- United States

- /

- Biotech

- /

- NasdaqGM:CRSP

CRISPR Therapeutics (NasdaqGM:CRSP) Advances Cardiovascular Programs With Promising Trial Results

Reviewed by Simply Wall St

CRISPR Therapeutics (NasdaqGM:CRSP) witnessed a substantial price movement, increasing 57% over the last quarter. This significant rise aligns with key developments, such as the company's inclusion in various Russell Indexes, enhancing its market visibility. Concurrently, CRISPR's progress in cardiovascular disease programs with CTX310™ and CTX320™ shows promising clinical trial results, likely fueling investor optimism. Amid a largely flat market, these elements likely contributed to the company's robust performance, even as broader market sectors see moderate changes. Global trade policy uncertainties and recent fluctuations in the tech sector may have further impacted investor sentiment positively during this period.

Over the past year, CRISPR Therapeutics' total return, including share price movements and dividends, was a 0.38% decline. This performance reflects a contrasting picture compared to its recent robust quarter. While the company's share price surged recently, its year-long total return fell short of the US market's 12.6% increase and outperformed the US Biotechs industry, which saw an 8.4% decline. This mixed performance indicates challenges in sustaining longer-term value appreciation.

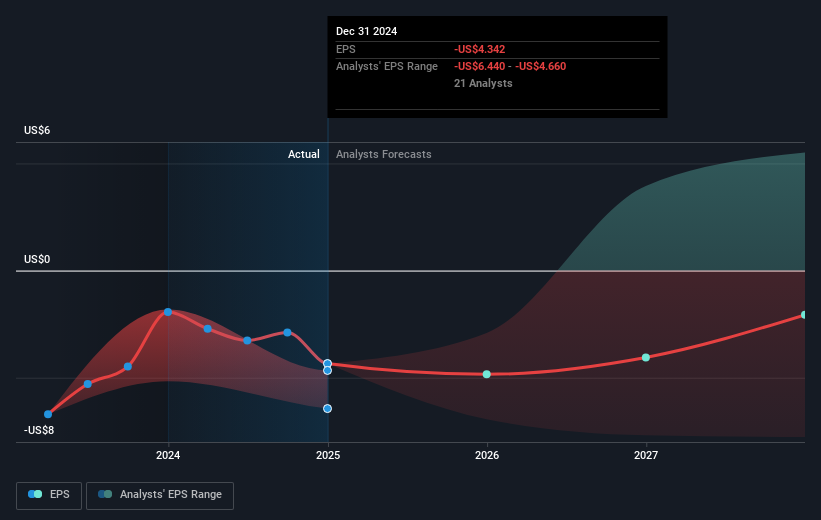

The recent positive developments, such as advancement in cardiovascular programs and increased market visibility through index inclusion, might contribute to optimistic revenue and earnings forecasts. Despite a challenging earnings background, with an annual revenue of US$37.68 million and a net loss of US$385.66 million, the company's forward-looking projections are hopeful, with anticipated significant revenue growth outpacing market expectations at a rapid 57% annually. Analyst consensus indicates a fair value of US$81.75, suggesting the stock is trading at a 49.13% discount. However, investors should weigh these insights along with ongoing expectations of profitability challenges within the next three years while considering new market developments and research outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CRSP

CRISPR Therapeutics

A gene editing company, focuses on developing gene-based medicines for serious human diseases using its Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR)/CRISPR-associated protein 9 (Cas9) platform.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives