- United States

- /

- Diversified Financial

- /

- NYSE:CPAY

Corpay (CPAY) Partners With Sunderland AFC For FX Solutions And Global Payments

Reviewed by Simply Wall St

Corpay (CPAY) recently made significant strides by becoming the Official Foreign Exchange Partner for Sunderland AFC, complementing its strategic partnerships with entities like FIM World Supercross Championship and Real Madrid. These collaborations could augment Corpay's market positioning but come amid a mixed economic backdrop where the S&P 500 and Nasdaq have hit new highs. While the market trend saw a broader rise of 1.5% over the past week, these integrations likely reinforced Corpay’s 3% upward share price movement in the last quarter, amid robust economic data and easing tariff concerns at the national level.

We've discovered 1 warning sign for Corpay that you should be aware of before investing here.

The recently announced partnership with Sunderland AFC positions Corpay to enhance its market reach, aligning with previous alliances like those with Real Madrid and FIM World Supercross Championship. While these partnerships could bolster Corpay’s brand visibility and competitive edge, the real test lies in their ability to translate into tangible revenue gains. Such collaborations might amplify Corpay's ability to capture a larger share of the Corporate Payments market, a vital segment driving recent revenue momentum.

Over a longer-term horizon, Corpay’s total shareholder return, inclusive of both share price appreciation and dividends, stood at 49.86% over the past three years. This performance provides context to the company's current valuation and shareholder sentiment that might be influenced by these recent partnerships. In the past year, however, Corpay’s performance did not match the broader US Diversified Financial industry, which returned 19.6%.

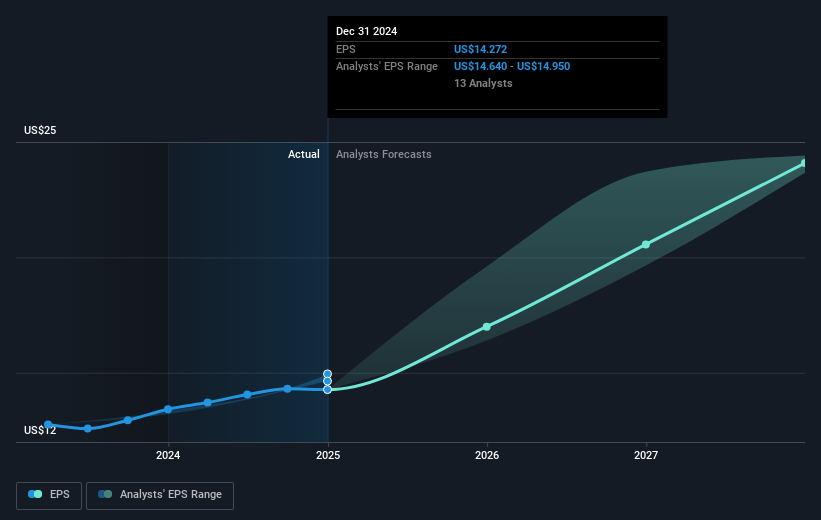

The new strategic maneuvers are poised to support revenue and earnings forecasts as they potentially boost growth in Corporate Payments, where Corpay is already seeing organic revenue increases. Analyst forecasts suggest expected revenue growth of 10.9% annually for the next three years, though this hinges on favorable macroeconomic conditions. Despite the current market price of US$333.46, analyst consensus places Corpay’s fair value at US$391.5, suggesting a potential upside if strategic initiatives yield expected results.

Evaluate Corpay's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPAY

Corpay

Operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives