Could Wong's Kong King International (Holdings) Limited (HKG:532) Have The Makings Of Another Dividend Aristocrat?

Is Wong's Kong King International (Holdings) Limited (HKG:532) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

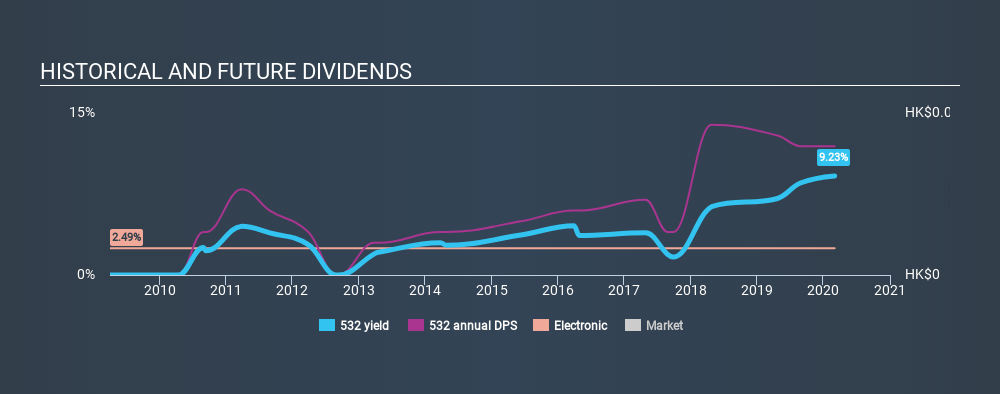

With Wong's Kong King International (Holdings) yielding 9.2% and having paid a dividend for over 10 years, many investors likely find the company quite interesting. We'd guess that plenty of investors have purchased it for the income. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 60% of Wong's Kong King International (Holdings)'s profits were paid out as dividends in the last 12 months. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Last year, Wong's Kong King International (Holdings) paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

Is Wong's Kong King International (Holdings)'s Balance Sheet Risky?

As Wong's Kong King International (Holdings) has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A rough way to check this is with these two simple ratios: a) net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and b) net interest cover. Net debt to EBITDA is a measure of a company's total debt. Net interest cover measures the ability to meet interest payments. Essentially we check that a) the company does not have too much debt, and b) that it can afford to pay the interest. Wong's Kong King International (Holdings) has net debt of 2.21 times its EBITDA. Using debt can accelerate business growth, but also increases the risks.

We calculated its interest cover by measuring its earnings before interest and tax (EBIT), and dividing this by the company's net interest expense. Wong's Kong King International (Holdings) has EBIT of 6.10 times its interest expense, which we think is adequate.

We update our data on Wong's Kong King International (Holdings) every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Wong's Kong King International (Holdings) has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. The dividend has been cut on at least one occasion historically. During the past ten-year period, the first annual payment was HK$0.02 in 2010, compared to HK$0.06 last year. Dividends per share have grown at approximately 12% per year over this time. Wong's Kong King International (Holdings)'s dividend payments have fluctuated, so it hasn't grown 12% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

So, its dividends have grown at a rapid rate over this time, but payments have been cut in the past. The stock may still be worth considering as part of a diversified dividend portfolio.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? It's good to see Wong's Kong King International (Holdings) has been growing its earnings per share at 10% a year over the past five years. Earnings per share have been growing rapidly, but given that it is paying out more than half of its earnings as dividends, we wonder how Wong's Kong King International (Holdings) will keep funding its growth projects in the future.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Wong's Kong King International (Holdings) gets a pass on its dividend payout ratio, but it paid out virtually all of its cash flow as dividends. This may just be a one-off, but we'd keep an eye on this. We were also glad to see it growing earnings, but it was concerning to see the dividend has been cut at least once in the past. Ultimately, Wong's Kong King International (Holdings) comes up short on our dividend analysis. It's not that we think it is a bad company - just that there are likely more appealing dividend prospects out there on this analysis.

Are management backing themselves to deliver performance? Check their shareholdings in Wong's Kong King International (Holdings) in our latest insider ownership analysis.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:532

Wong's Kong King International (Holdings)

An investment holding company, trades in and distributes chemicals, materials, and equipment for use in the manufacturing of printed circuit boards and electronic products in North America, Europe, Hong Kong, Mainland China, Taiwan, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives