- Canada

- /

- Consumer Durables

- /

- TSX:DBO

Cronos Group And 2 Other Noteworthy Penny Stocks On The TSX

Reviewed by Simply Wall St

The Canadian market is currently navigating a complex landscape of trade developments, central bank meetings, and fiscal debates, all contributing to potential volatility. Despite these challenges, the fundamentals remain supportive of growth, providing a backdrop where investors might explore opportunities in various sectors. Though the term 'penny stocks' might feel like a relic from past market eras, they still offer potential for growth when backed by strong financials. In this article, we explore three noteworthy penny stocks on the TSX that exemplify this blend of affordability and potential upside.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| PetroTal (TSX:TAL) | CA$0.65 | CA$594.7M | ✅ 3 ⚠️ 3 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.37 | CA$722.21M | ✅ 4 ⚠️ 2 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.52 | CA$190.97M | ✅ 4 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.46M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.69 | CA$459.06M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.75 | CA$14.86M | ✅ 2 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.39 | CA$101.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.47 | CA$141.24M | ✅ 3 ⚠️ 1 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.82 | CA$143.13M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.79 | CA$173.06M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 874 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Cronos Group (TSX:CRON)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cronos Group Inc. is a cannabinoid company involved in the cultivation, production, distribution, and marketing of cannabis products across Canada, Israel, and internationally with a market cap of CA$1.05 billion.

Operations: The company's revenue is primarily derived from the cultivation, manufacture, and marketing of cannabis and cannabis-derived products, totaling $124.59 million.

Market Cap: CA$1.05B

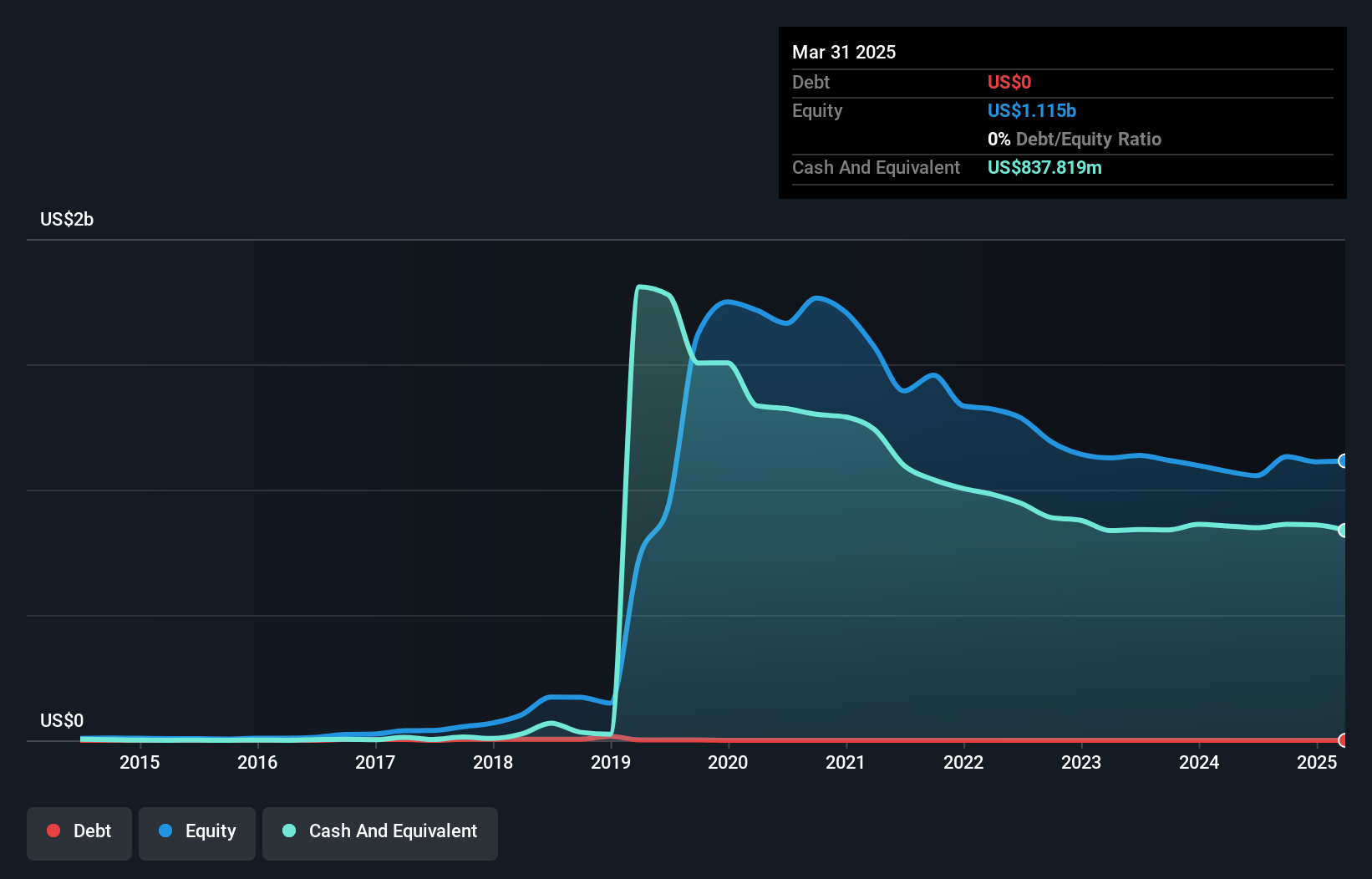

Cronos Group Inc., with a market cap of CA$1.05 billion, has shown significant financial developments, becoming profitable in the past year with net income reaching US$6.12 million for Q1 2025 compared to a loss previously. The company has initiated a share repurchase program worth $50 million, indicating confidence in its valuation and future prospects. Despite low return on equity at 4.5%, Cronos is debt-free and maintains strong liquidity with short-term assets significantly exceeding liabilities. Recent product innovations and strategic leadership changes aim to bolster its market position amidst anticipated revenue growth of 9.74% annually.

- Dive into the specifics of Cronos Group here with our thorough balance sheet health report.

- Gain insights into Cronos Group's future direction by reviewing our growth report.

D-BOX Technologies (TSX:DBO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: D-BOX Technologies Inc. designs, manufactures, and commercializes motion systems for the entertainment, simulation, and training markets worldwide, with a market cap of CA$65.47 million.

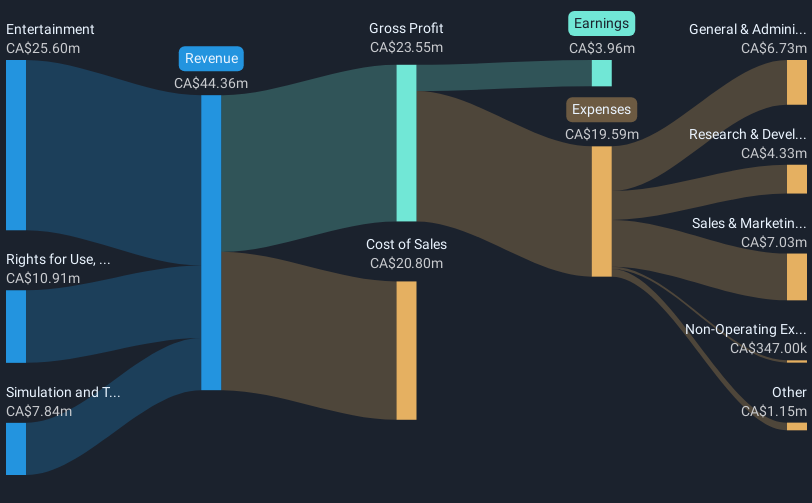

Operations: The company's revenue is derived from three primary segments: Entertainment (CA$25.60 million), Simulation and Training (CA$7.84 million), and Rights for Use, Rental and Maintenance (CA$10.91 million).

Market Cap: CA$65.47M

D-BOX Technologies Inc., with a market cap of CA$65.47 million, has demonstrated robust financial growth, achieving profitability over the past five years with earnings growing by 62.7% annually and a remarkable 1003.1% increase in the past year alone. The company's debt is well managed, covered by operating cash flow and short-term assets exceeding both short and long-term liabilities. Recent executive changes see Naveen Prasad stepping in as interim CEO, bringing extensive leadership experience to drive further innovation and expansion efforts, such as its significant partnership expansion with Cinemark Holdings Inc., enhancing its global footprint in haptic technology-enabled theaters.

- Click here and access our complete financial health analysis report to understand the dynamics of D-BOX Technologies.

- Gain insights into D-BOX Technologies' historical outcomes by reviewing our past performance report.

Sintana Energy (TSXV:SEI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sintana Energy Inc. is involved in crude oil and natural gas exploration and development in Colombia, with a market cap of CA$240.85 million.

Operations: Sintana Energy Inc. currently does not report any revenue segments.

Market Cap: CA$240.85M

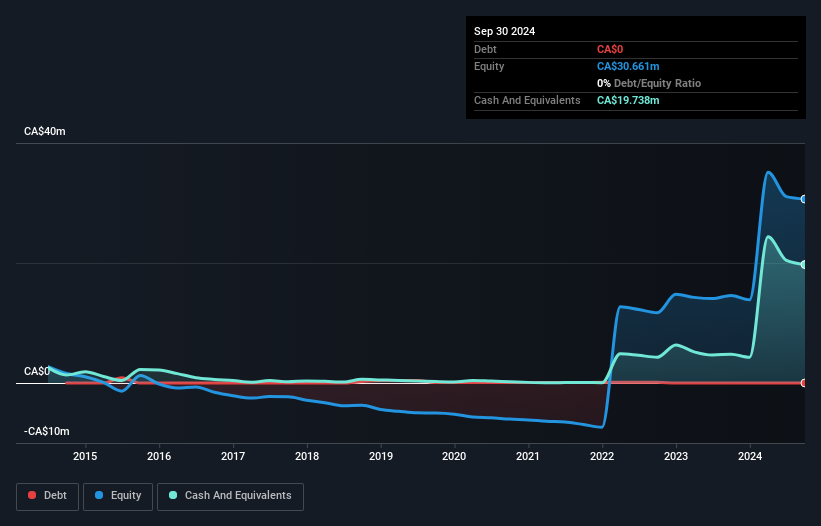

Sintana Energy Inc., with a market cap of CA$240.85 million, is focused on crude oil and natural gas exploration in Colombia but remains pre-revenue. Recent strategic moves include a partnership with Corcel plc to acquire an indirect 5% interest in Angola's KON-16, potentially unlocking access to significant oil reserves. Despite being debt-free and having sufficient short-term assets to cover liabilities, the company faces challenges such as high volatility and increasing losses—CA$3.16 million for Q1 2025—and auditor concerns about its ability to continue as a going concern due to limited cash runway if cash flow worsens.

- Get an in-depth perspective on Sintana Energy's performance by reading our balance sheet health report here.

- Explore historical data to track Sintana Energy's performance over time in our past results report.

Taking Advantage

- Click this link to deep-dive into the 874 companies within our TSX Penny Stocks screener.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DBO

D-BOX Technologies

Designs, manufactures, and commercializes haptic motion systems intended for theatrical entertainment, sim racing and simulation, and training business in the United States, Canada, Europe, Asia, South America, Oceania, and Africa.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion