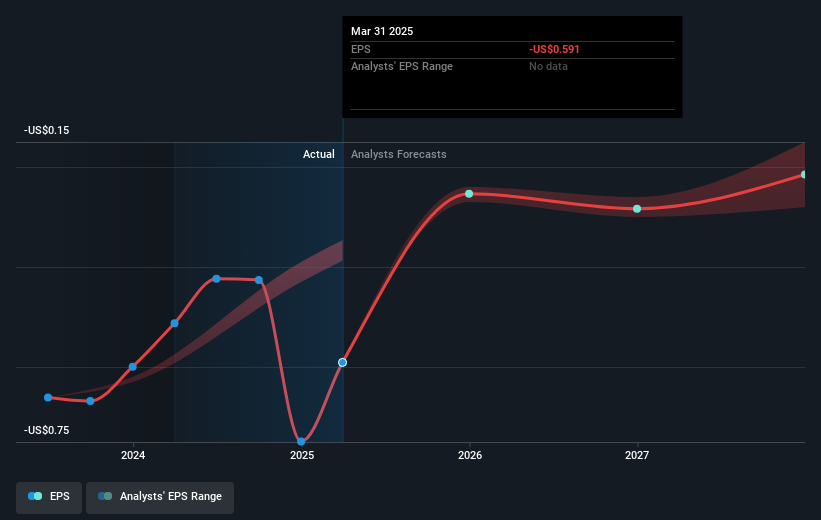

The recent announcements and developments detailed previously play a crucial role in shaping investors' expectations regarding the company’s revenue and earnings forecasts. The introduction of new quantum AI tools and strategic partnerships may catalyze revenue growth, but ongoing high net losses suggest profitability remains a distant goal. Despite a substantial share price increase, D-Wave's current share price of US$17.17 remains below the consensus analyst price target of roughly US$21.22, suggesting analysts see further potential for gains.

Gain insights into D-Wave Quantum's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QBTS

D-Wave Quantum

Develops and delivers quantum computing systems, software, and services worldwide.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion