Corning (GLW) Reports Strong Q2 Results With US$3.9 Billion Sales and Solid Earnings Guidance

Reviewed by Simply Wall St

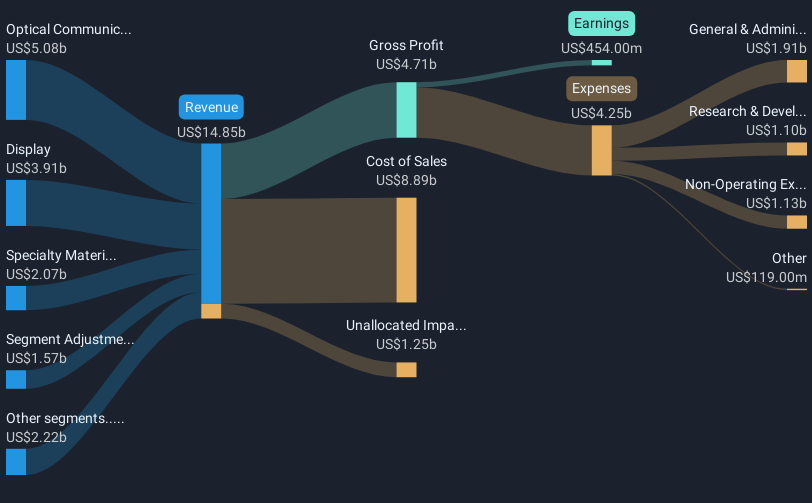

Corning (GLW) has experienced a significant price increase of nearly 25% over the last quarter, coinciding with its robust Q2 2025 financial results. The company's sales rose to $3.86 billion, and net income climbed to $469 million, a compelling improvement from the previous year. This strong performance might have bolstered investor confidence, propelling the share price higher during a period when the broader market also saw gains, supported by healthy corporate earnings and economic optimism. The anticipation of future growth, as outlined in Corning’s upbeat third-quarter guidance, would have further supported the positive trajectory of the stock.

Corning has 5 warning signs we think you should know about.

The impressive price increase for Corning over the last quarter, buoyed by strong Q2 financial results, aligns with the company's promising narrative surrounding growth in Optical Communications and Solar sectors. This recent momentum may further bolster investor confidence as the company continues its strategic alignment with robust secular trends and energy policies. Over the past five years, Corning's total shareholder return, including dividends, was 106.86%, showcasing significant long-term value creation. Comparatively, Corning aligned with the US Electronic industry's 28.9% return over the past year, reflecting its resilience in a competitive space.

This surge in share price brings Corning close to its analyst price target of US$56.92, indicating that the stock is approaching what analysts consider fair value. The recent developments, particularly within the Optical and Solar sectors, are expected to positively influence revenue and earnings projections, with an anticipated annual revenue growth of 11.3% over the next three years. Despite these encouraging signs, the company must address challenges like tariff risks and competitive pressures to maintain profit margin enhancements. The modest discount to the consensus price target suggests room for potential upside if Corning executes its forecasted growth efficiently.

Jump into the full analysis health report here for a deeper understanding of Corning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLW

Corning

Operates in optical communications, display technologies, environmental technologies, specialty materials, and life sciences businesses.

High growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives