Could PreveCeutical Medical Inc.'s (CSE:PREV) Investor Composition Influence The Stock Price?

Every investor in PreveCeutical Medical Inc. (CSE:PREV) should be aware of the most powerful shareholder groups. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

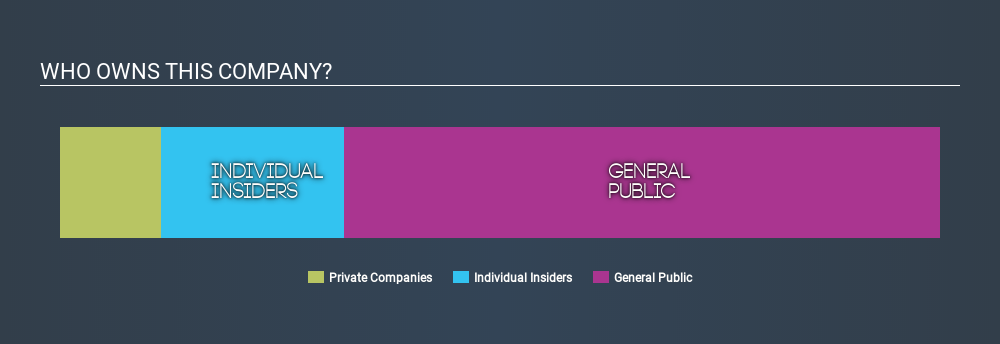

PreveCeutical Medical is not a large company by global standards. It has a market capitalization of CA$9.9m, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutional investors have not yet purchased shares. Let's take a closer look to see what the different types of shareholder can tell us about PreveCeutical Medical.

View our latest analysis for PreveCeutical Medical

What Does The Lack Of Institutional Ownership Tell Us About PreveCeutical Medical?

We don't tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it's not particularly common.

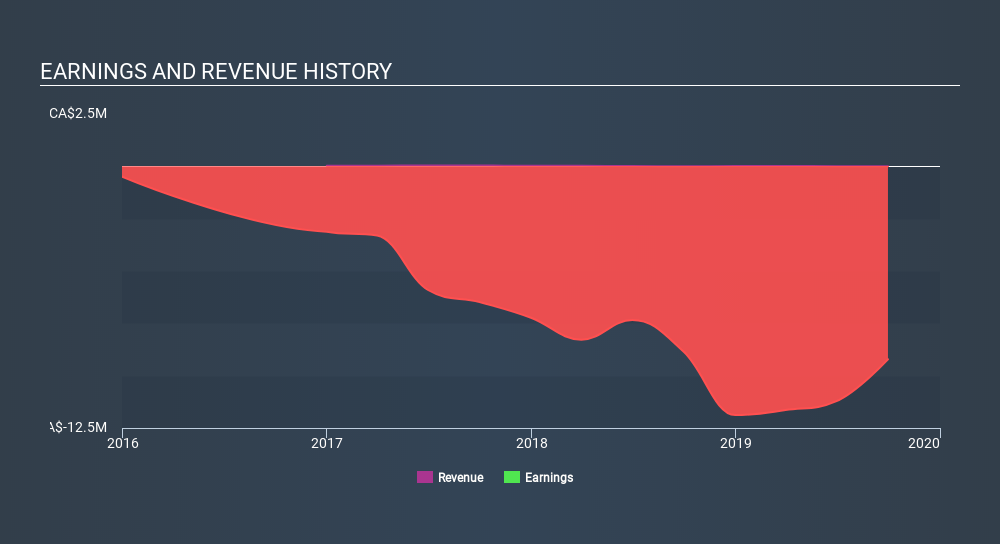

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to fund under management, so the institition does not bother to look closely at the company. On the other hand, it's always possible that professional investors are avoiding a company because they don't think it's the best place for their money. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of PreveCeutical Medical, for yourself, below.

PreveCeutical Medical is not owned by hedge funds. Our data shows that Cornerstone Global Partners Inc. is the largest shareholder with 12% of shares outstanding. Stephen Van Deventer is the second largest shareholder with 10% of common stock, followed by Kimberly Van Deventer, holding 9.2% of the stock. Stephen Van Deventer also happens to hold the title of Chief Executive Officer.

On studying our ownership data, we found that 6 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of PreveCeutical Medical

The definition of company insiders can be subjective, and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. The company management answer to the board; and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board, themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

It seems insiders own a significant proportion of PreveCeutical Medical Inc.. Insiders own CA$2.1m worth of shares in the CA$9.9m company. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

The general public, who are mostly retail investors, collectively hold 68% of PreveCeutical Medical shares. This size of ownership gives retail investors collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

Private Company Ownership

Our data indicates that Private Companies hold 12%, of the company's shares. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand PreveCeutical Medical better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 7 warning signs with PreveCeutical Medical (at least 4 which can't be ignored) , and understanding them should be part of your investment process.

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About CNSX:PREV

PreveCeutical Medical

A health sciences company, engages in the development of options for preventive and curative therapies utilizing organic and nature identical products.

Moderate risk with weak fundamentals.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion