- United States

- /

- Biotech

- /

- NasdaqGS:TSHA

Cumberland Pharmaceuticals Leads The Charge With 2 Other Prominent Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations with major indices like the Dow Jones and S&P 500 retreating from early-session gains, investors are keenly observing economic indicators and trade developments. Amid these broader market dynamics, penny stocks continue to capture interest for their potential to offer value and growth opportunities in smaller or newer companies. Despite being an older term, penny stocks remain relevant, particularly when they are supported by strong financials that could make them appealing candidates for those seeking long-term potential in under-the-radar investments.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.68 | $600.36M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9432 | $155.13M | ✅ 4 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.645 | $20.89M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $90.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Cricut (CRCT) | $4.72 | $982.65M | ✅ 2 ⚠️ 1 View Analysis > |

| Riverview Bancorp (RVSB) | $4.86 | $101.11M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (BABB) | $0.8925 | $6.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.17 | $95.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Resources Connection (RGP) | $4.65 | $159.36M | ✅ 3 ⚠️ 1 View Analysis > |

| TETRA Technologies (TTI) | $3.98 | $513.66M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 418 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Cumberland Pharmaceuticals (CPIX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cumberland Pharmaceuticals Inc. is a specialty pharmaceutical company that acquires, develops, and commercializes prescription products for hospital acute care, gastroenterology, and oncology in the United States and internationally, with a market cap of $59.99 million.

Operations: Cumberland Pharmaceuticals generates revenue of $41.08 million from its specialty pharmaceutical products.

Market Cap: $59.99M

Cumberland Pharmaceuticals, with a market cap of US$59.99 million and revenue of US$41.08 million, has recently gained attention due to its addition to several Russell indices, indicating increased visibility among investors. The company is actively expanding its product offerings, as evidenced by the new contract for Vibativ® with Vizient®, enhancing access to this critical antibiotic therapy. Despite being unprofitable, Cumberland maintains a strong cash position exceeding its total debt and has not significantly diluted shareholders recently. Its management team and board are experienced, supporting strategic decisions in advancing clinical trials for promising treatments like ifetroban for DMD heart disease.

- Dive into the specifics of Cumberland Pharmaceuticals here with our thorough balance sheet health report.

- Gain insights into Cumberland Pharmaceuticals' historical outcomes by reviewing our past performance report.

Taysha Gene Therapies (TSHA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Taysha Gene Therapies, Inc. is a clinical-stage biotechnology company that develops adeno-associated virus-based gene therapies for central nervous system monogenic diseases, with a market cap of approximately $564.56 million.

Operations: The company's revenue is primarily derived from developing adeno-associated virus-based therapies for rare monogenic diseases, totaling $7.22 million.

Market Cap: $564.56M

Taysha Gene Therapies, with a market cap of approximately US$564.56 million, is focused on developing gene therapies for central nervous system diseases. The company recently gained attention by joining the S&P Biotechnology Select Industry Index and aligning its pivotal trial design for TSHA-102 with FDA guidance under the RMAT pathway. Despite being unprofitable, Taysha has reduced losses over five years and maintains a cash position exceeding its total debt, supporting ongoing clinical trials. A recent follow-on equity offering raised US$199.97 million to bolster financial stability without significant shareholder dilution amidst stable weekly volatility.

- Navigate through the intricacies of Taysha Gene Therapies with our comprehensive balance sheet health report here.

- Examine Taysha Gene Therapies' earnings growth report to understand how analysts expect it to perform.

Viomi Technology (VIOT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Viomi Technology Co., Ltd, with a market cap of $220.99 million, develops and sells IoT-enabled smart home products in the People's Republic of China through its subsidiaries.

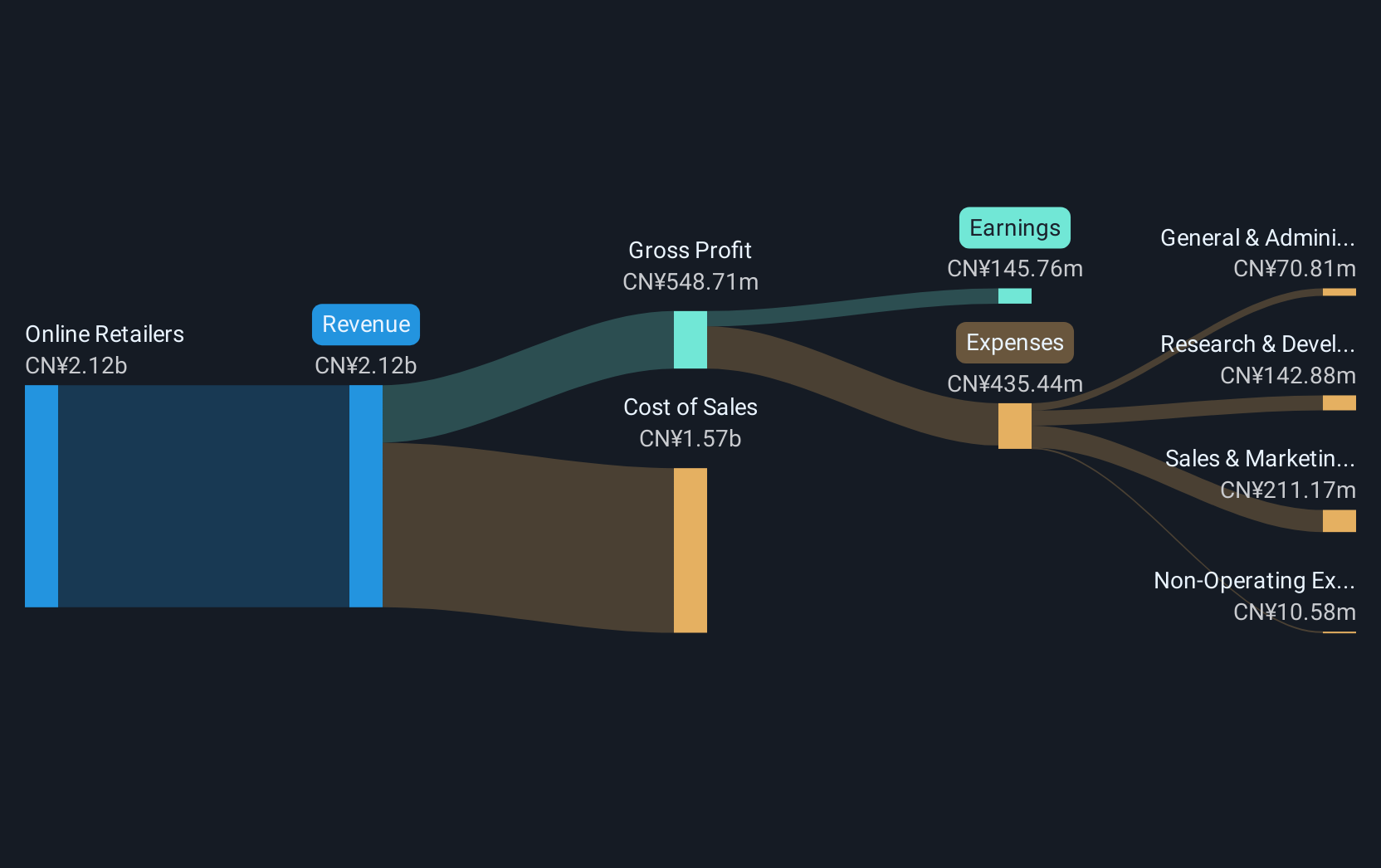

Operations: The company generates revenue of CN¥2.12 billion from online retailers in the People's Republic of China.

Market Cap: $220.99M

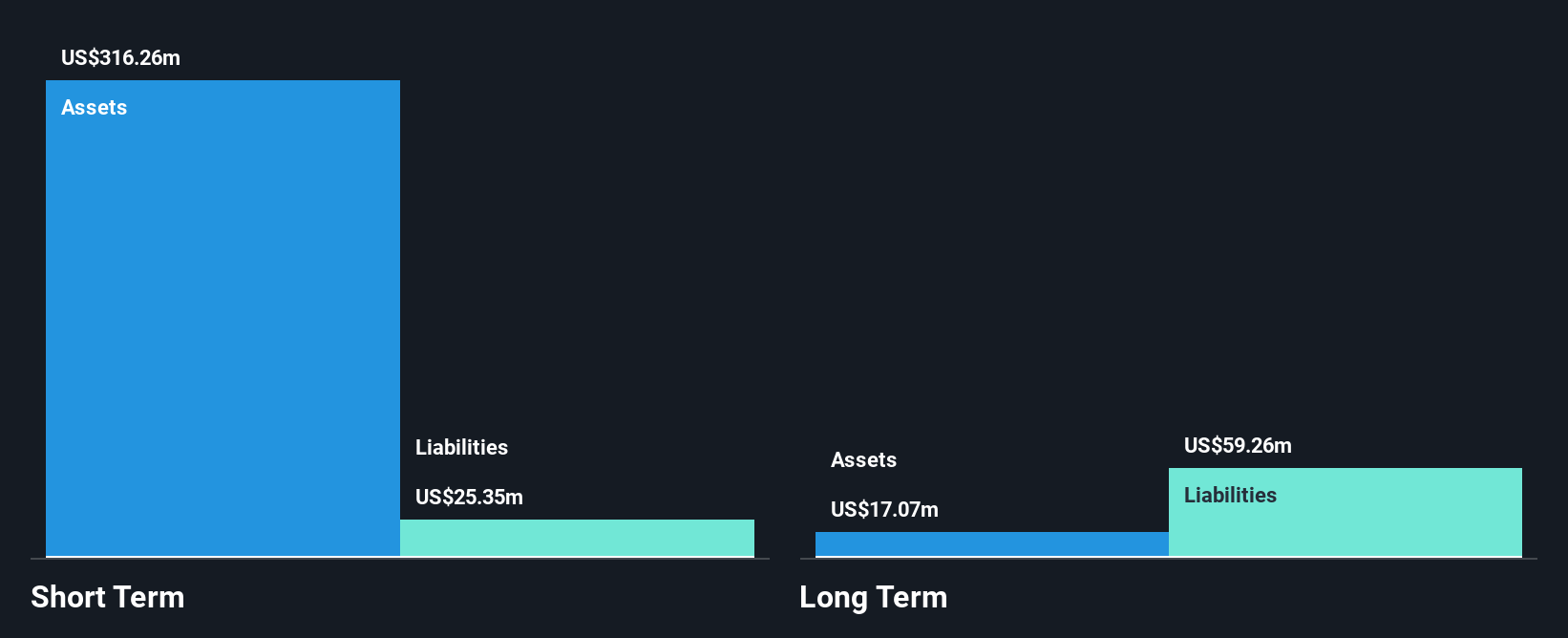

Viomi Technology, with a market cap of US$220.99 million, has recently become profitable and offers a price-to-earnings ratio below the US market average. Despite high volatility and past earnings decline, Viomi's short-term assets comfortably cover both its short and long-term liabilities. The company announced a special dividend of approximately US$6 million and launched the Kunlun 4 Pro Alkaline Mineral Water Purifier, emphasizing AI-driven innovation in water purification technology. Recent auditor changes reflect strategic shifts toward focusing on home water solutions, underscoring its commitment to advancing household mineral water technology.

- Click here and access our complete financial health analysis report to understand the dynamics of Viomi Technology.

- Assess Viomi Technology's future earnings estimates with our detailed growth reports.

Next Steps

- Embark on your investment journey to our 418 US Penny Stocks selection here.

- Interested In Other Possibilities? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taysha Gene Therapies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSHA

Taysha Gene Therapies

A clinical-stage biotechnology company, focuses on developing and commercializing adeno-associated virus-based gene therapies for the treatment of monogenic diseases of the central nervous system.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives